I want to know the four parts.

| | Dec2014 | Dec2015 | Dec2016 | Dec2017 | Dec2018 | Industry average 2018 |

| Asset efficiency ratios | | | | | | |

| Inventory turnover (times) | | | | | | 4.1 |

| Inventory days (days) | | | | | | 89.0 |

| Acct. receivable days (days) | | | | | | 3.2 |

| Acct. payable days (days) | | | | | | 24.9 |

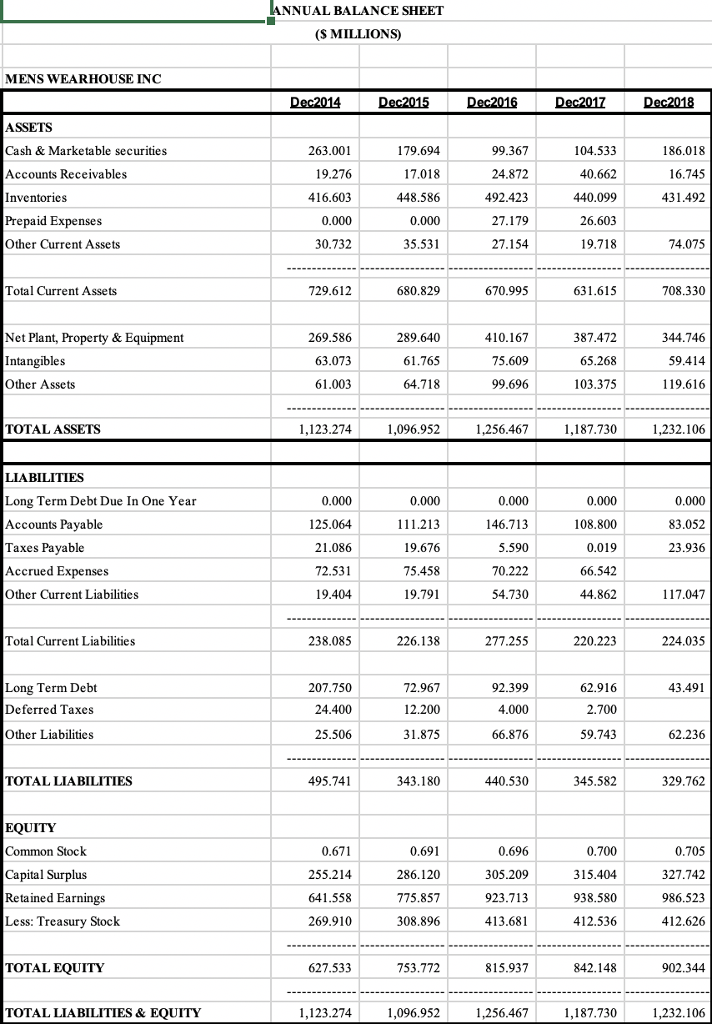

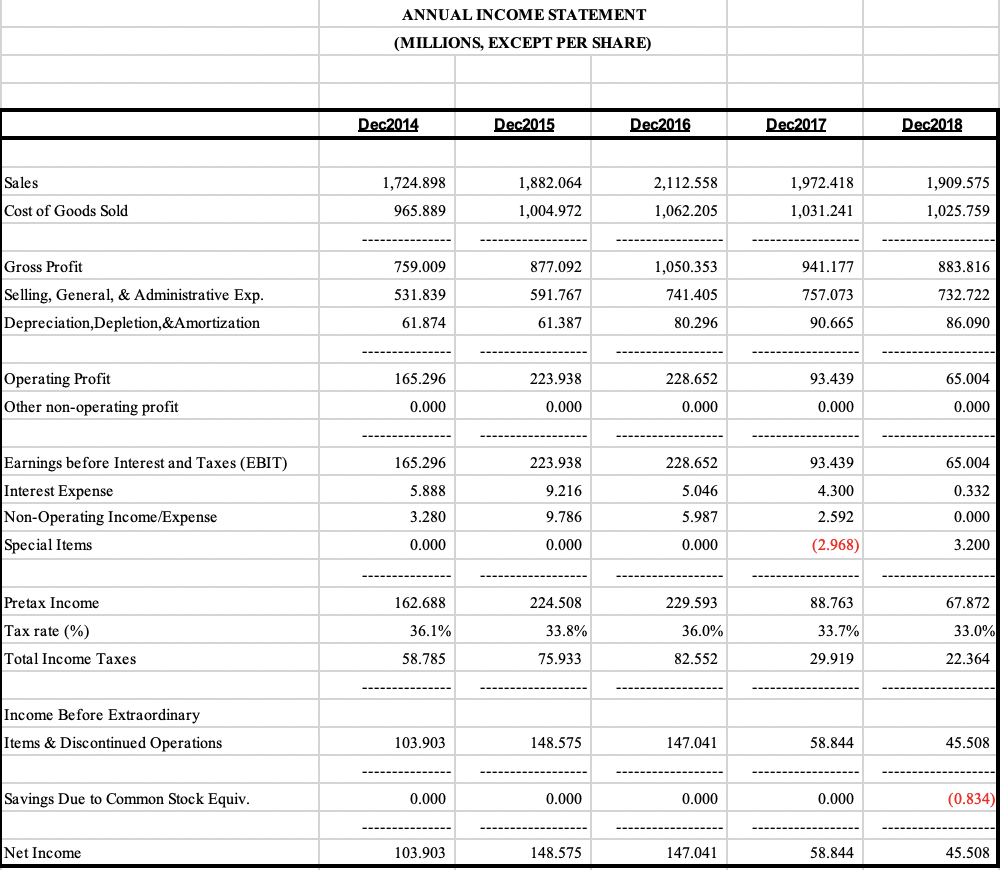

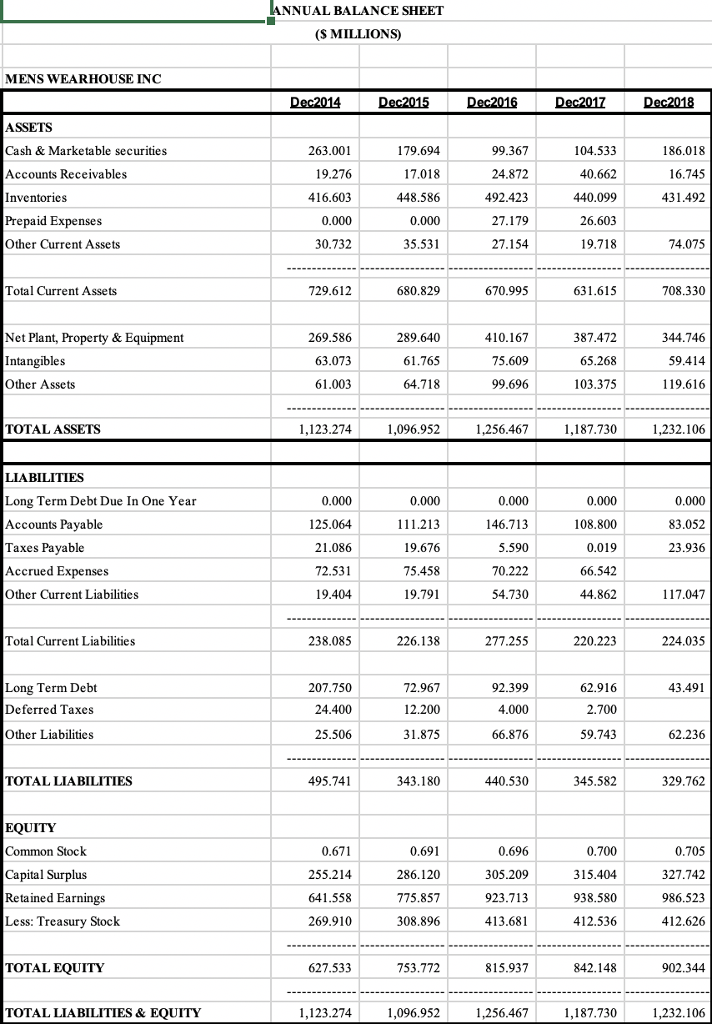

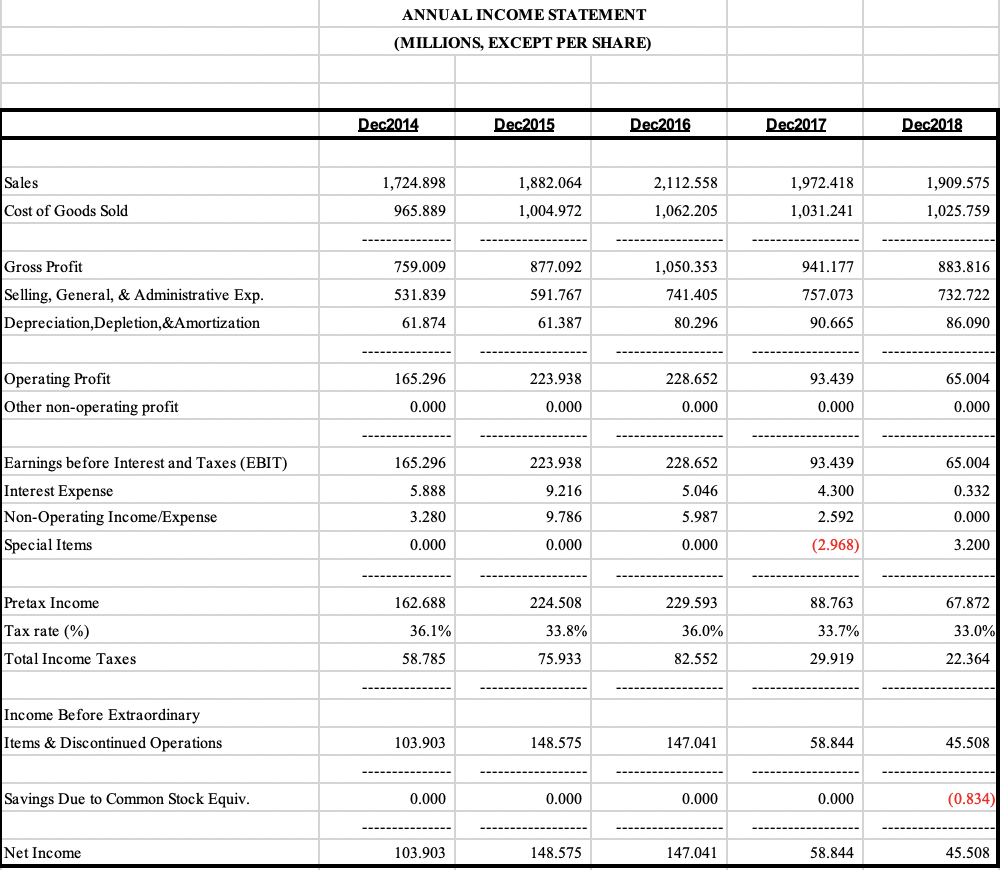

ANNUAL BALANCE SHEET S MILLIONS) MENS WEARHOUSE INC Dec2015 Dec2018 ASSETS Cash & Marketable securities Accounts Receivables Inventories 263.001 19.276 416.603 179.694 17.018 448.586 0.000 99.367 24.872 492.423 104.533 40.662 440.099 26.603 186.018 16.745 431.492 xpenses Other Current Assets 30.732 74.075 Total Current Assets 729.612 680.829 670.995 631.615 708.330 289.640 Net Plant, Property & Equipment Intangible:s Other Assets 269.586 63.073 61.003 387.472 65.268 103.375 61.765 75.609 59.414 119.616 TOTAL ASSETS 1,123.274 1,096.952 1,256.467 1,187.730 1,232.106 LIABILITIES Long Term Debt Due In One Year Accounts Payable Taxes Payable Accrued Expenses Other Current Liabilities 0.000 111.213 19.676 75.458 19.791 0.000 0.000 0.000 83.052 23.936 125.064 21.086 72.531 19.404 146.713 108.800 70.222 66.542 54.730 117.047 Total Current Liabilities 238.085 226.138 277.255 220.223 224.035 62.916 Long Term Debt Deferred Taxes Other Liabilities 207.750 24.400 25.506 72.967 12.200 31.875 92.399 43.491 66.876 59.743 62.236 TOTAL LIABILITIES 495.741 440.530 329.762 EQUITY Common Stock 255.214 641.558 269.910 286.120 775.857 308.896 305.209 315.404 938.580 412.536 327.742 986.523 412.626 us Retained Earnings Less: Treasury Stock 923.713 TOTAL EQUITY 627.533 753.772 815.937 842.148 902.344 TOTAL LIABILITIES & EQUITY 1,123.274 1,096.952 1,256.467 1,187.730 1,232.106 ANNUAL INCOME STATEMENT (MILLIONS, EXCEPT PER SHARE) 1,724.898 1,882.064 2,112.558 1,972.418 1,909.575 Cost of Goods Sold 965.889 1,004.972 1,062.205 1,031.241 1,025.759 Gross Profit Selling, General, & Administrative Exp Depreciation,Depletion,&Amortization 759.009 531.839 61.874 877.092 591.767 61.387 1,050.353 741.405 80.296 941.177 757.073 90.665 883.816 732.722 86.090 Operating Profit Other non-operating profit 165.296 223.938 228.652 93.439 65.004 0.000 0.000 0.000 0.000 0.000 Earnings before Interest and Taxes (EBIT) Interest Expense Non-Operating Income/Expense Special Items 165.296 5.888 3.280 0.000 223.938 9.216 9.786 0.000 228.652 5.046 5.987 0.000 93.439 4.300 2.592 (2.968) 65.004 0.332 0.000 3.200 Pretax Income Tax rate (%) Total Income Taxes 162.688 224.508 229.593 88.763 67.872 33.7% 33.0% 58.785 75.933 82.552 29.919 22.364 Income Before Extraordinary Items & Discontinued Operations 103.903 148.575 147.041 58.844 45.508 Savings Due to Common Stock Equiv 0.000 0.000 0.000 0.000 (0.834 Net Income 103.903 148.575 147.041 58.844 45.508