Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I want to see the cells references, int the bar. simple explanations please. dont make it more difficult. Thanks Job Costing Time Period Used to

I want to see the cells references, int the bar. simple explanations please. dont make it more difficult. Thanks

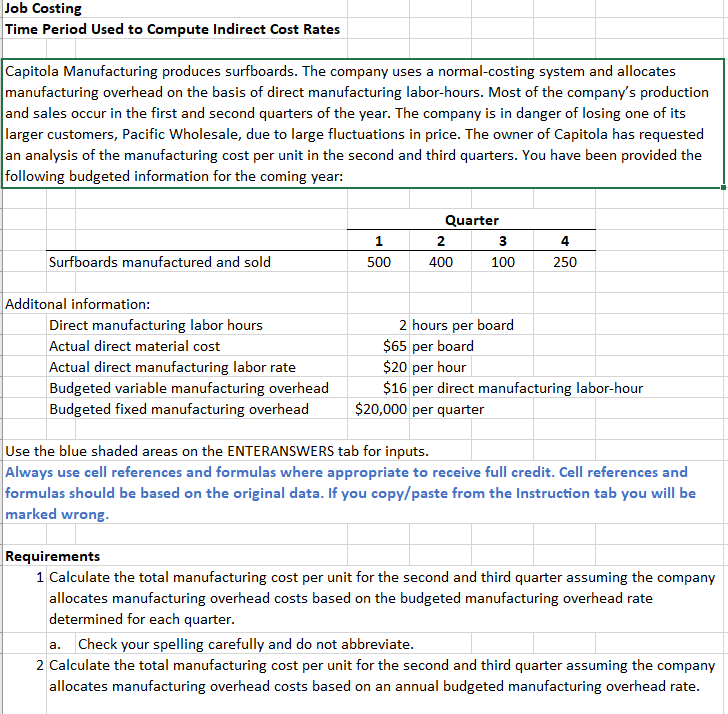

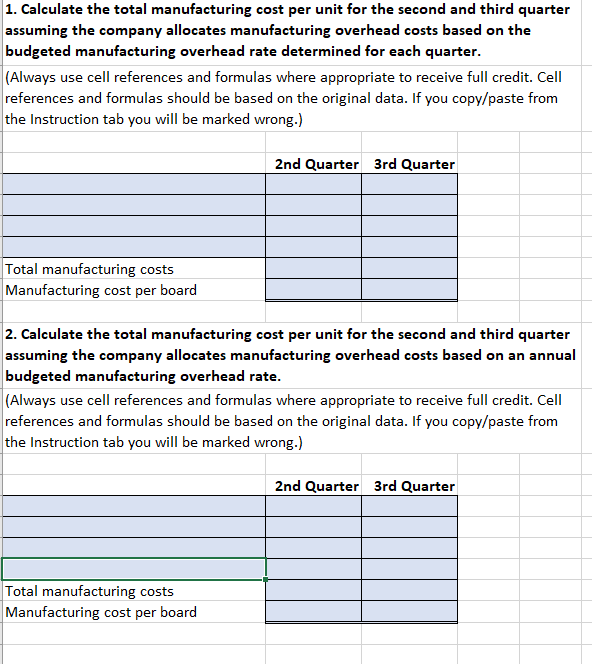

Job Costing Time Period Used to compute Indirect Cost Rates Capitola Manufacturing produces surfboards. The company uses a normal-costing system and allocates manufacturing overhead on the basis of direct manufacturing labor-hours. Most of the company's production and sales occur in the first and second quarters of the year. The company is in danger of losing one of its larger customers, Pacific Wholesale, due to large fluctuations in price. The owner of Capitola has requested an analysis of the manufacturing cost per unit in the second and third quarters. You have been provided the following budgeted information for the coming year: Quarter 2 3 400 100 1 500 4 Surfboards manufactured and sold 250 Additonal information: Direct manufacturing labor hours Actual direct material cost Actual direct manufacturing labor rate Budgeted variable manufacturing overhead Budgeted fixed manufacturing overhead 2 hours per board $65 per board $20 per hour $16 per direct manufacturing labor-hour $20,000 per quarter Use the blue shaded areas on the ENTERANSWERS tab for inputs. Always use cell references and formulas where appropriate to receive full credit. Cell references and formulas should be based on the original data. If you copy/paste from the Instruction tab you will be marked wrong. Requirements 1 Calculate the total manufacturing cost per unit for the second and third quarter assuming the company allocates manufacturing overhead costs based on the budgeted manufacturing overhead rate determined for each quarter. Check your spelling carefully and do not abbreviate. 2 Calculate the total manufacturing cost per unit for the second and third quarter assuming the company allocates manufacturing overhead costs based on an annual budgeted manufacturing overhead rate. aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started