i will appriciate if you can correct my answer!!! thank toy and have a nice day!

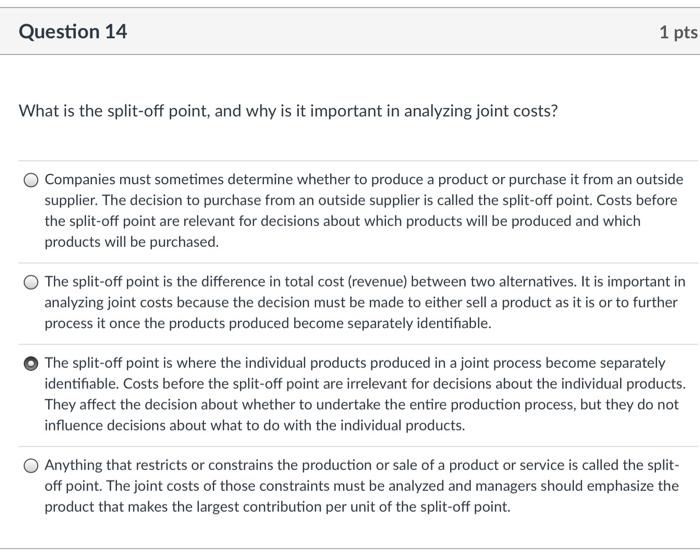

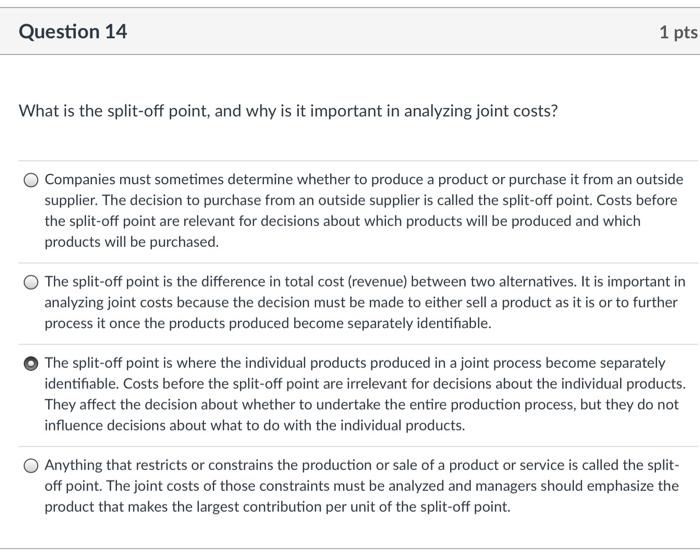

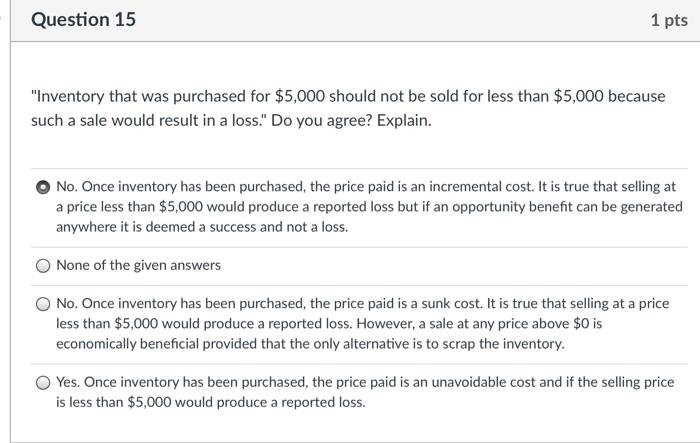

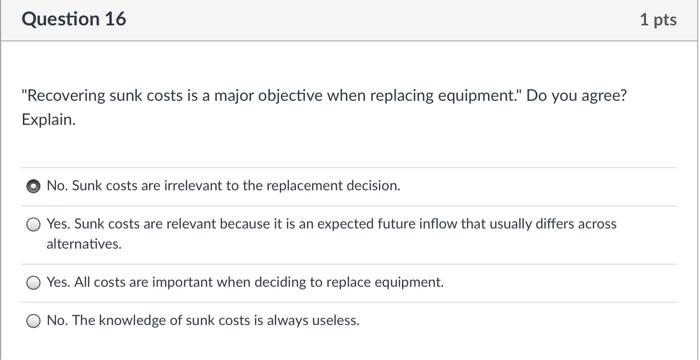

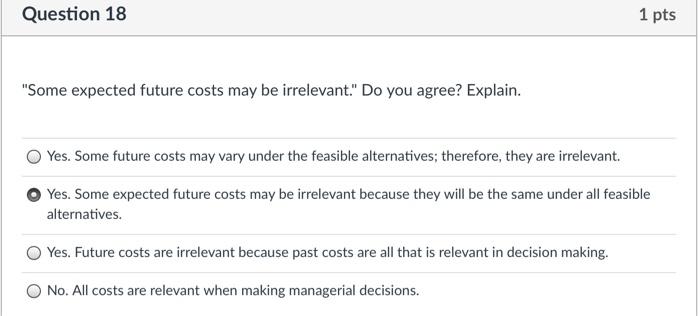

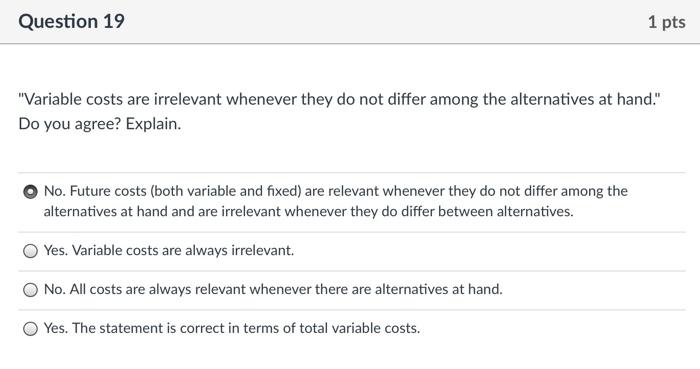

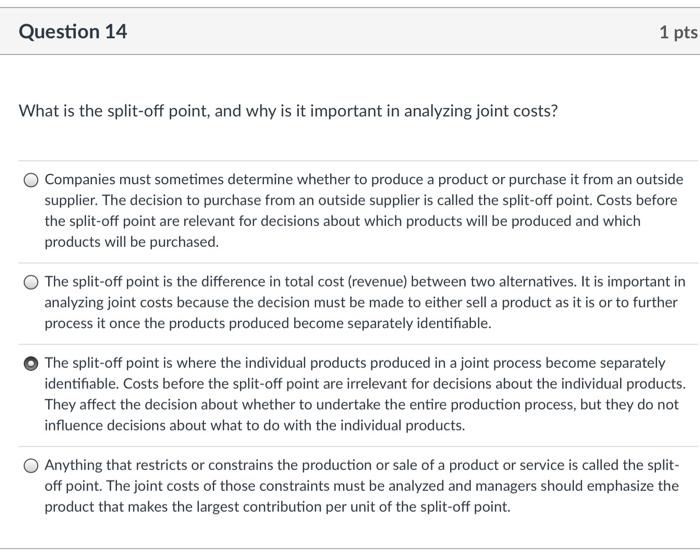

Question 14 1 pts What is the split-off point, and why is it important in analyzing joint costs? Companies must sometimes determine whether to produce a product or purchase it from an outside supplier. The decision to purchase from an outside supplier is called the split-off point. Costs before the split-off point are relevant for decisions about which products will be produced and which products will be purchased. The split-off point is the difference in total cost (revenue) between two alternatives. It is important in analyzing joint costs because the decision must be made to either sell a product as it is or to further process it once the products produced become separately identifiable. The split-off point is where the individual products produced in a joint process become separately identifiable. Costs before the split-off point are irrelevant for decisions about the individual products. They affect the decision about whether to undertake the entire production process, but they do not influence decisions about what to do with the individual products. Anything that restricts or constrains the production or sale of a product or service is called the split- off point. The joint costs of those constraints must be analyzed and managers should emphasize the product that makes the largest contribution per unit of the split-off point. Question 15 1 pts "Inventory that was purchased for $5,000 should not be sold for less than $5,000 because such a sale would result in a loss." Do you agree? Explain. No. Once inventory has been purchased, the price paid is an incremental cost. It is true that selling at a price less than $5,000 would produce a reported loss but if an opportunity benefit can be generated anywhere it is deemed a success and not a loss. None of the given answers No. Once inventory has been purchased, the price paid is a sunk cost. It is true that selling at a price less than $5,000 would produce a reported loss. However, a sale at any price above $0 is economically beneficial provided that the only alternative is to scrap the inventory. Yes. Once inventory has been purchased, the price paid is an unavoidable cost and if the selling price is less than $5,000 would produce a reported loss. Question 16 1 pts "Recovering sunk costs is a major objective when replacing equipment." Do you agree? Explain. No. Sunk costs are irrelevant to the replacement decision. Yes. Sunk costs are relevant because it is an expected future inflow that usually differs across alternatives. Yes. All costs are important when deciding to replace equipment. No. The knowledge of sunk costs is always useless. Question 18 1 pts "Some expected future costs may be irrelevant." Do you agree? Explain. Yes. Some future costs may vary under the feasible alternatives; therefore, they are irrelevant Yes. Some expected future costs may be irrelevant because they will be the same under all feasible alternatives. Yes. Future costs are irrelevant because past costs are all that is relevant in decision making. No. All costs are relevant when making managerial decisions. Question 19 1 pts "Variable costs are irrelevant whenever they do not differ among the alternatives at hand." Do you agree? Explain. No. Future costs (both variable and fixed) are relevant whenever they do not differ among the alternatives at hand and are irrelevant whenever they do differ between alternatives. Yes. Variable costs are always irrelevant. No. All costs are always relevant whenever there are alternatives at hand. Yes. The statement is correct in terms of total variable costs