Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I uploaded the correct answers to the question with the problem. Please show work on how to calculate these... AW Defender = -$13,498 AW Challenger

I uploaded the correct answers to the question with the problem. Please show work on how to calculate these... AW Defender = -$13,498

AW Defender = -$13,498

AW Challenger = -$13,645

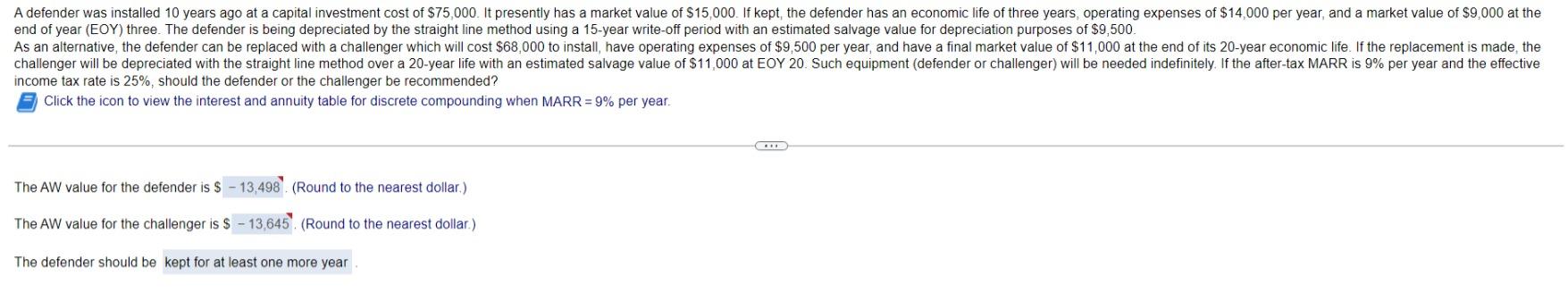

A defender was installed 10 years ago at a capital investment cost of $75,000. It presently has a market value of $15,000. If kept, the defender has an economic life of three years, operating expenses of $14,000 per year, and a market value of $9,000 at the end of year (EOY) three. The defender is being depreciated by the straight line method using a 15-year write-off period with an estimated salvage value for depreciation purposes of $9,500. As an alternative, the defender can be replaced with a challenger which will cost $68,000 to install, have operating expenses of $9,500 per year, and have a final market value of $11,000 at the end of its 20-year economic life. If the replacement is made, the challenger will be depreciated with the straight line method over a 20-year life with an estimated salvage value of $11,000 at EOY 20. Such equipment (defender or challenger) will be needed indefinitely. If the after-tax MARR is 9% per year and the effective income tax rate is 25%, should the defender or the challenger be recommended? Click the icon to view the interest and annuity table for discrete compounding when MARR = 9% per year. CHE The AW value for the defender is $13,498 (Round to the nearest dollar.) The AW value for the challenger is $13,645. (Round to the nearest dollar.) The defender should be kept for at least one more yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started