Answered step by step

Verified Expert Solution

Question

1 Approved Answer

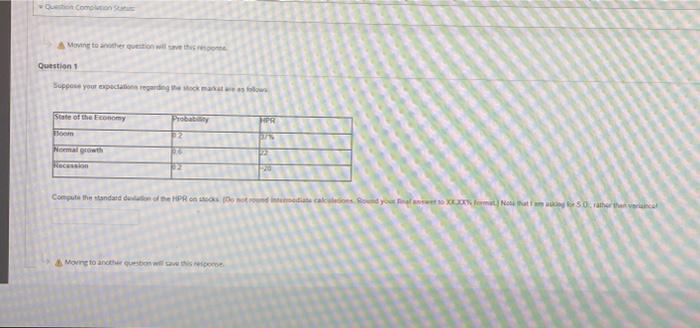

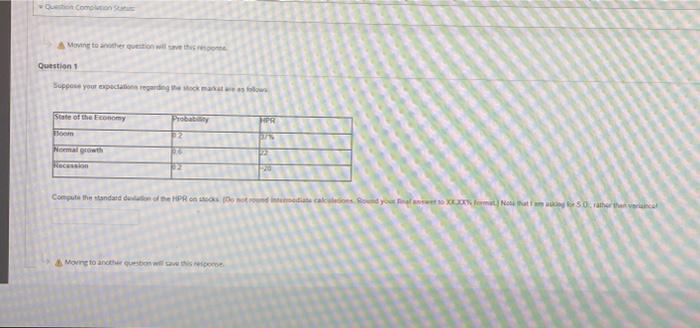

I will leave a like! Use bottom pictures that are clear Comotion Morning to the question will see them Question 1 Suppose your expectations regarding

I will leave a like!

Use bottom pictures that are clear

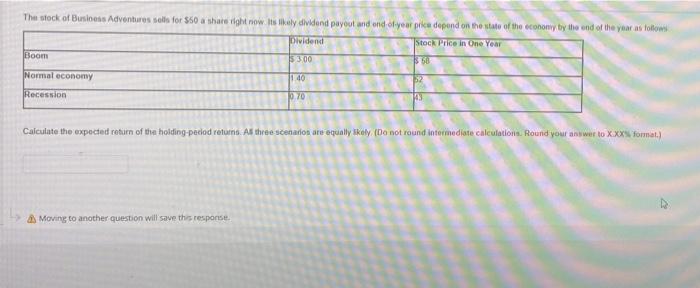

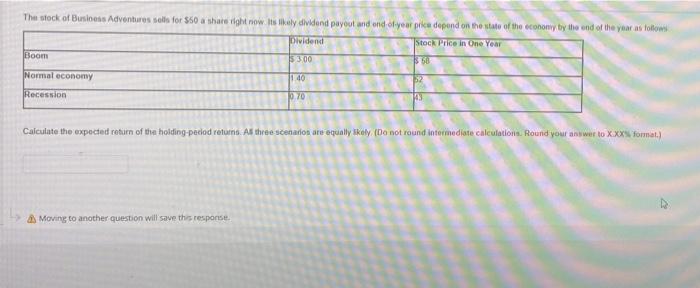

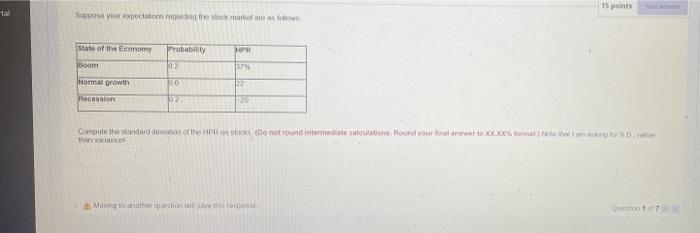

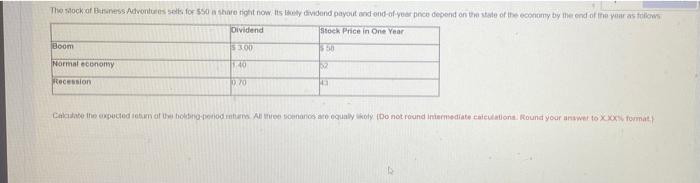

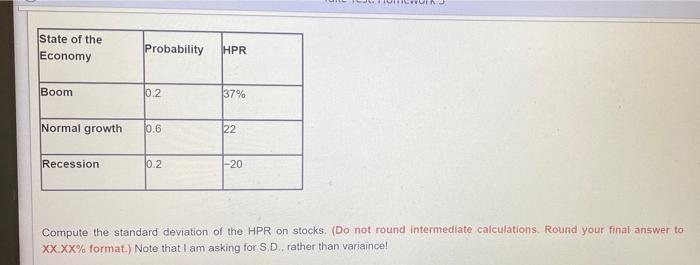

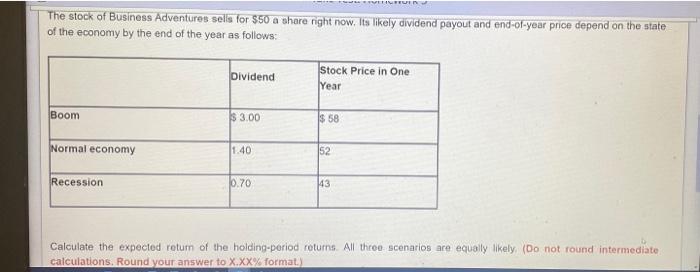

Comotion Morning to the question will see them Question 1 Suppose your expectations regarding the caso State of the Economy 1 Normal growth NEGERI Compute the standard du Ponyo o X Format North a varico More to answer The stock of Business Adventures sells for $50 a share right now. Its likely dividend payout and end of year price depend on the state of the economy by the end of the year as follow Dividend Stock Price in One Year 5300 60 Boom Normal economy 1.40 32 Recession 570 Calculate the expected return of the holding-perlod returns. All three scenation are equally ikely (Do not round intermediate calculations. Round your answer to X.XX format.) as Moving to another question will save this response 15 points Ryour progreso State of the Economy Probability Boom 02 1979 Normal growth 12 20 Racession 02 Comouin the Wandard de HR Do not found intermediate calculation Round your watexxxx. formula tani Muto a question will be Con 17 The stock of Business Avontures Belts for 550 share right now. Istoy dividend payout and onid of your price depend on the state of the economy by the end of the year as follows Dividend Stock Price in One Year Boom 53:00 30 Normal economy 40 Recension 0/0 1 Calculate the expected humobolno-poodmans All Donna qual oly (Do not round intermediate calculations. Round your answer to xxx format State of the Economy Probability HPR Boom 0.2 37% Normal growth 0.6 22 Recession 10.2 -20 Compute the standard deviation of the HPR on stocks. (Do not round intermediate calculations. Round your final answer to XX.XX% format.) Note that I am asking for S.D. rather than variance! The stock of Business Adventures sells for $50 a share right now. Its likely dividend payout and end-of-year price depend on the state of the economy by the end of the year as follows: Dividend Stock Price in One Year Boom $ 3.00 $ 58 Normal economy 1.40 52 Recession 0.70 43 Calculate the expected return of the holding period returns. All three scenarios are equally likely. (Do not found intermediate calculations. Round your answer to X.XX% format Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started