I was wondering if you can help me with Chapter 9 exercise AI-4 (Completing a payroll register using tables) Excel LO2 this exercise is in the book fundamental accounting principles.

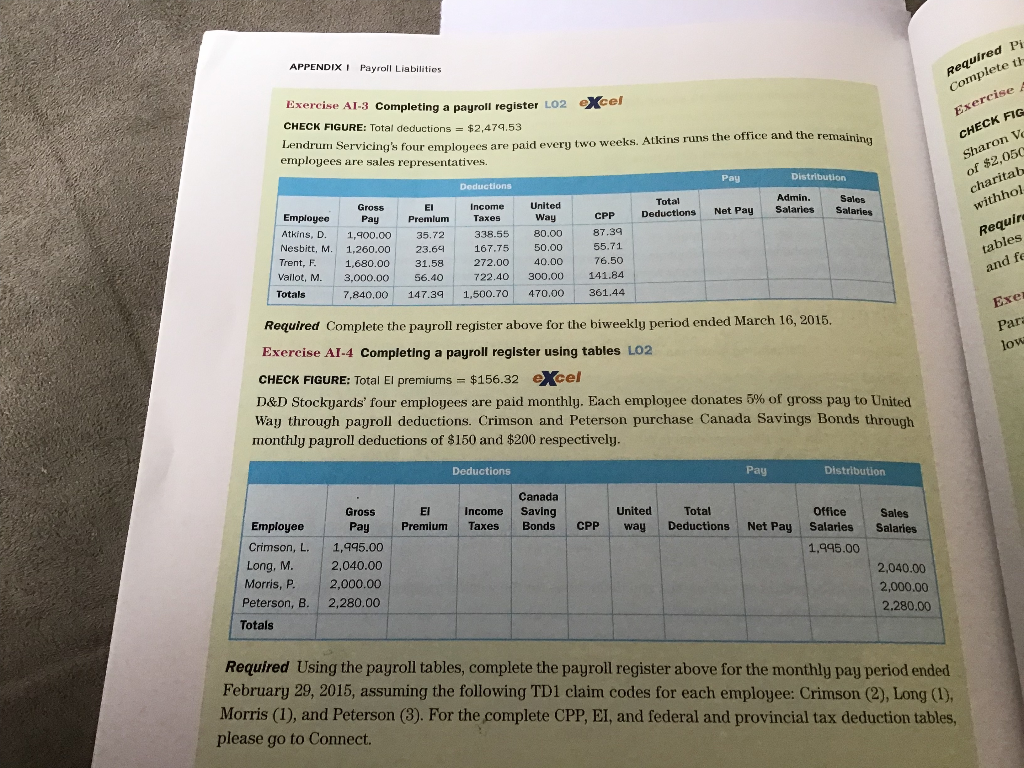

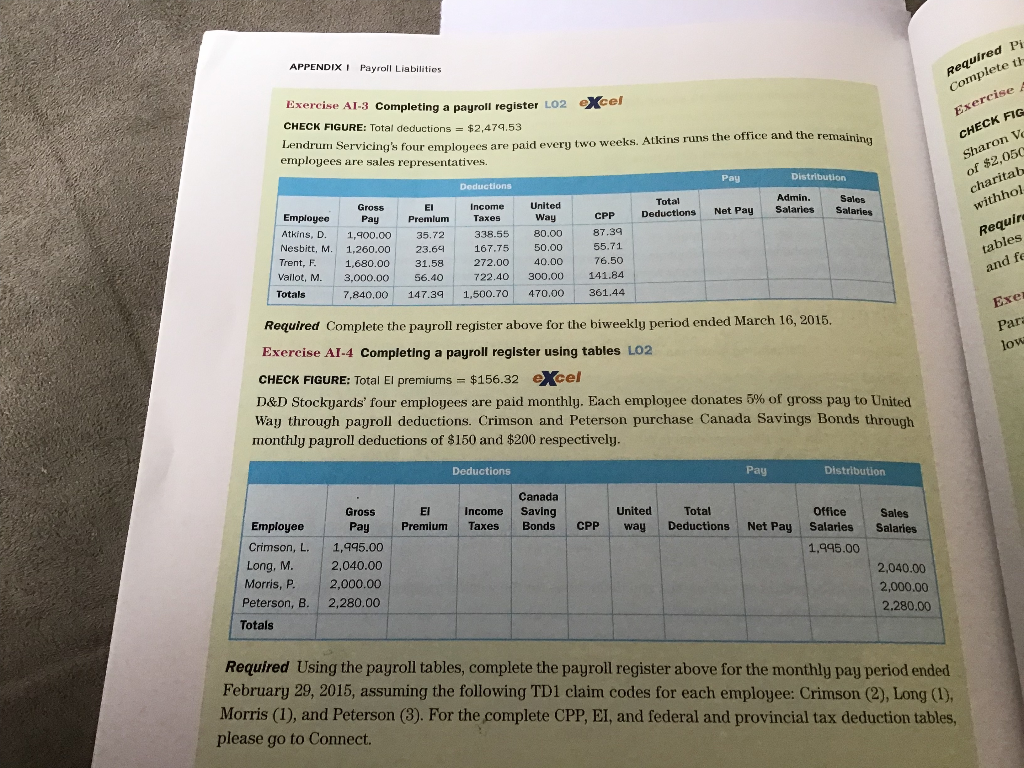

ire dl APPENDIXI Payroll Liabilitios et cise el Exercise AI-3 Completing a payroll register LO2 erc CHECK FIGURE: Total deductions $2,479.53 remaining ng's four emplogees are paid every two weeks. Atkins runs the office and the re 05 employees are sales representatives. of Pay Distribution Admin. Sales thho Total Gross EI Income United Employeo Pay Premlum TaxesWay CPP Deductions Net Pay Salaries Salaries Atkins, D. 1,400.00 35.72 338.55 80.0o 87.39 Nesbitt, M. 1,260.00 23.6 167.75 50.00 55.71 Trent, F.1,680.00 31.58 272.00 40.00 76.50 Vailot, M. 3,000.00 S6.407 Totals bles a fe 722.40 300.00 141.84 7,840.00 147.31,500.70 470.00 361.44 Required Complete the payroll register above for the biweelkly period ended March 16, 2015. Exercise AI-4 Completing a payroll reglster using tables L02 Par CHECK FIGURE: Total El premiums $156.32 eXcel D&D Stockyards four employees are paid monthly. Each employee donates 5% of gross pay to United Way through payroll deductions. Crimson and Peterson purchase Canada Savings Bonds through monthly payroll deductions of $150 and $200 respectively. Deductions Distribution Canada Income Saving Office Sales Gross El United Total Employee Pay Premium Taxes Bonds CPP way Deductions Net Pay Salaries Salaries Crimson, L. 1,995.00 Long, M. 2,040.00 Morris, P. 2,000.00 Peterson, B. 2,280.00 1,995.00 2,040.00 2,000.00 2.280,00 Totals Required Using the payroll tables, complete the payroll register above for the monthly pay period ended February 29, 2015, assuming the following TD1 claim codes for each employee: Crimson (2), Long (1), Morris (I), and Peterson (3). For the complete CPP, EI, and federal and provincial tax deduction tables, please go to Connect. ire dl APPENDIXI Payroll Liabilitios et cise el Exercise AI-3 Completing a payroll register LO2 erc CHECK FIGURE: Total deductions $2,479.53 remaining ng's four emplogees are paid every two weeks. Atkins runs the office and the re 05 employees are sales representatives. of Pay Distribution Admin. Sales thho Total Gross EI Income United Employeo Pay Premlum TaxesWay CPP Deductions Net Pay Salaries Salaries Atkins, D. 1,400.00 35.72 338.55 80.0o 87.39 Nesbitt, M. 1,260.00 23.6 167.75 50.00 55.71 Trent, F.1,680.00 31.58 272.00 40.00 76.50 Vailot, M. 3,000.00 S6.407 Totals bles a fe 722.40 300.00 141.84 7,840.00 147.31,500.70 470.00 361.44 Required Complete the payroll register above for the biweelkly period ended March 16, 2015. Exercise AI-4 Completing a payroll reglster using tables L02 Par CHECK FIGURE: Total El premiums $156.32 eXcel D&D Stockyards four employees are paid monthly. Each employee donates 5% of gross pay to United Way through payroll deductions. Crimson and Peterson purchase Canada Savings Bonds through monthly payroll deductions of $150 and $200 respectively. Deductions Distribution Canada Income Saving Office Sales Gross El United Total Employee Pay Premium Taxes Bonds CPP way Deductions Net Pay Salaries Salaries Crimson, L. 1,995.00 Long, M. 2,040.00 Morris, P. 2,000.00 Peterson, B. 2,280.00 1,995.00 2,040.00 2,000.00 2.280,00 Totals Required Using the payroll tables, complete the payroll register above for the monthly pay period ended February 29, 2015, assuming the following TD1 claim codes for each employee: Crimson (2), Long (1), Morris (I), and Peterson (3). For the complete CPP, EI, and federal and provincial tax deduction tables, please go to Connect