Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I want help mainly on number III and I. Please show me how to get to the answer Quark Donut Company was incorporated (as a

I want help mainly on number III and I. Please show me how to get to the answer

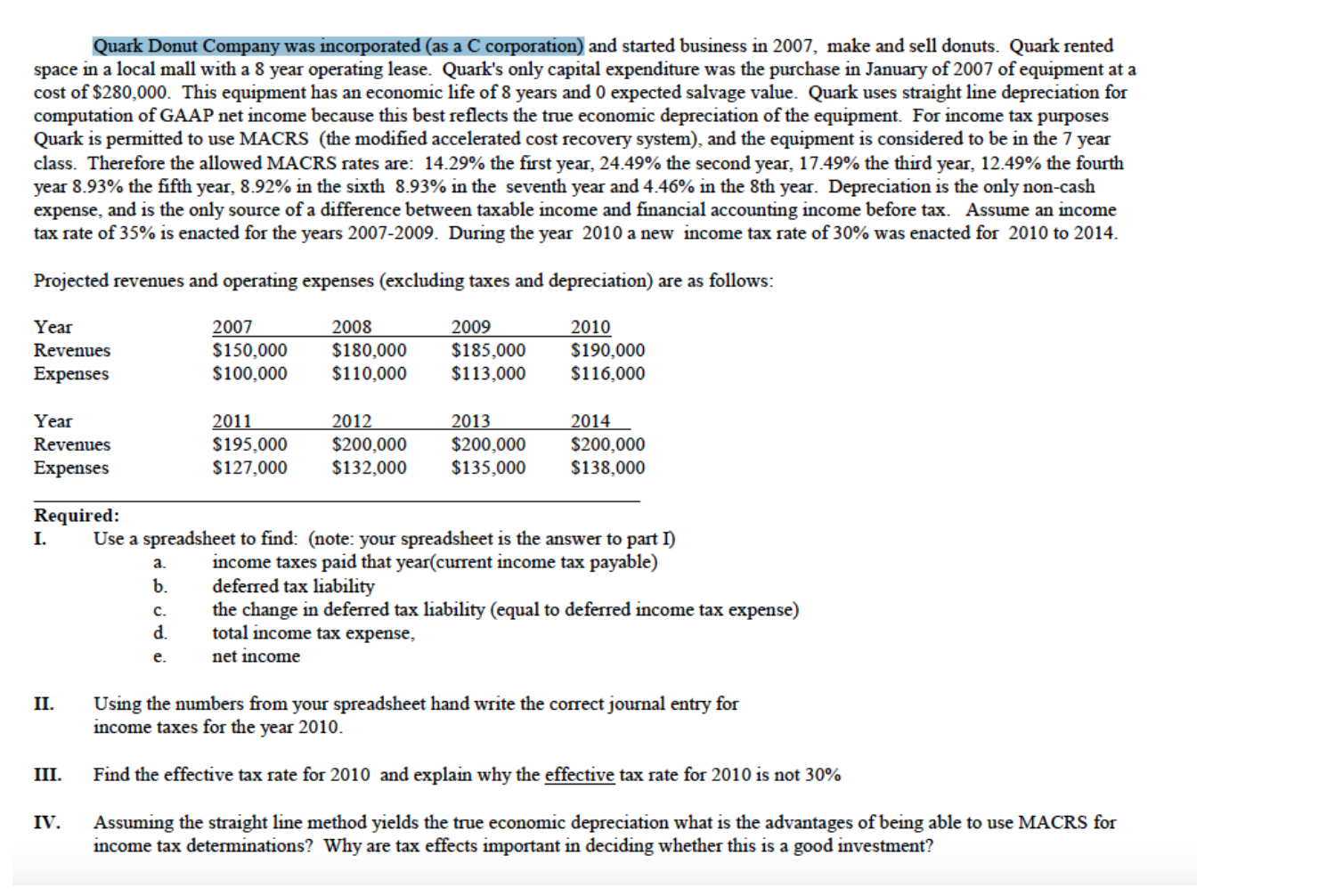

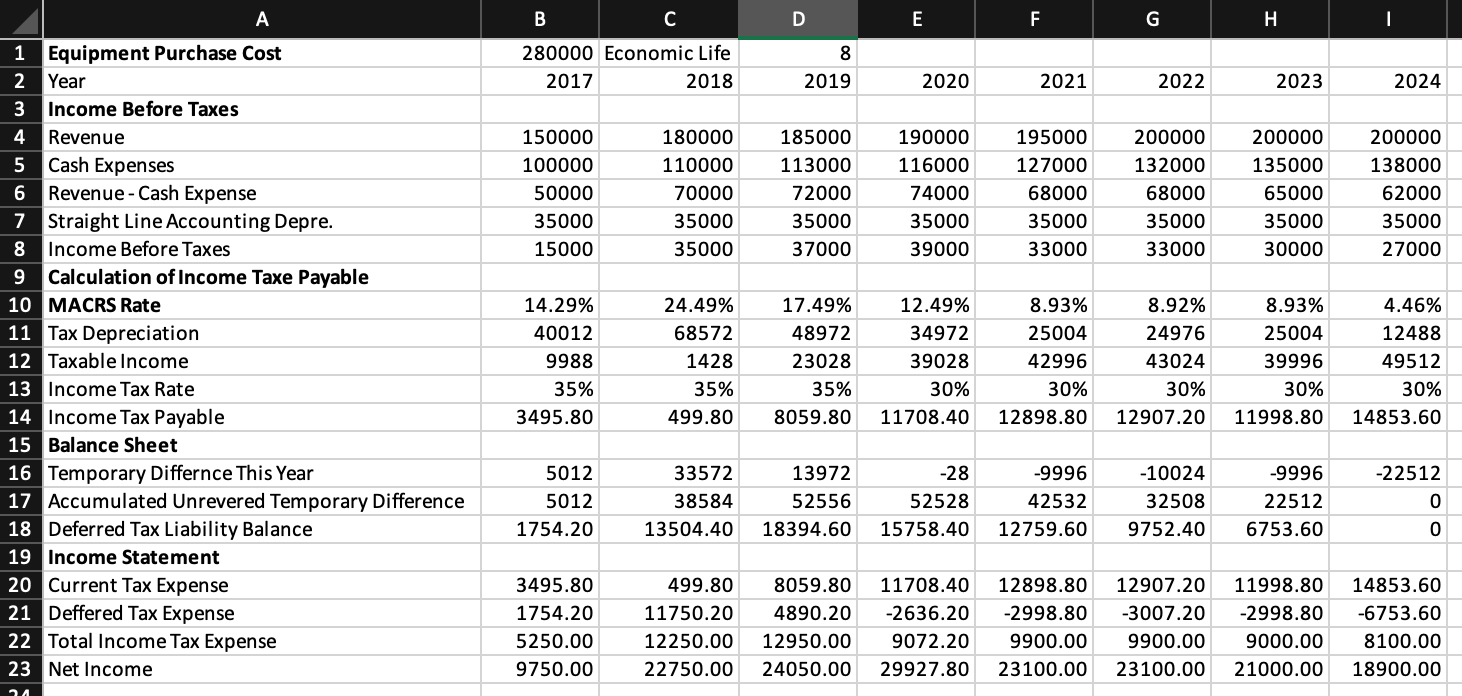

Quark Donut Company was incorporated (as a C corporation and started business in 2007, make and sell donuts. Quark rented space in a local mall with a 8 year operating lease. Quark's only capital expenditure was the purchase in January of 2007 of equipment at a cost of $280,000. This equipment has an economic life of 8 years and 0 expected salvage value. Quark uses straight line depreciation for computation of GAAP net income because this best reflects the true economic depreciation of the equipment. For income tax purposes Quark is permitted to use MACRS (the modified accelerated cost recovery system), and the equipment is considered to be in the 7 year class. Therefore the allowed MACRS rates are: 14.29% the first year, 24.49% the second year, 17.49% the third year, 12.49% the fourth year 8.93% the fifth year, 8.92% in the sixth 8.93% in the seventh year and 4.46% in the 8th year. Depreciation is the only non-cash expense, and is the only source of a difference between taxable income and financial accounting income before tax. Assume an income tax rate of 35% is enacted for the years 2007-2009. During the year 2010 a new income tax rate of 30% was enacted for 2010 to 2014. Projected revenues and operating expenses (excluding taxes and depreciation) are as follows: Year Revenues Expenses 2007 $150,000 $100,000 2008 $180,000 $110,000 2009 $185,000 $113,000 2010 $190,000 $116,000 Year Revenues Expenses 2011 $195,000 $127,000 2012 $200,000 $132,000 2013 $200,000 $135,000 2014 $200,000 $138,000 Required: I. Use a spreadsheet to find: (note: your spreadsheet is the answer to part I) a. income taxes paid that year(current income tax payable) deferred tax liability the change in deferred tax liability (equal to deferred income tax expense) total income tax expense, net income II. Using the numbers from your spreadsheet hand write the correct journal entry for income taxes for the year 2010. III. Find the effective tax rate for 2010 and explain why the effective tax rate for 2010 is not 30% IV. Assuming the straight line method yields the true economic depreciation what is the advantages of being able to use MACRS for income tax determinations? Why are tax effects important in deciding whether this is a good investment? F G H I 280000 Economic Life 2017 2018 8 2019 2020 2021 2022 2023 2024 150000 100000 50000 35000 15000 180000 110000 70000 35000 35000 185000 113000 72000 35000 37000 190000 116000 74000 35000 39000 195000 127000 68000 35000 33000 200000 132000 68000 35000 33000 200000 135000 65000 35000 30000 200000 138000 62000 35000 27000 1 1 Equipment Purchase Cost 2 Year 3 Income Before Taxes 4 Revenue 5 Cash Expenses 6 Revenue - Cash Expense 7 Straight Line Accounting Depre. 8 Income Before Taxes 9 Calculation of Income Taxe Payable 10 MACRS Rate 11 Tax Depreciation 12 Taxable income 13 Income Tax Rate 14 Income Tax Payable 15 Balance Sheet 16 Temporary Differnce This Year 17 Accumulated Unrevered Temporary Difference 18 Deferred Tax Liability Balance 19 Income Statement 20 Current Tax Expense 21 Deffered Tax Expense 22 Total Income Tax Expense 23 Net Income 14.29% 40012 9988 35% 3495.80 24.49% 68572 1428 35% 499.80 17.49% 48972 23028 35% 8059.80 12.49% 34972 39028 30% 11708.40 8.93% 25004 42996 30% 12898.80 8.92% 24976 43024 30% 12907.20 8.93% 25004 39996 30% 11998.80 4.46% 12488 49512 30% 14853.60 -22512 5012 5012 1754.20 33572 38584 13504.40 13972 52556 18394.60 -28 52528 15758.40 -9996 42532 12759.60 -10024 32508 9752.40 -9996 22512 6753.60 0 3495.80 1754.20 5250.00 9750.00 499.80 11750.20 12250.00 22750.00 8059.80 4890.20 12950.00 24050.00 11708.40 -2636.20 9072.20 29927.80 12898.80 -2998.80 9900.00 23100.00 12907.20 -3007.20 9900.00 23100.00 11998.80 -2998.80 9000.00 21000.00 14853.60 -6753.60 8100.00 18900.00 Quark Donut Company was incorporated (as a C corporation and started business in 2007, make and sell donuts. Quark rented space in a local mall with a 8 year operating lease. Quark's only capital expenditure was the purchase in January of 2007 of equipment at a cost of $280,000. This equipment has an economic life of 8 years and 0 expected salvage value. Quark uses straight line depreciation for computation of GAAP net income because this best reflects the true economic depreciation of the equipment. For income tax purposes Quark is permitted to use MACRS (the modified accelerated cost recovery system), and the equipment is considered to be in the 7 year class. Therefore the allowed MACRS rates are: 14.29% the first year, 24.49% the second year, 17.49% the third year, 12.49% the fourth year 8.93% the fifth year, 8.92% in the sixth 8.93% in the seventh year and 4.46% in the 8th year. Depreciation is the only non-cash expense, and is the only source of a difference between taxable income and financial accounting income before tax. Assume an income tax rate of 35% is enacted for the years 2007-2009. During the year 2010 a new income tax rate of 30% was enacted for 2010 to 2014. Projected revenues and operating expenses (excluding taxes and depreciation) are as follows: Year Revenues Expenses 2007 $150,000 $100,000 2008 $180,000 $110,000 2009 $185,000 $113,000 2010 $190,000 $116,000 Year Revenues Expenses 2011 $195,000 $127,000 2012 $200,000 $132,000 2013 $200,000 $135,000 2014 $200,000 $138,000 Required: I. Use a spreadsheet to find: (note: your spreadsheet is the answer to part I) a. income taxes paid that year(current income tax payable) deferred tax liability the change in deferred tax liability (equal to deferred income tax expense) total income tax expense, net income II. Using the numbers from your spreadsheet hand write the correct journal entry for income taxes for the year 2010. III. Find the effective tax rate for 2010 and explain why the effective tax rate for 2010 is not 30% IV. Assuming the straight line method yields the true economic depreciation what is the advantages of being able to use MACRS for income tax determinations? Why are tax effects important in deciding whether this is a good investment? F G H I 280000 Economic Life 2017 2018 8 2019 2020 2021 2022 2023 2024 150000 100000 50000 35000 15000 180000 110000 70000 35000 35000 185000 113000 72000 35000 37000 190000 116000 74000 35000 39000 195000 127000 68000 35000 33000 200000 132000 68000 35000 33000 200000 135000 65000 35000 30000 200000 138000 62000 35000 27000 1 1 Equipment Purchase Cost 2 Year 3 Income Before Taxes 4 Revenue 5 Cash Expenses 6 Revenue - Cash Expense 7 Straight Line Accounting Depre. 8 Income Before Taxes 9 Calculation of Income Taxe Payable 10 MACRS Rate 11 Tax Depreciation 12 Taxable income 13 Income Tax Rate 14 Income Tax Payable 15 Balance Sheet 16 Temporary Differnce This Year 17 Accumulated Unrevered Temporary Difference 18 Deferred Tax Liability Balance 19 Income Statement 20 Current Tax Expense 21 Deffered Tax Expense 22 Total Income Tax Expense 23 Net Income 14.29% 40012 9988 35% 3495.80 24.49% 68572 1428 35% 499.80 17.49% 48972 23028 35% 8059.80 12.49% 34972 39028 30% 11708.40 8.93% 25004 42996 30% 12898.80 8.92% 24976 43024 30% 12907.20 8.93% 25004 39996 30% 11998.80 4.46% 12488 49512 30% 14853.60 -22512 5012 5012 1754.20 33572 38584 13504.40 13972 52556 18394.60 -28 52528 15758.40 -9996 42532 12759.60 -10024 32508 9752.40 -9996 22512 6753.60 0 3495.80 1754.20 5250.00 9750.00 499.80 11750.20 12250.00 22750.00 8059.80 4890.20 12950.00 24050.00 11708.40 -2636.20 9072.20 29927.80 12898.80 -2998.80 9900.00 23100.00 12907.20 -3007.20 9900.00 23100.00 11998.80 -2998.80 9000.00 21000.00 14853.60 -6753.60 8100.00 18900.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started