Question: i will pay you more to do this For this project, you will need to use the finance formulas introduced over the next two weeks

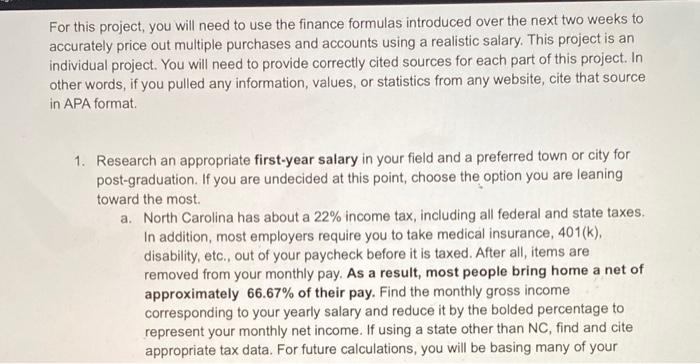

For this project, you will need to use the finance formulas introduced over the next two weeks to accurately price out multiple purchases and accounts using a realistic salary. This project is an individual project. You will need to provide correctly cited sources for each part of this project. In other words, if you pulled any information, values, or statistics from any website, cite that source in APA format 1. Research an appropriate first-year salary in your field and a preferred town or city for post-graduation. If you are undecided at this point, choose the option you are leaning toward the most a. North Carolina has about a 22% income tax, including all federal and state taxes, In addition, most employers require you to take medical insurance, 401(k), disability, etc., out of your paycheck before it is taxed. After all, items are removed from your monthly pay. As a result, most people bring home a net of approximately 66.67% of their pay. Find the monthly gross income corresponding to your yearly salary and reduce it by the bolded percentage to represent your monthly net income. If using a state other than NC, find and cite appropriate tax data. For future calculations, you will be basing many of your For this project, you will need to use the finance formulas introduced over the next two weeks to accurately price out multiple purchases and accounts using a realistic salary. This project is an individual project. You will need to provide correctly cited sources for each part of this project. In other words, if you pulled any information, values, or statistics from any website, cite that source in APA format 1. Research an appropriate first-year salary in your field and a preferred town or city for post-graduation. If you are undecided at this point, choose the option you are leaning toward the most a. North Carolina has about a 22% income tax, including all federal and state taxes, In addition, most employers require you to take medical insurance, 401(k), disability, etc., out of your paycheck before it is taxed. After all, items are removed from your monthly pay. As a result, most people bring home a net of approximately 66.67% of their pay. Find the monthly gross income corresponding to your yearly salary and reduce it by the bolded percentage to represent your monthly net income. If using a state other than NC, find and cite appropriate tax data. For future calculations, you will be basing many of your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts