1. Suppose Hybrid shareholders will agree to a merger price of $23.13 per share. Should Birdie proceed...

Question:

1. Suppose Hybrid shareholders will agree to a merger price of $23.13 per share. Should Birdie proceed with the merger?

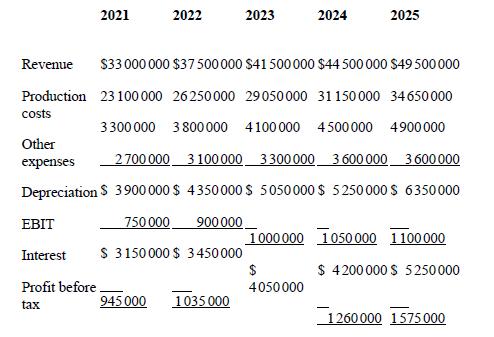

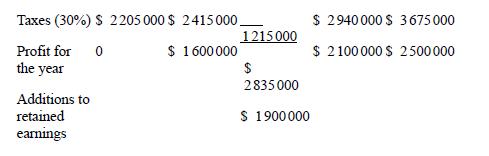

Birdie Golf Ltd has been in merger talks with Hybrid Golf Company for the past six months. After several rounds of negotiations, the offer under discussion is a cash offer of $18.5 million for Hybrid Golf. Both companies have niche markets in the golf club industry, and both believe that a merger will result in synergies due to economies of scale in manufacturing and marketing, as well as significant savings in general and administrative expenses.

If Birdie Golf buys Hybrid Golf, an immediate dividend of $5.5 million would be paid from Hybrid Golf to Birdie. Shares in Birdie Golf currently sell for $87 per share, and the company has 1.8 million shares outstanding. Hybrid Golf has 0.8 million shares outstanding. Both companies can borrow at an 8 per cent interest rate. Bruce believes the current cost of capital for Birdie Golf is 11 per cent. The cost of capital for Hybrid Golf is 12.4 per cent, and the cost of equity is 16.9 per cent. In five years, the value of Hybrid Golf is expected to be $23.5 million.

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781743768051

8th Edition

Authors: Stephen A. Ross, Rowan Trayler, Charles Koh, Gerhard Hambusch, Kristoffer Glover, Randolph W. Westerfield, Bradford D. Jordan