Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will give a thumbs up for correct answers! Universal Leasing leases electronic equipment to a variety of businesses. The company's primary service is providing

I will give a thumbs up for correct answers!

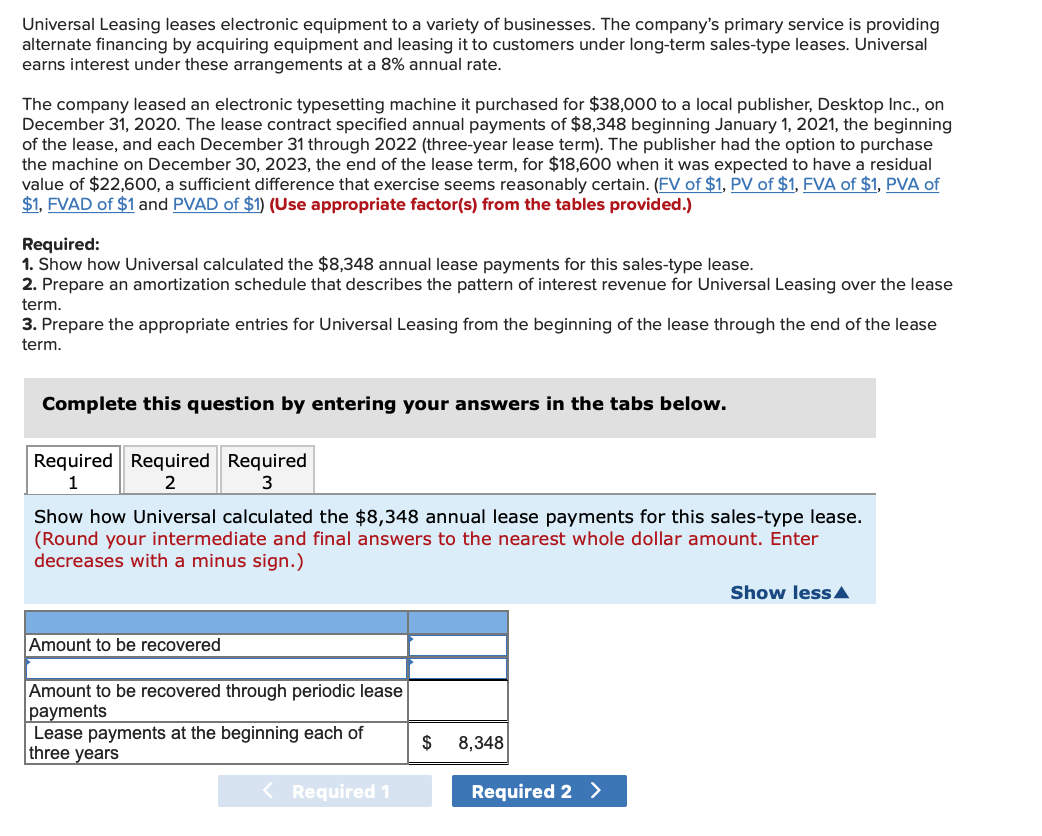

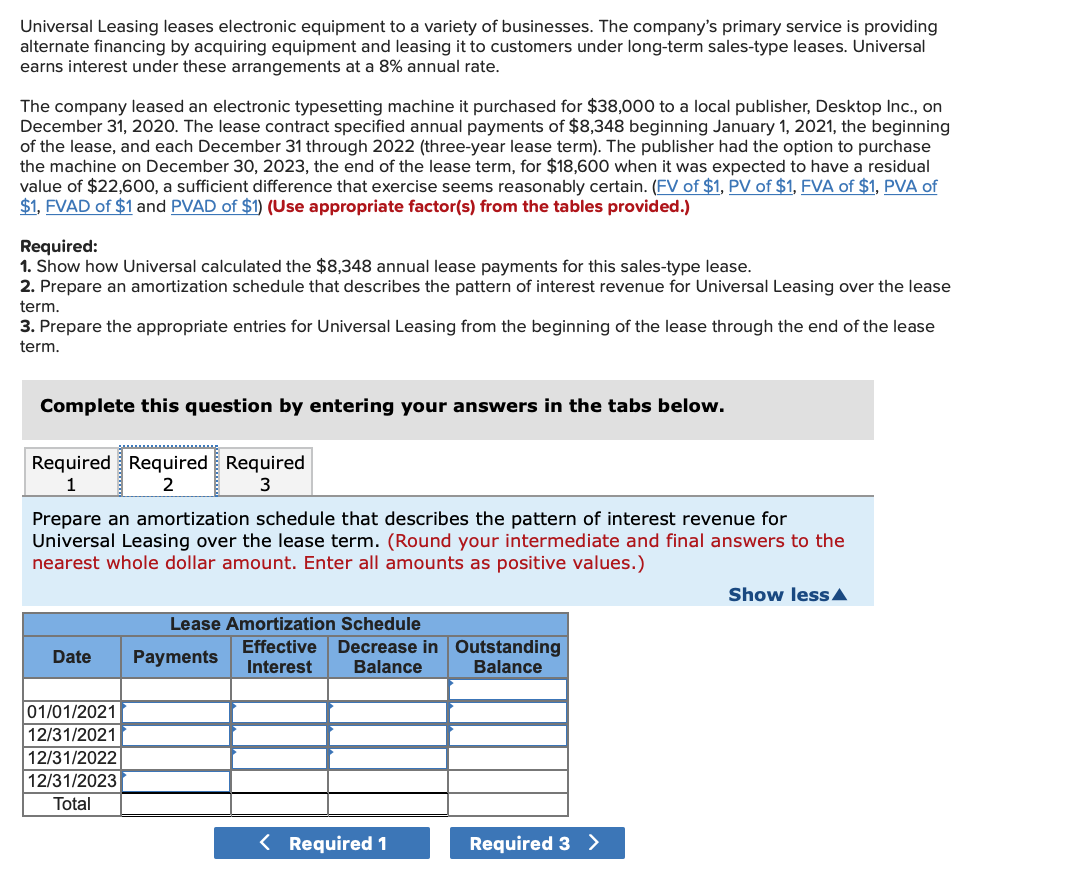

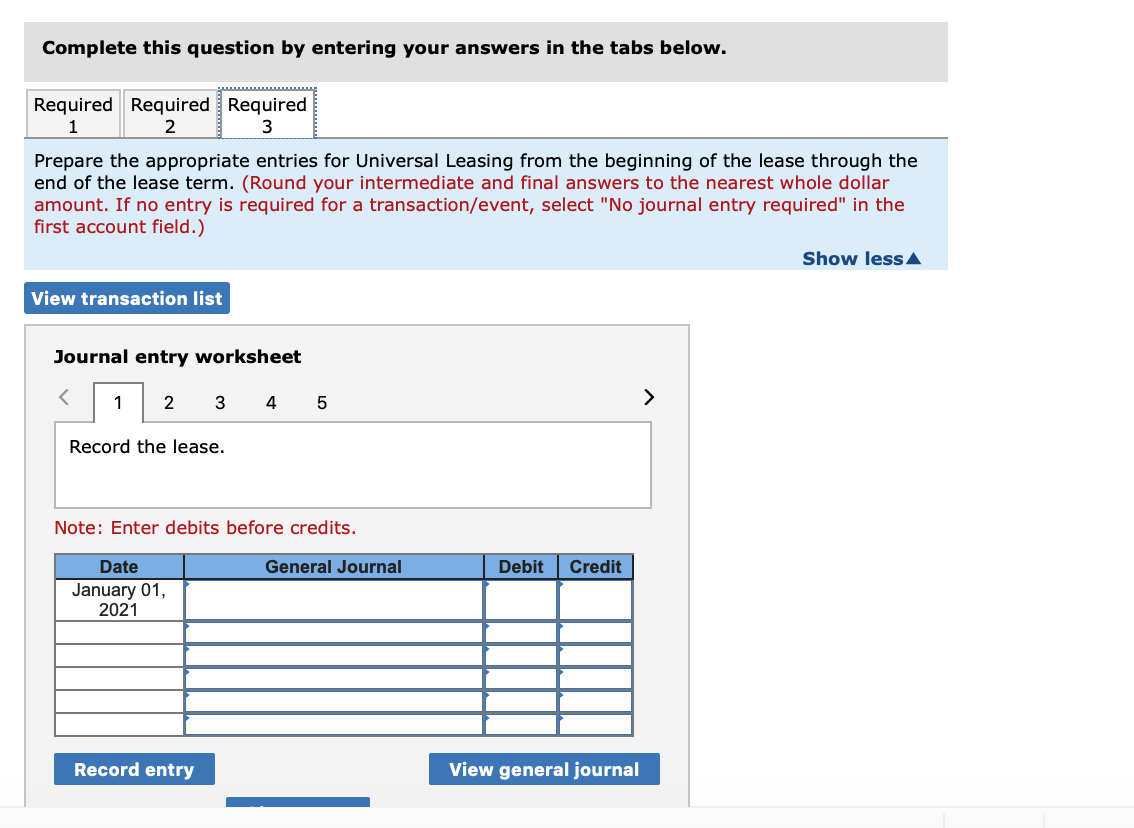

Universal Leasing leases electronic equipment to a variety of businesses. The company's primary service is providing alternate financing by acquiring equipment and leasing it to customers under long-term sales-type leases. Universal earns interest under these arrangements at a 8% annual rate. The company leased an electronic typesetting machine it purchased for $38,000 to a local publisher, Desktop Inc., on December 31, 2020. The lease contract specified annual payments of $8,348 beginning January 1, 2021, the beginning of the lease, and each December 31 through 2022 (three-year lease term). The publisher had the option to purchase the machine on December 30, 2023, the end of the lease term, for $18,600 when it was expected to have a residual value of $22,600, a sufficient difference that exercise seems reasonably certain. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Show how Universal calculated the $8,348 annual lease payments for this sales-type lease. 2. Prepare an amortization schedule that describes the pattern of interest revenue for Universal Leasing over the lease term. 3. Prepare the appropriate entries for Universal Leasing from the beginning of the lease through the end of the lease term. Complete this question by entering your answers in the tabs below. Required Required Required 1 2 3 Show how Universal calculated the $8,348 annual lease payments for this sales-type lease. (Round your intermediate and final answers to the nearest whole dollar amount. Enter decreases with a minus sign.) Show less Amount to be recovered Amount to be recovered through periodic lease payments Lease payments at the beginning each of three years $ 8,348 Required 1 Required 2 > Universal Leasing leases electronic equipment to a variety of businesses. The company's primary service is providing alternate financing by acquiring equipment and leasing it to customers under long-term sales-type leases. Universal earns interest under these arrangements at a 8% annual rate. The company leased an electronic typesetting machine it purchased for $38,000 to a local publisher, Desktop Inc., on December 31, 2020. The lease contract specified annual payments of $8,348 beginning January 1, 2021, the beginning of the lease, and each December 31 through 2022 (three-year lease term). The publisher had the option to purchase the machine on December 30, 2023, the end of the lease term, for $18,600 when it was expected to have a residual value of $22,600, a sufficient difference that exercise seems reasonably certain. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Show how Universal calculated the $8,348 annual lease payments for this sales-type lease. 2. Prepare an amortization schedule that describes the pattern of interest revenue for Universal Leasing over the lease term. 3. Prepare the appropriate entries for Universal Leasing from the beginning of the lease through the end of the lease term. Complete this question by entering your answers in the tabs below. Required Required Required 1 3 Prepare an amortization schedule that describes the pattern of interest revenue for Universal Leasing over the lease term. (Round your intermediate and final answers to the nearest whole dollar amount. Enter all amounts as positive values.) Show less Lease Amortization Schedule Effective Decrease in Outstanding Date Payments Interest Balance Balance 01/01/2021 12/31/2021 12/31/2022 12/31/2023 Total Complete this question by entering your answers in the tabs below. Required Required Required 1 2 3 Prepare the appropriate entries for Universal Leasing from the beginning of the lease through the end of the lease term. (Round your intermediate and final answers to the nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less View transaction list Journal entry worksheet Record the lease. Note: Enter debits before credits. General Journal Debit Credit Date January 01, 2021 Record entry View general journalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started