Answered step by step

Verified Expert Solution

Question

1 Approved Answer

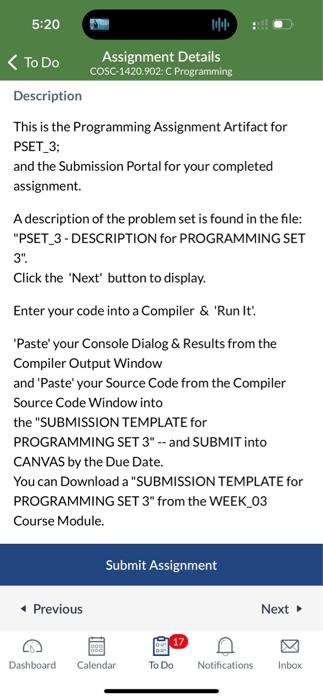

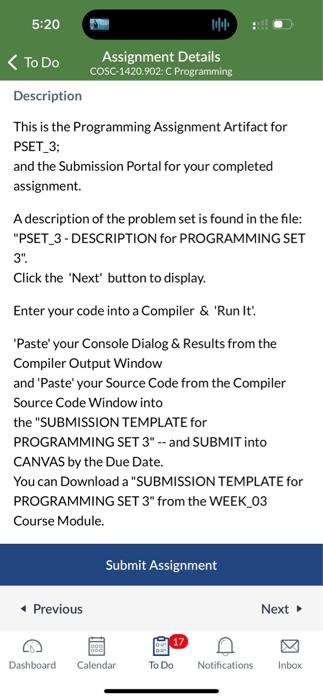

I want the answer in C programming language Description This is the Programming Assignment Artifact for PSET_3; and the Submission Portal for your completed assignment.

I want the answer in C programming language

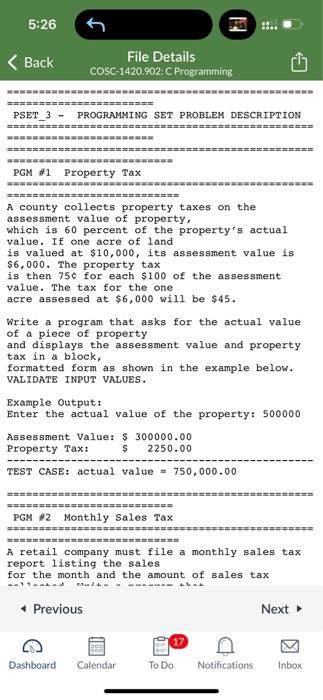

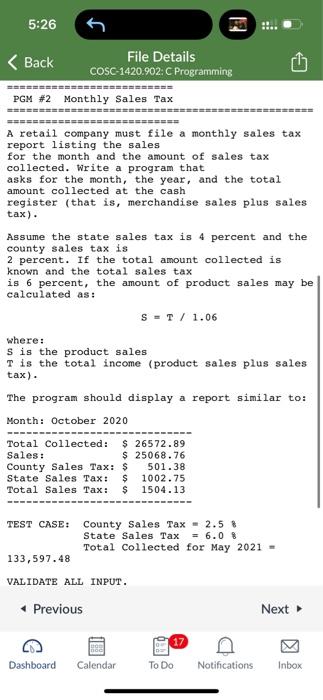

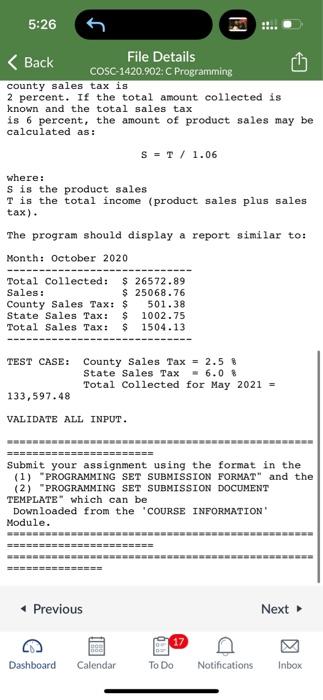

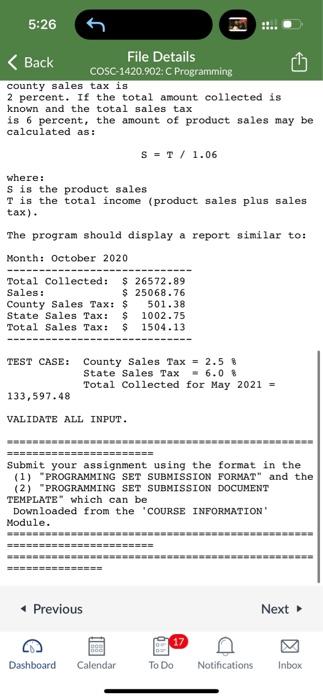

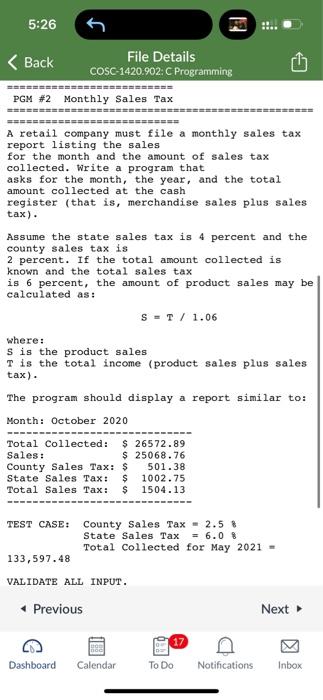

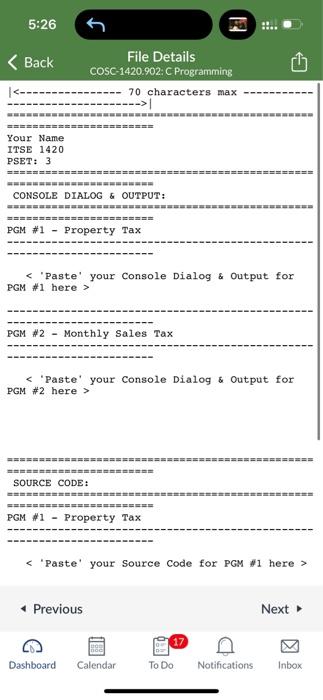

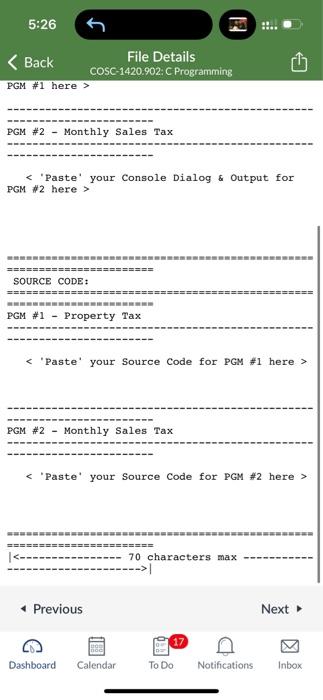

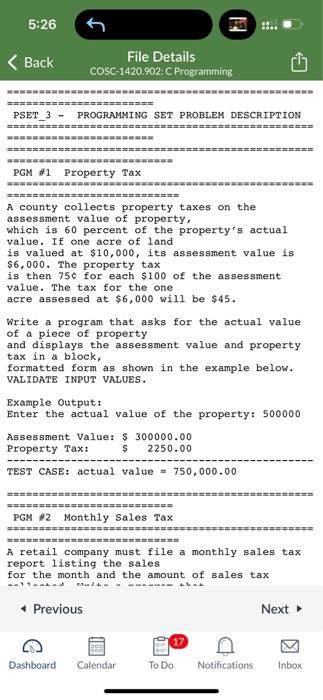

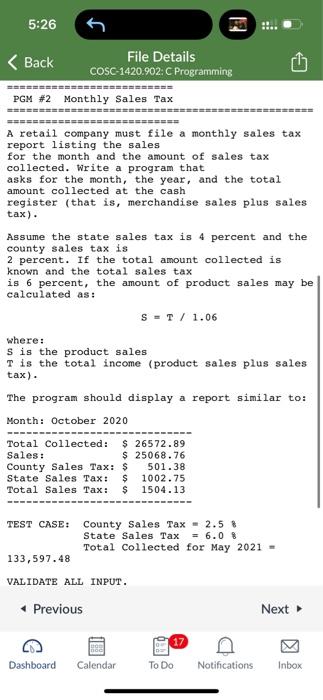

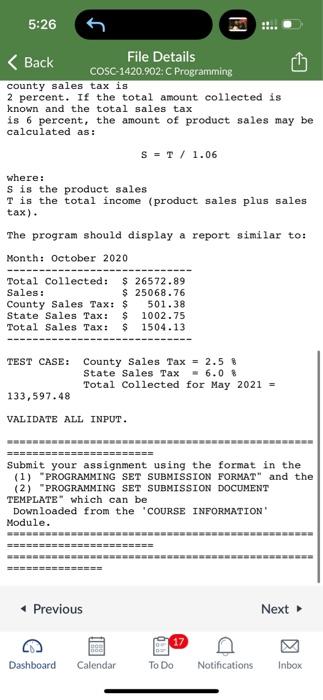

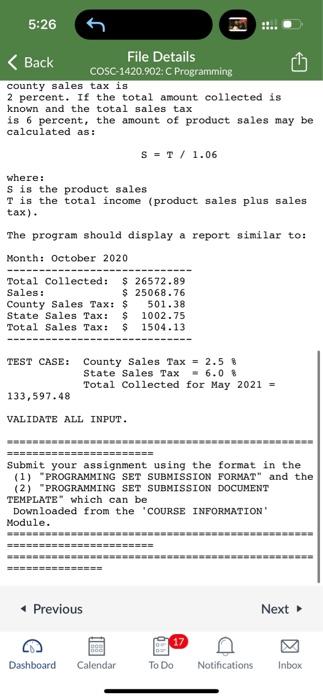

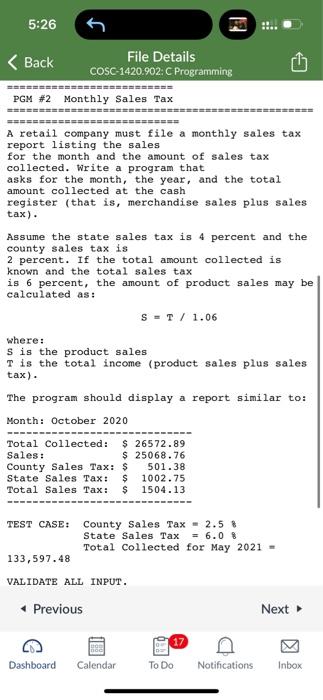

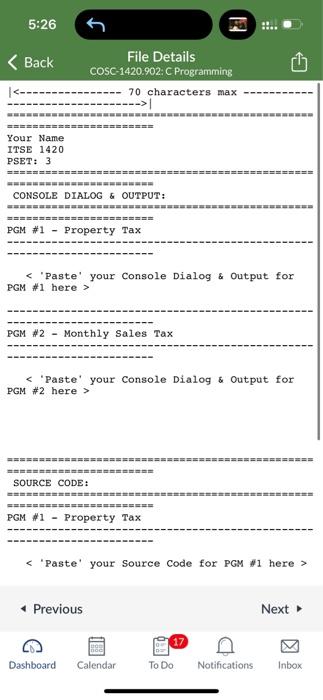

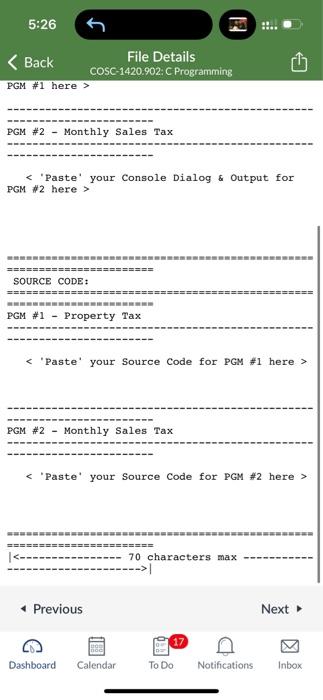

Description This is the Programming Assignment Artifact for PSET_3; and the Submission Portal for your completed assignment. A description of the problem set is found in the file: "PSET_3 - DESCRIPTION for PROGRAMMING SET 3". Click the 'Next' button to display. Enter your code into a Compiler \& 'Run It'. 'Paste' your Console Dialog \& Results from the Compiler Output Window and 'Paste' your Source Code from the Compiler Source Code Window into the "SUBMISSION TEMPLATE for PROGRAMMING SET 3" -- and SUBMIT into CANVAS by the Due Date. You can Download a "SUBMISSION TEMPLATE for PROGRAMMING SET 3 " from the WEEK_03 Course Module. PSET_3 - PROGRAMMING SET PROBLEM DESCRIPTION PGM \#1 Property Tax A county collects property taxes on the assessment value of property, which is 60 percent of the property's actual value. If one acre of land is valued at $10,000, its assessment value is $6,000. The property tax is then 756 for each $100 of the assessment value. The tax for the one acre assessed at $6,000 will be $45. Write a program that asks for the actual value of a piece of property and displays the assessment value and property tax in a block, formatted form as shown in the example below. VALIDATE INPUT VALUES. Example Output: Enter the actual value of the property: 500000 Assessment Value: $300000.00 Property Tax: \$ 2250.00 TEST CASE: actual value =750,000.00 A retail company must file a monthly sales tax report listing the sales for the month and the amount of sales tax 4 Previous Next PGM \#2 Monthly Sales Tax A retail company must file a monthly sales tax report 1 isting the sales for the month and the amount of sales tax collected. Write a program that asks for the month, the year, and the total amount collected at the cash register (that is, merchandise sales plus sales tax ). Assume the state sales tax is 4 percent and the county sales tax is 2 percent. If the total amount collected is known and the total sales tax is 6 percent, the amount of product sales may be calculated as : S=T/1.06 where: S is the product sales T is the total income (product sales plus sales tax). The program should display a report similar to: Month: October 2020 Total Collected: \$26572.89 Sales: $25068.76 County Sales Tax: $501.38 State Sales Tax: \$ 1002.75 Total Sales Tax: \$ 1504.13 TEST CASE: County Sales Tax =2.5 8 State Sales Tax =6.0f 133,597.48 Total Collected for May 2021= VALIDATE ALL INPUT. 4 Previous county sales tax is 2 percent. If the total amount collected is known and the total sales tax is 6 percent, the amount of product sales may be calculated as: s=T/1.06 where: S is the product sales T is the total income (product sales plus sales tax)+ The program should display a report similar to: Month: October 2020 TESTCASE:133,597,48CountySalesTax=2.58StateSalesTax=6.08TotalCollectedforMay2021= VALIDATE ALL INPUT . Submit your assignment using the format in the (1) "PROGRAMMING SET SUBMISSION FORMAT" and the (2) "PROGRAMMING SET SUBMISSION DOCUMENT TEMPLATE" which can be Downloaded from the 'COURSE INFORMATION" Module. nan=n=n=n=n=A Next county sales tax is 2 percent. If the total amount collected is known and the total sales tax is 6 percent, the amount of product sales may be calculated as: s=T/1.06 where: S is the product sales T is the total income (product sales plus sales tax)+ The program should display a report similar to: Month: October 2020 TESTCASE:133,597,48CountySalesTax=2.58StateSalesTax=6.08TotalCollectedforMay2021= VALIDATE ALL INPUT . Submit your assignment using the format in the (1) "PROGRAMMING SET SUBMISSION FORMAT" and the (2) "PROGRAMMING SET SUBMISSION DOCUMENT TEMPLATE" which can be Downloaded from the 'COURSE INFORMATION" Module. nan=n=n=n=n=A Next PGM \#2 Monthly Sales Tax A retail company must file a monthly sales tax report 1 isting the sales for the month and the amount of sales tax collected. Write a program that asks for the month, the year, and the total amount collected at the cash register (that is, merchandise sales plus sales tax ). Assume the state sales tax is 4 percent and the county sales tax is 2 percent. If the total amount collected is known and the total sales tax is 6 percent, the amount of product sales may be calculated as : S=T/1.06 where: S is the product sales T is the total income (product sales plus sales tax). The program should display a report similar to: Month: October 2020 Total Collected: \$26572.89 Sales: $25068.76 County Sales Tax: $501.38 State Sales Tax: \$ 1002.75 Total Sales Tax: \$ 1504.13 TEST CASE: County Sales Tax =2.5 8 State Sales Tax =6.0f 133,597.48 Total Collected for May 2021= VALIDATE ALL INPUT. 4 Previous SOURCE CODE: PGM \#1 - Property Tax 4 Previous Next PGM \#1 here > PGM \#2 - Monthly Sales Tax men

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started