- i want the calculation process for question 2 8 and 9

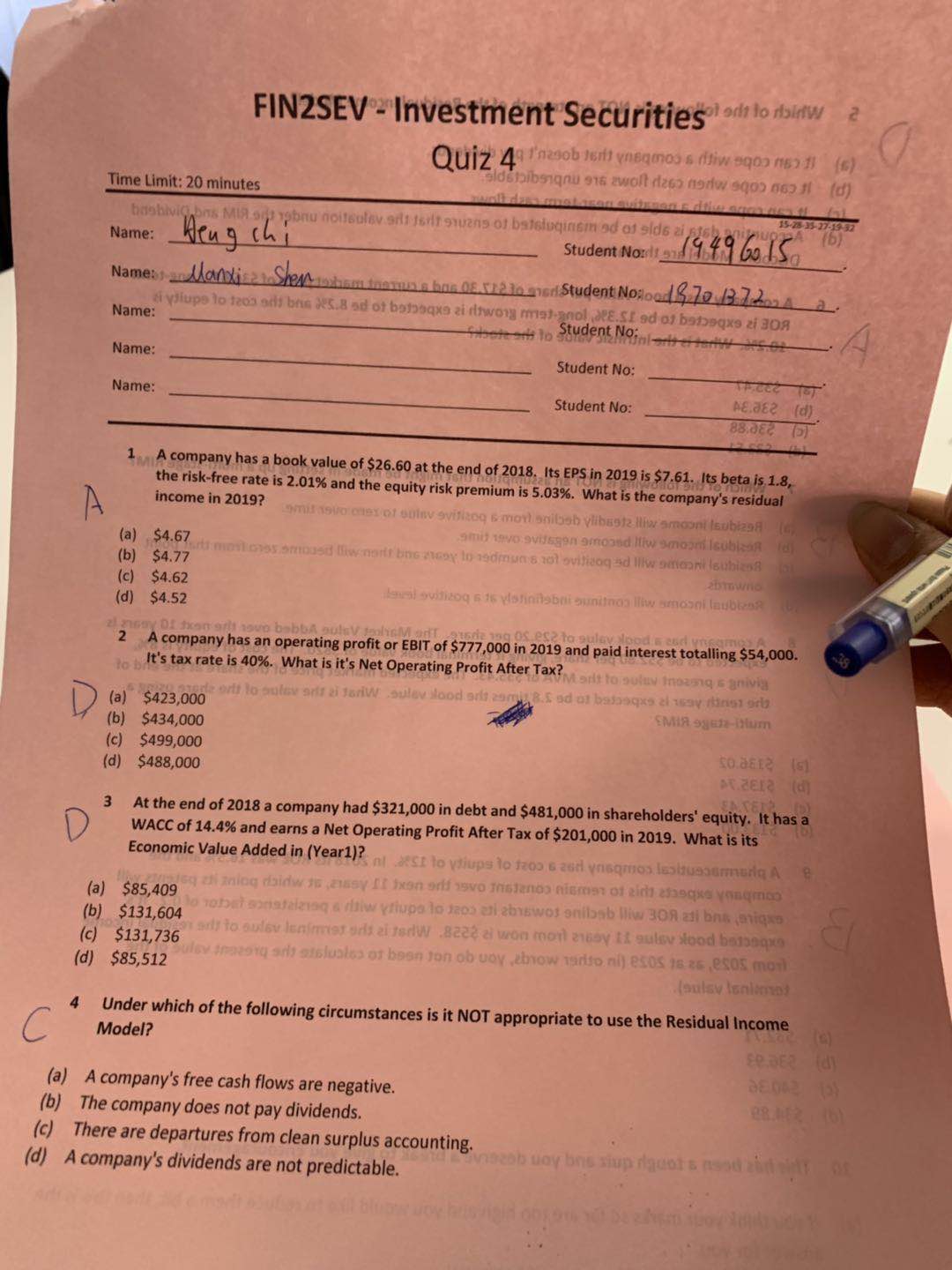

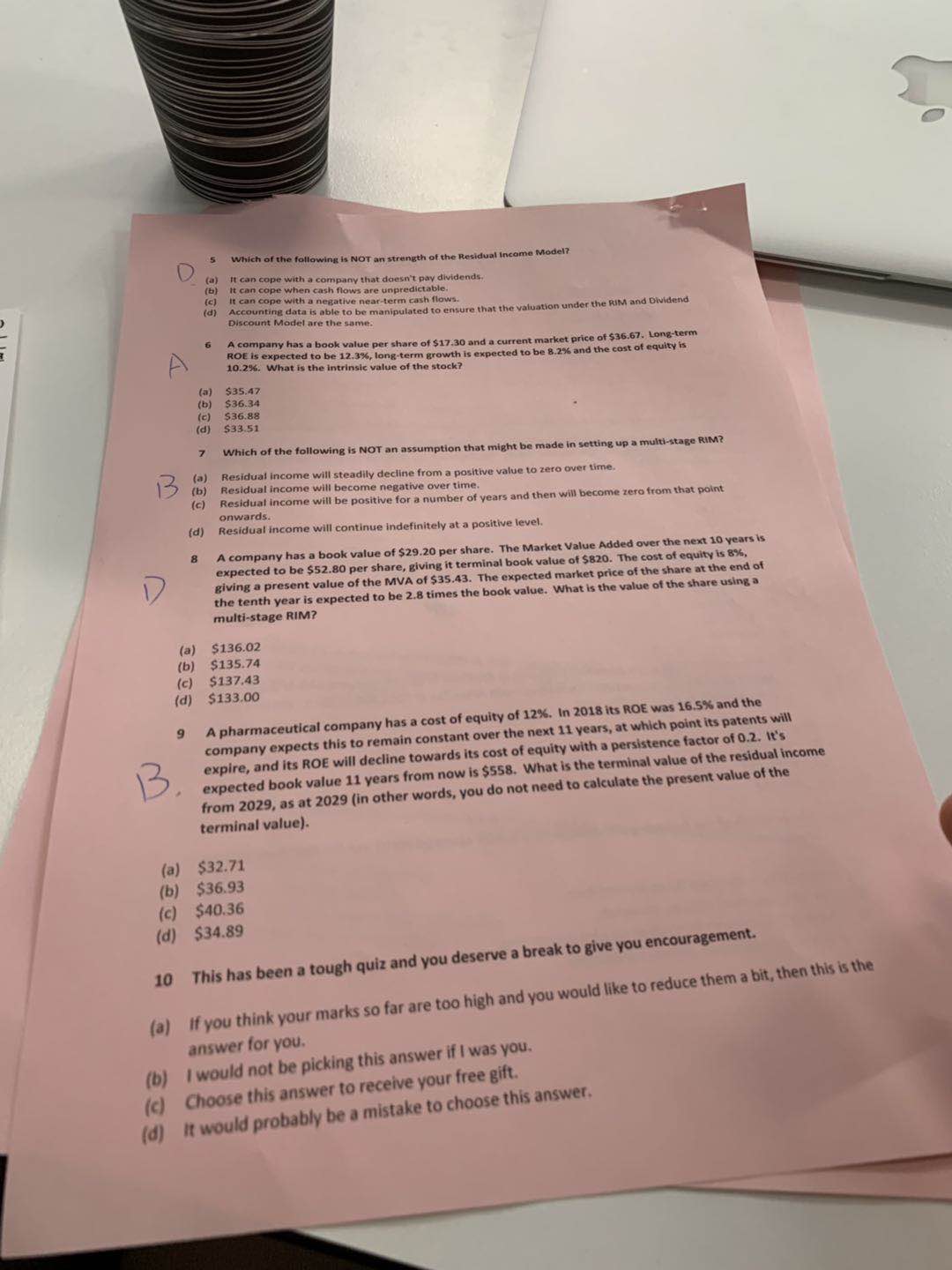

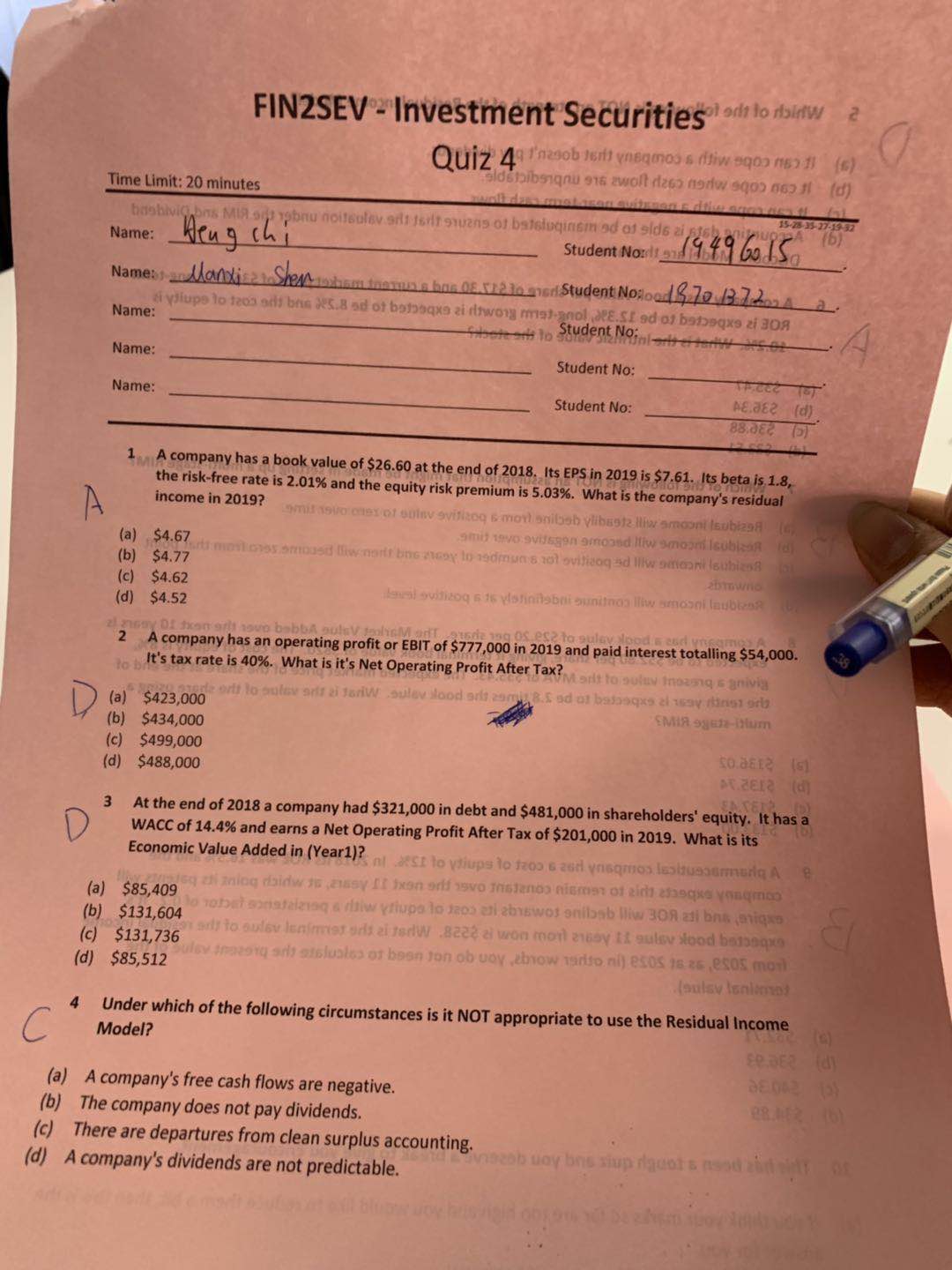

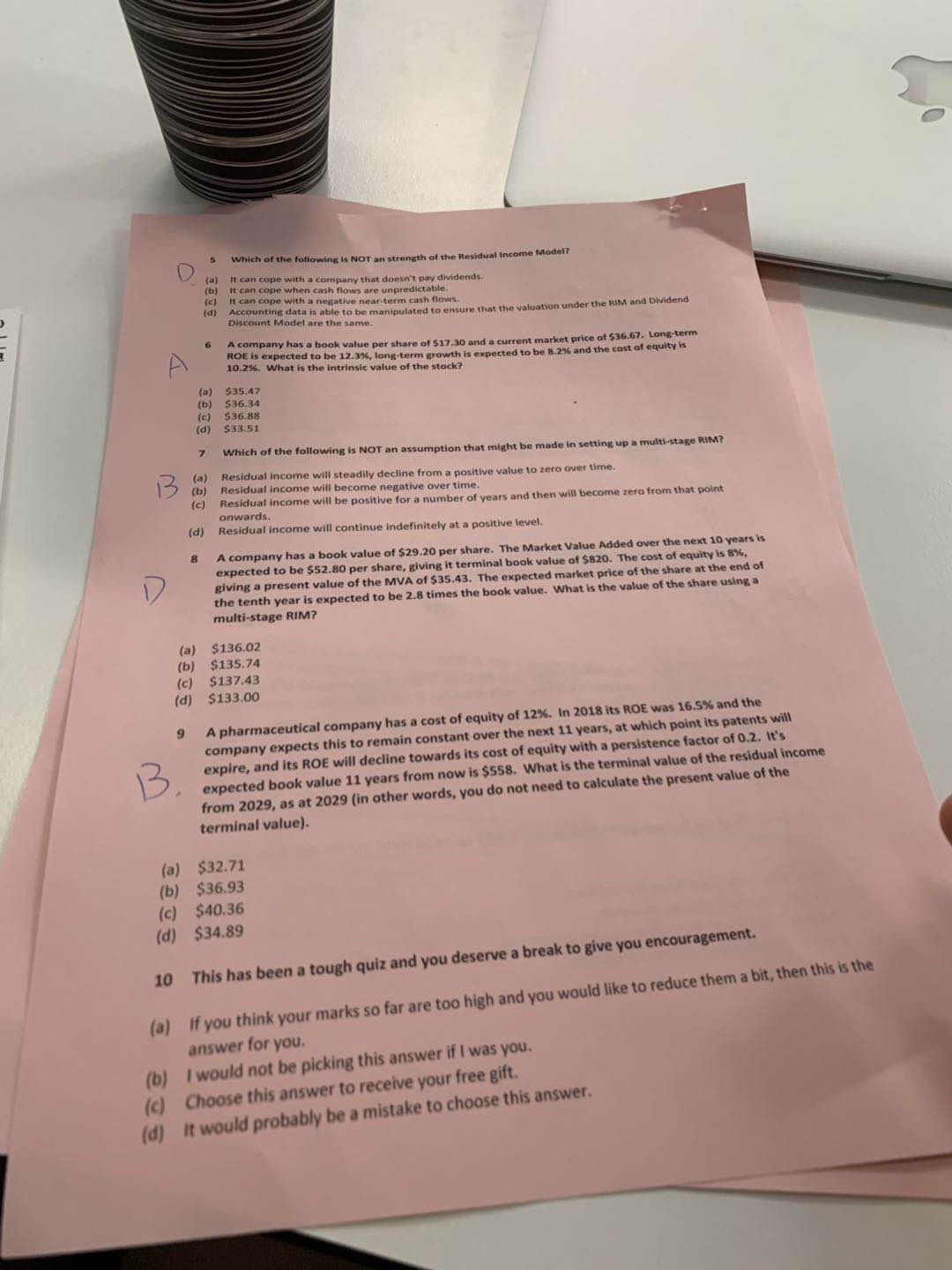

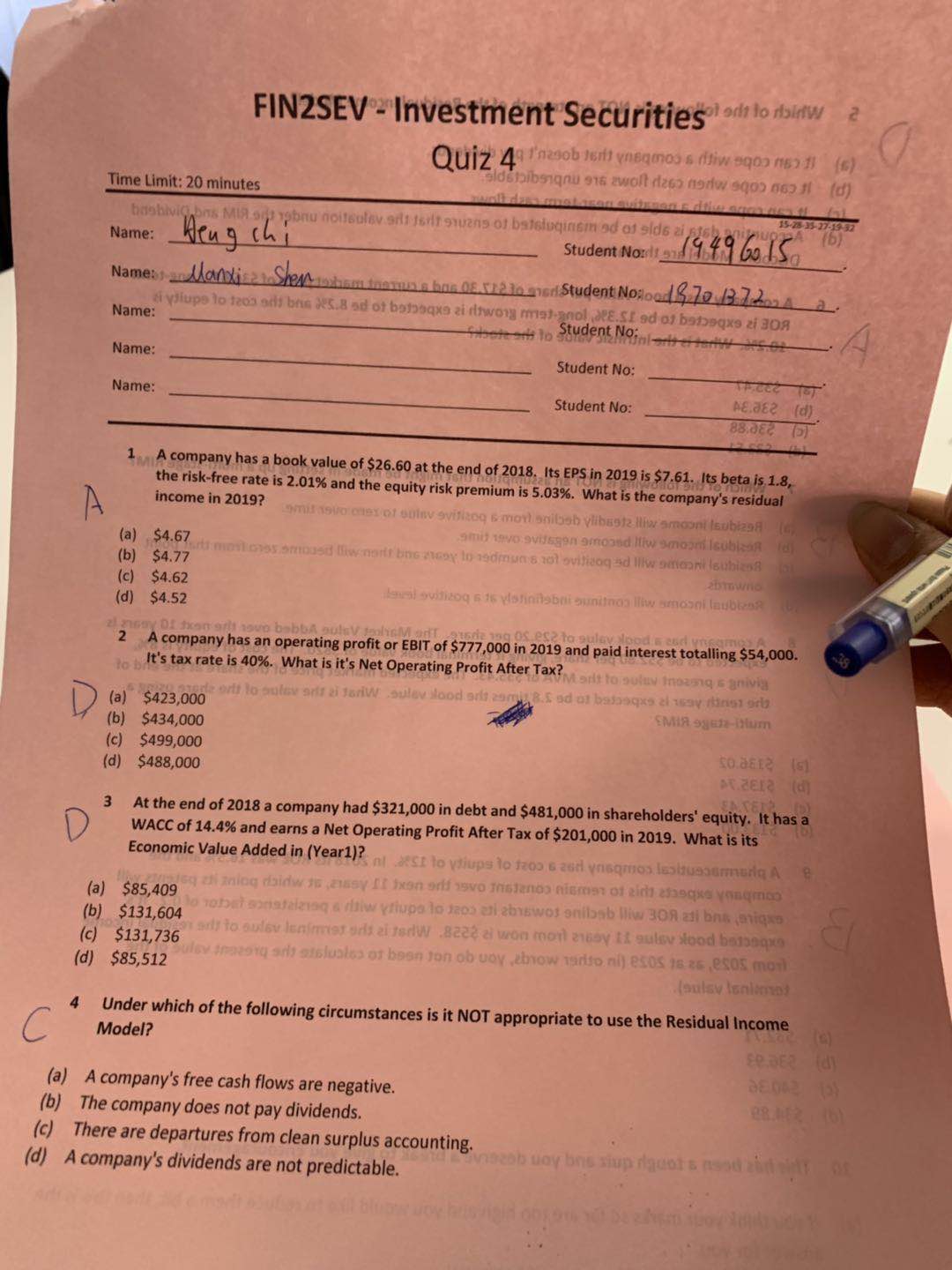

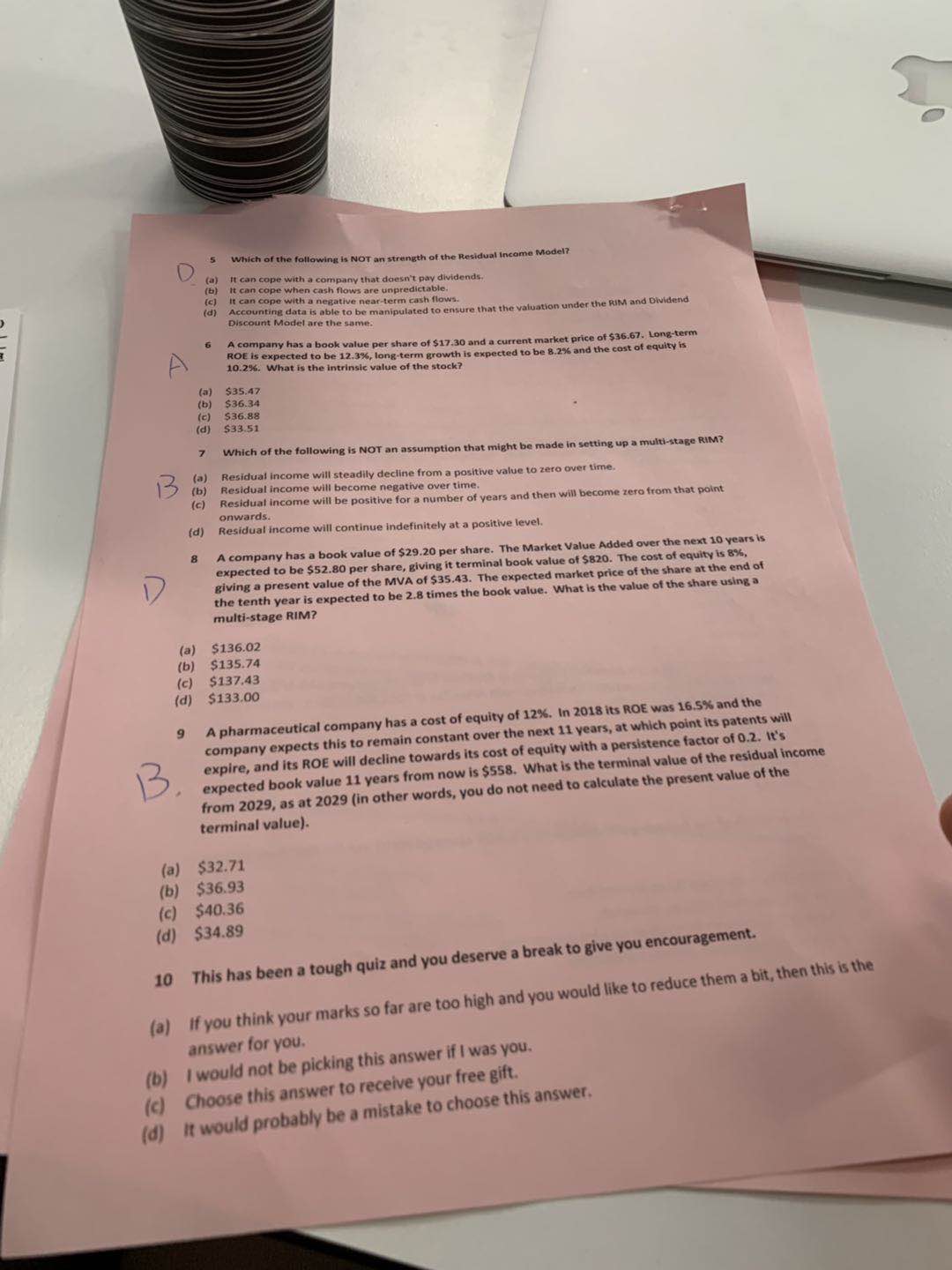

FIN2SEV -Investment Securities ah to rbinw 2 Quiz 4: "'nzoob 161fl vnegmos s (fliw 9qoo /15) 11 (6) Time Limit: 20 minutes aldshibsignu 916 awalt daco norw sqoo ness! (d) hashivig 15-28-35-27-19-32 Name: Heng chi pbru foilsulev sit forit owens of batsluginem ed of aids zi sis Student Norland 9.49 Gods (6) Name: i yilups to leon ards bris *5.Bad of bombsqxe ai sitwong mal anoldE.SF ed of barosqxe zi 308 Student No; - Name: Student No: Name: Student No: 88.082 (5) A company has a book value of $26.60 at the end of 2018, Its EPS in 2019 is $7.61. Its beta is 1.8, income in 2019? the risk-free rate is 2.01% and the equity risk premium is 5.03%. What is the company's residual A milastto meY of only evilling s moy nilab vlibasta lliw amount Isubizag (6, amit 19vo svifegan amoand Illw smaam Isublean ray (b ) $4.67 movloves ambued liw not be stay lo 19dmums zol evilidog ad Illwomen Iswhizsa $4.77 (c) $4.62 abrowno (d) $4.52 laval ovidizog s is wishinilabut aunitwon lliw amosni laubless 2 A company has an operating profit or EBIT of $777,000 in 2019 and paid interest totalling $54,000. It's tax rate is 40%. What is it's Net Operating Profit After Tax?Man to suluv Inoasig s gnivia (a) $423,000 off to anlev arif ai fariW . sulev lood aris zomy 8.S ed at babasque al way thing orla (b) $434,000 EMIR sgene-blum (c ) $499,000 (d) $488,000 so.a81.2 (51 3 At the end of 2018 a company had $321,000 in debt and $481,000 in shareholders' equity. It has a D WACC of 14.4% and earns a Net Operating Profit After Tax of $201,000 in 2019. What is its Economic Value Added in (Year!)? est to viups to fzoo's asd vnegros, Isshaunsummerin A (a) $85,409Ing aidw th ,assy It ixen orif asvo Islenoo nisman of zich abogus vongmoo (b) $131,604 to nobel sonataizing a rhiw yfiups lo laos all amawos anibab lliw BOR all bris (migas (c) $131,736 vardy to oulev lenfries oris al rarlw .82ed a won more asay it subsy stood bangaqua (d) $85,512 lev #naeorg aris sisluales of been Jon ob voy ,ehow marifo al) esos 18 25 ,e505 mor) .loulsy lanlamas C Under which of the following circumstances is it NOT appropriate to use the Residual Income Model? (a) A company's free cash flows are negative. (b) The company does not pay dividends. BR.ME2. (6) (c) There are departures from clean surplus accounting. (d) A company's dividends are not predictable. inseobuoy bnis xiup quot s asod zad city orS Which of the following is NOT an strength of the Residual Income Model? (a) It can cope with a company that doesn't pay dividends, (b) It can cope when cash predictable. (c) It can cope with a negative near-term cash flows. (d) Accounting data is able to be Discount Model are the same. able to be manipulated to ensure that the valuation under the RIM and Dividend A A company has a book value per share of $17.30 and a current market price of $36.67. Long-term ROE is expected to be 12.3%, long-term growth is expected to be 8.2% and the cost of equity is 10.2%. What is the intrinsic value of the stock? (a) $35.47 (b) $36.34 (c) 536.88 (d) $33.51 Which of the following is NOT an assumption that might be made in setting up a multi-stage RIM? 13 (a) b) Residual income will steadily decline from a positive value to zero over time, Residual income will become negative over time. Residual income will be positive for a number of years and then will become zero from that point onwards. (d) Residual income will continue indefinitely at a positive level. 8 A company has a book value of $29.20 per share. The Market Value Added over the next 10 years is expected to be $52.80 per share, giving it terminal book value of $820. The cost of equity is 8%, giving a present value of the MVA of $35.43. The expected market price of the share at the end of the tenth year is expected to be 2.8 times the book value. What is the value of the share using a multi-stage RIM? (a) $136.02 (b) $135.74 (c) $137.43 (d) $133.00 9 A pharmaceutical company has a cost of equity of 12%. In 2018 its ROE was 16.5% and the company expects this to remain constant over the next 11 years, at which point its patents will expire, and its ROE will decline towards its cost of equity with a persistence factor of 0.2. It's expected book value 11 years from now is $558. What is the terminal value of the residual income from 2029, as at 2029 (in other words, you do not need to calculate the present value of the terminal value). (a) $32.71 (b) $36.93 (c) $40.36 (d) $34.89 10 This has been a tough quiz and you deserve a break to give you encouragement. (a) If you think your marks so far are too high and you would like to reduce them a bit, then this is the answer for you. (b) I would not be picking this answer if I was you. (c) Choose this answer to receive your free gift. (d) It would probably be a mistake to choose this