Answered step by step

Verified Expert Solution

Question

1 Approved Answer

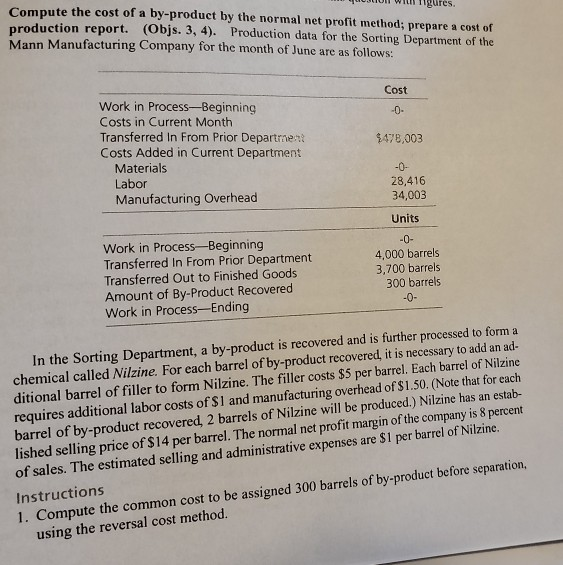

I Wigures. Compute the cost of a by-product by the normal net profit method; prepare a cost of production report. (Objs. 3, 4). Production data

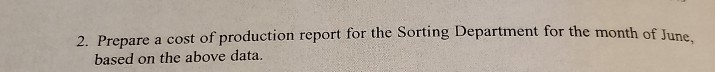

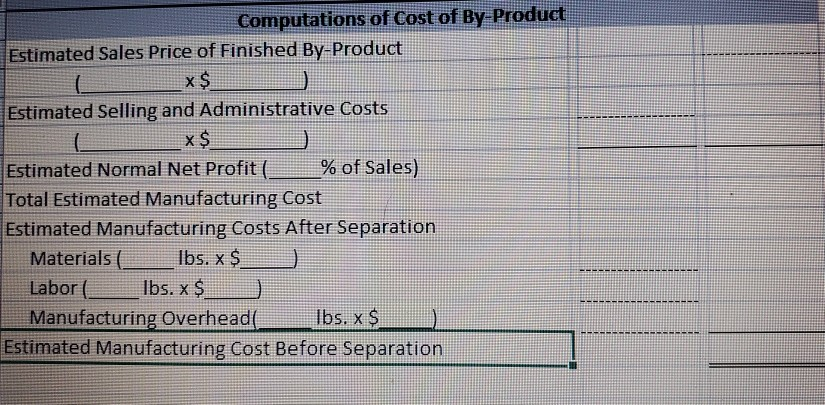

I Wigures. Compute the cost of a by-product by the normal net profit method; prepare a cost of production report. (Objs. 3, 4). Production data for the Sorting Department of the Mann Manufacturing Company for the month of June are as follows: Cost $478,003 Work in Process-Beginning Costs in Current Month Transferred In From Prior Department Costs Added in Current Department Materials Labor Manufacturing Overhead 28,416 34,003 Work in Process-Beginning Transferred In From Prior Department Transferred Out to Finished Goods Amount of By-Product Recovered Work in Process-Ending Units -0- 4,000 barrels 3,700 barrels 300 barrels -0- In the Sorting Department, a by-product is recovered and is further processed to form a chemical called Nilzine. For each barrel of by-product recovered, it is necessary to add an ad- ditional barrel of filler to form Nilzine. The filler costs $5 per barrel. Each barrel of Nilzine requires additional labor costs of $1 and manufacturing overhead of $1.50. (Note that for each barrel of by-product recovered, 2 barrels of Nilzine will be produced.) Nilzine has an estab- lished selling price of $14 per barrel. The normal net profit margin of the company is 8 percent of sales. The estimated selling and administrative expenses are $1 per barrel of Nilzine. Instructions 1. Compute the common cost to be assigned 300 barrels of by-product before separation, using the reversal cost method. 2. Prepare a cost of production report for the Sorting Department for the month of .. based on the above data. Computations of Cost of By Product Estimated Sales Price of Finished By-Product x $ Estimated Selling and Administrative Costs X6 Estimated Normal Net Profit ( % of Sales) Total Estimated Manufacturing Cost Estimated Manufacturing Costs After Separation Materials ( lbs. * $ Labor ( lbs. x $ ). Manufacturing Overhead lbs. x $ Estimated Manufacturing Cost Before Separation 1 TOILE Quantity Schedule a. Quantity to Be Accounted For: Transferred in From Prior Department b. Quantity Accounted For Transferred Out to Next Department Bu-Product Recovered Total accounted For Total Cost EP. Units Unit Cost Cost Schedule o. Costs to be Accounted For Cests in Current Month Transferred in From Prior Department Costs Added in Current Department Labor Overhead Total Added in Current Department Total Costs to Be Accounted For Costs Accounted For Production Completed in Current Month Deduor value of By-Product Recovered Adjusted Cost of Main Product Transferred Outto Next Department Costs Assigned to By-Product Total Costs Accounted For

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started