Answered step by step

Verified Expert Solution

Question

1 Approved Answer

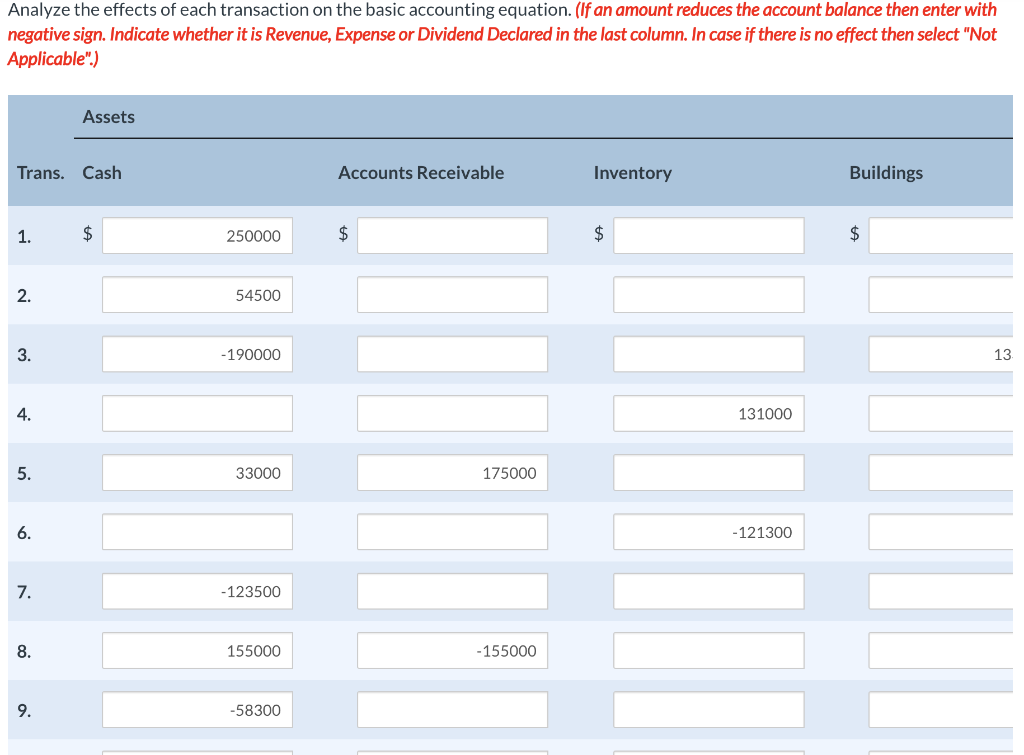

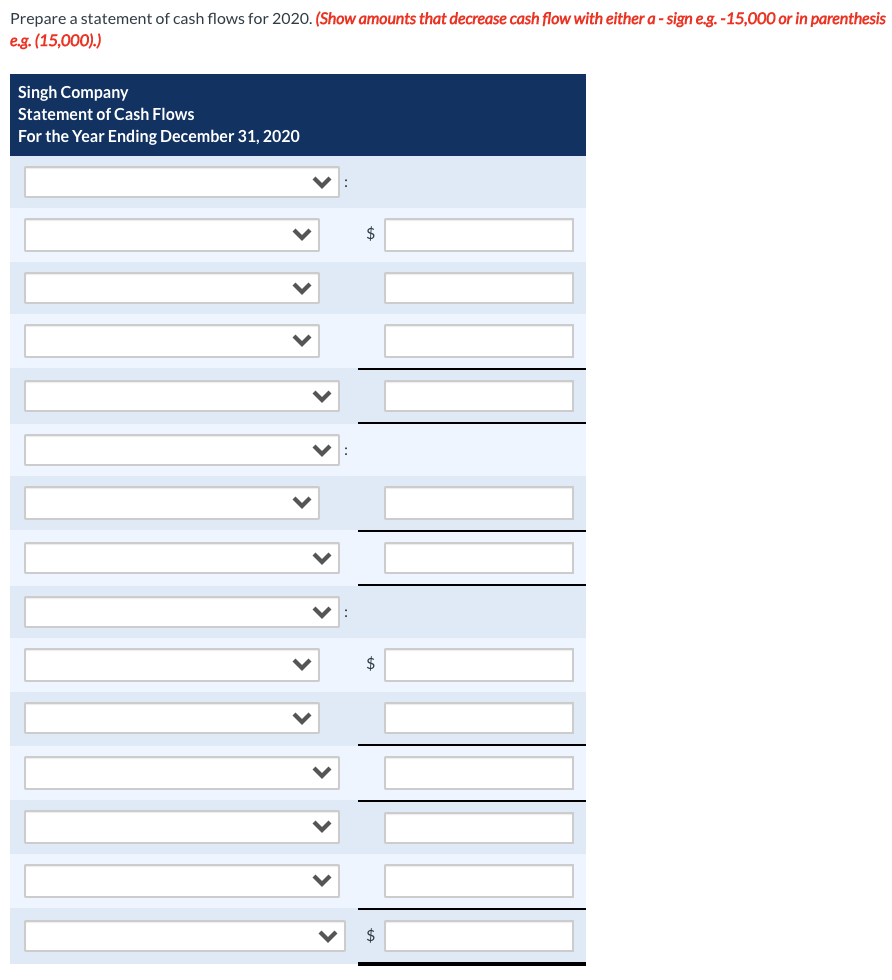

I will not upvote unless you answer all parts of the question!! Singh Company started business on January 1, 2020. The following transactions occurred in

I will not upvote unless you answer all parts of the question!!

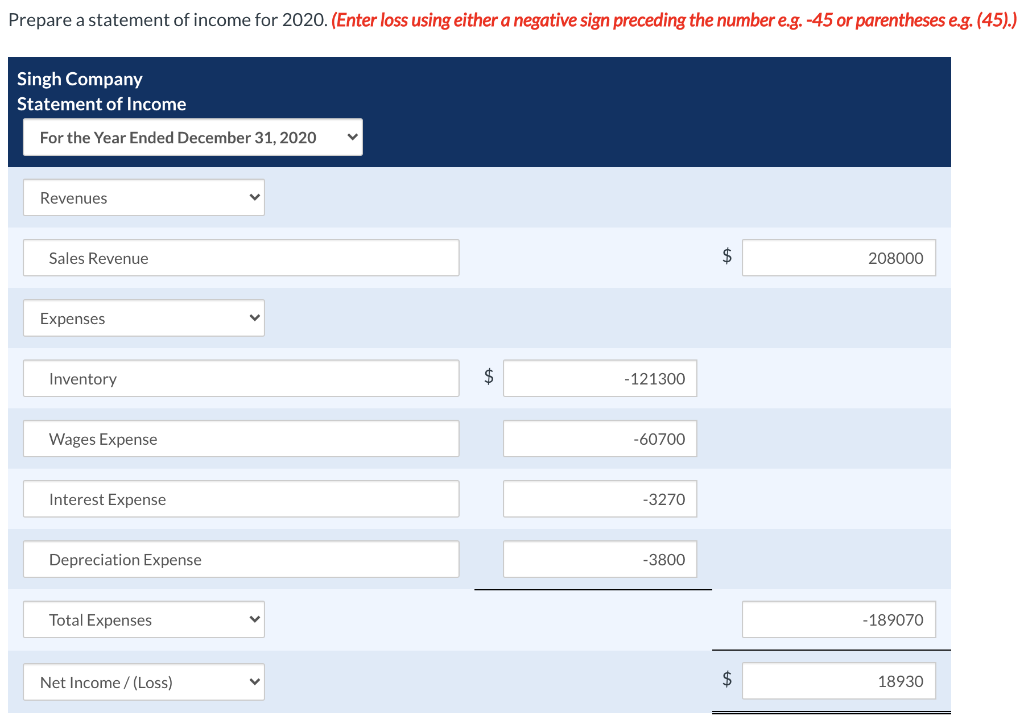

Singh Company started business on January 1, 2020. The following transactions occurred in 2020:

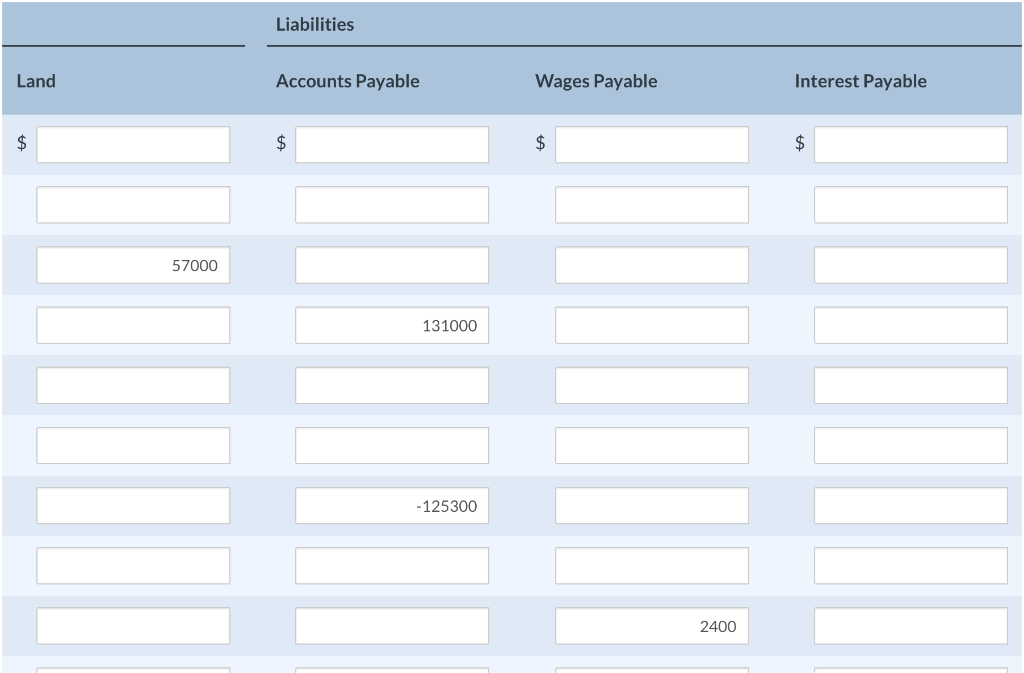

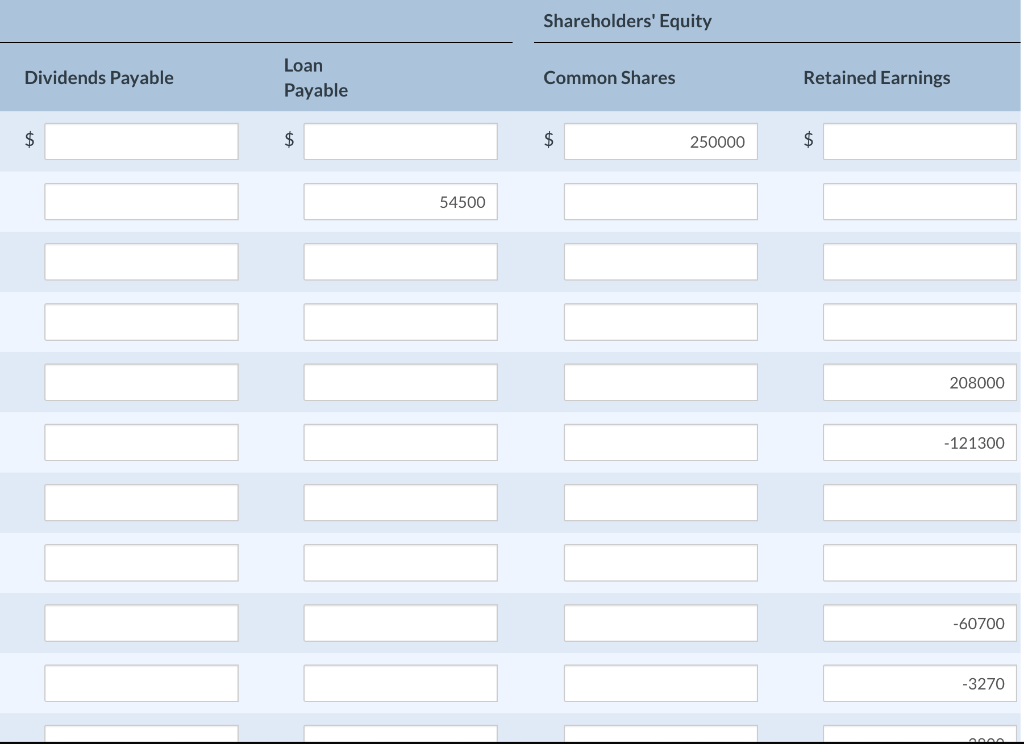

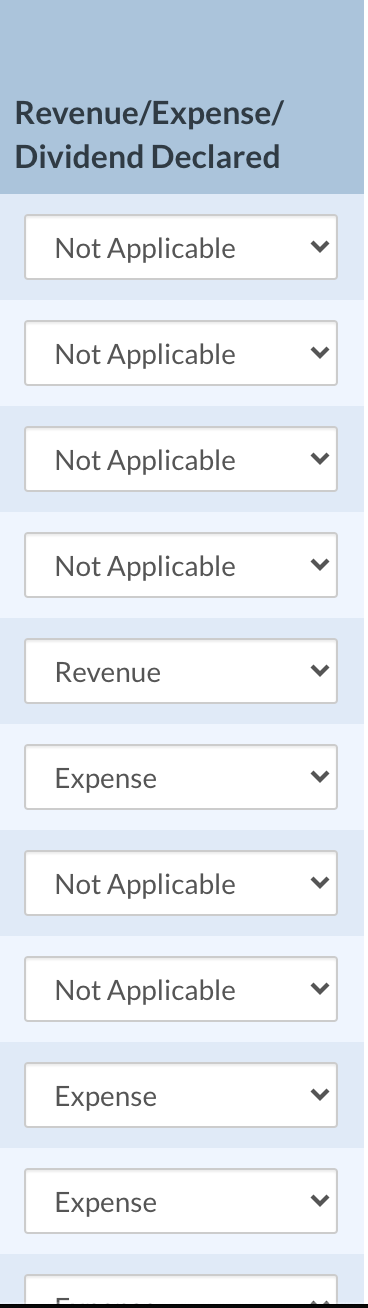

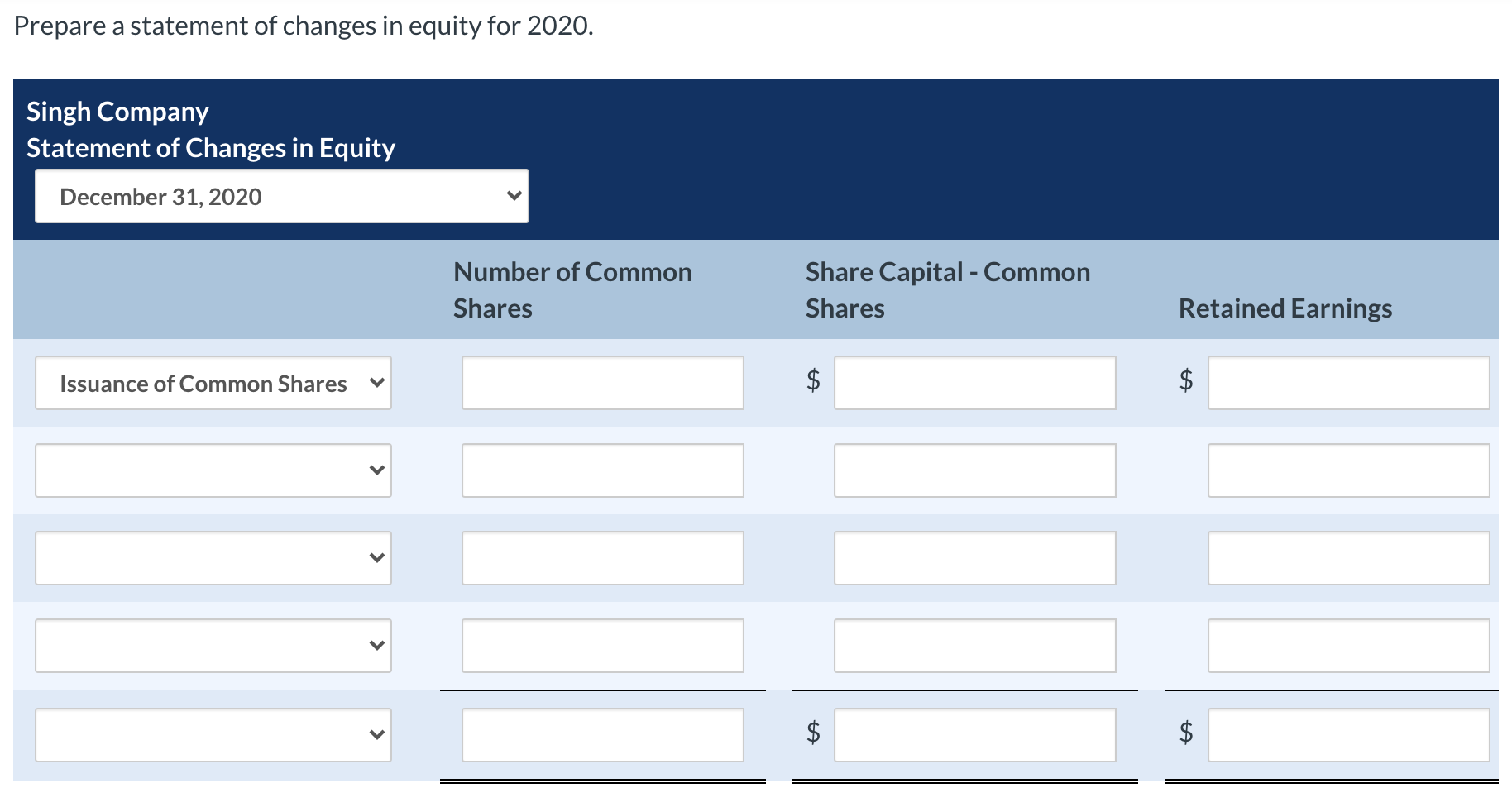

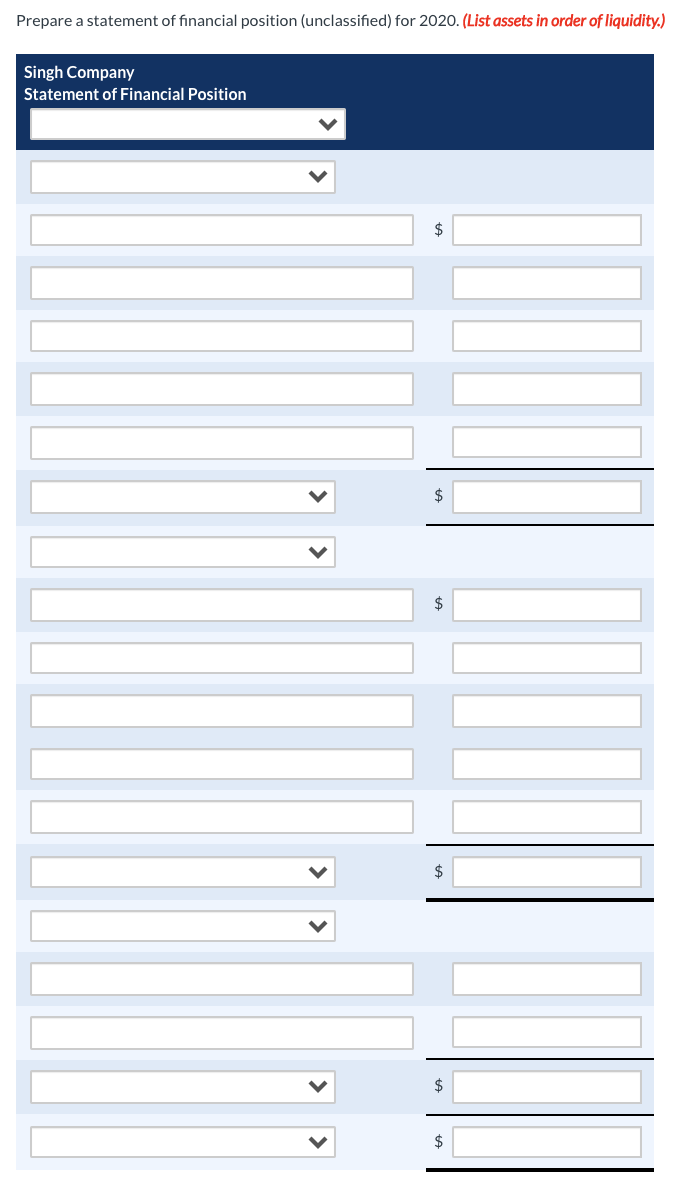

| 1. | On January 1, the company issued 10,000 common shares for $250,000. | |

| 2. | On January 2, the company borrowed $54,500 from the bank. | |

| 3. | On January 3, the company purchased land and a building for a total of $190,000 cash. The land was recently appraised at a fair market value of $57,000. (Note: Because the building will be depreciated in the future and the land will not, these two assets should be recorded in separate accounts.) | |

| 4. | Inventory costing $131,000 was purchased on account. | |

| 5. | Sales to customers totalled $208,000. Of these, $175,000 were sales on account. | |

| 6. | The cost of the inventory that was sold to customers in transaction 5 was $121,300. | |

| 7. | Payments to suppliers on account totalled $123,500. | |

| 8. | Collections from customers on account totalled $155,000. | |

| 9. | Payments to employees for wages were $58,300. In addition, there was $2,400 of unpaid wages at year end. | |

| 10. | The interest on the bank loan was recognized for the year. The interest rate on the loan was 6%. | |

| 11. | The building was estimated to have a useful life of 30 years and a residual value of $19,000. The company uses the straight-line method of depreciation. | |

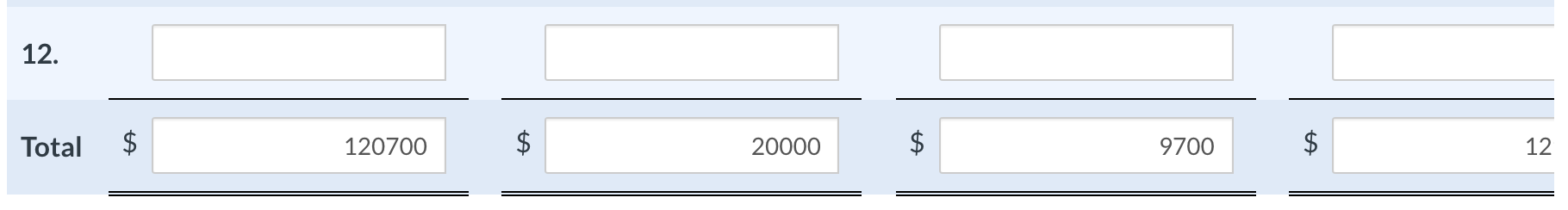

| 12. | The company declared dividends of $7,200 on December 15, 2020, to be paid on January 15, 2021. |

Question below (4 part question), please go through each part (please don't answer me with journal entries again, that isn't what the question is even asking):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started