Answered step by step

Verified Expert Solution

Question

1 Approved Answer

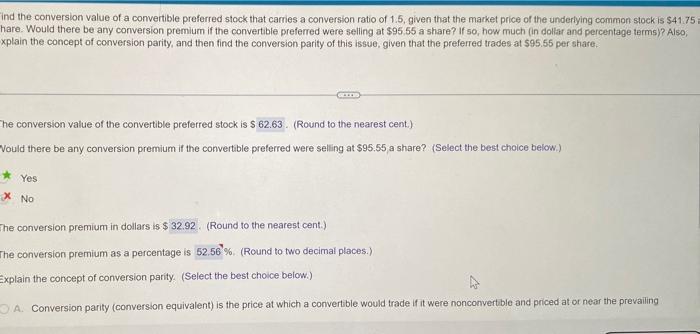

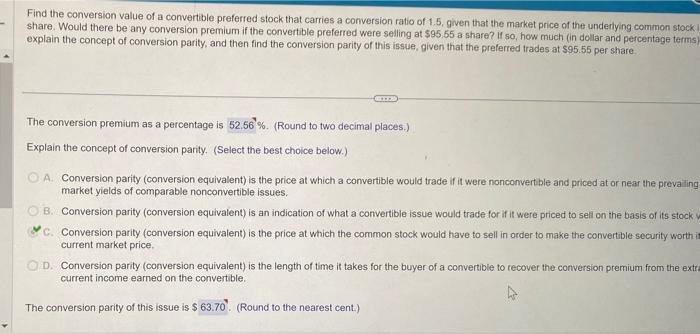

i will post similler q answer and the second photo is the new q ind the conversion value of a convertible preferred stock that carries

i will post similler q answer

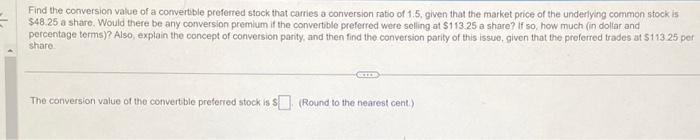

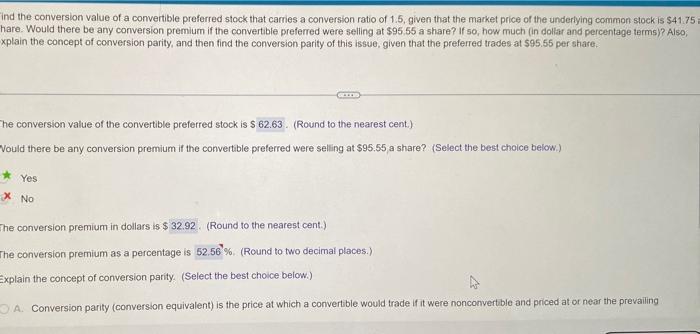

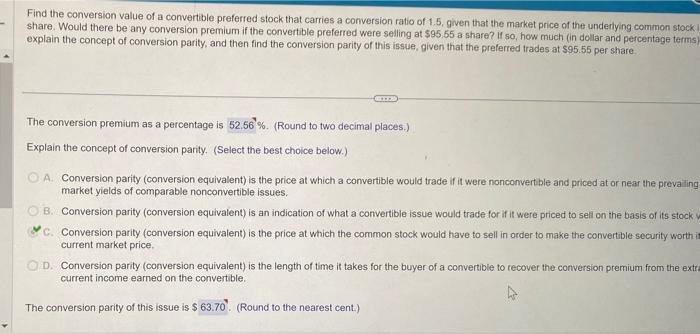

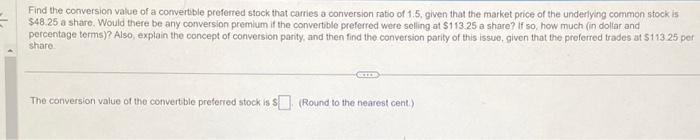

ind the conversion value of a convertible preferred stock that carries a conversion ratio of 1.5 , given that the market price of the underlying common stock is $41.75 hare. Would there be any conversion premium if the convertible preferred were selling at $95.55 a share? If so, how much (in dollar and percentage terms)? Also, xplain the concept of conversion parity, and then find the conversion parity of this issue, given that the preferred trades at $95.55 per share. The conversion value of the convertible preferred stock is $ (Round to the nearest cent.) Vould there be any conversion premium if the convertible preferred were selling at $95,55 a share? (Select the best choice below.) Yes X No The conversion premium in dollars is $ (Round to the nearest cent.) The conversion premium as a percentage is 16. (Round to two decimal places.) Explain the concept of conversion parity, (Select the best chalce below.) A. Conversion parity (conversion equivalent) is the price at which a convertible would trade if it were nonconvertble and priced at or near the prevailing Find the conversion value of a convertible preferred stock that carries a conversion ratio of 1.5 , given that the market price of the underlying common stock share. Would there be any conversion premium if the convertible preferred were selling at $95.55 a share? if so, how much fin dollar and percentage termis explain the concept of conversion parity, and then find the conversion parity of this issue, given that the preferred trades at $95.55 per share. The conversion premium as a percentage is (Round to two decimal places.) Explain the concept of conversion parity. (Select the best choice below.) A. Conversion parity (conversion equivalent) is the price at which a convertible would trade if it were nonconvertible and priced at or near the preva ing market yields of comparable nonconvertible issues. B. Conversion parity (conversion equivalent) is an indication of what a convertible issue would trade for if it were priced to seli on the basis of its stock C. Conversion parity (conversion equivalent) is the price at which the common stock would have to sell in order to make the convertible security worth current market price. D. Conversion parity (conversion equivalent) is the length of time it takes for the buyer of a convertible to recover the conversion premium from the extr current income earned on the convertible. The conversion parity of this issue is $ (Round to the nearest cent.) Find the conversion value of a convertble preferted stock that carries a conversion ratio of 1.5 , given that the market price of the underlying common stock is $48.25 a share. Would there be any conversion premium if the convertible preferred were solling at $113.25 a share? if so, how much fin doliar and percentage terms)? Also, explain the concept of conversion panity, and then find the conversion parity of this issue, given that the preforred trades at $113.25 per share. The conversion value of the convertble preterred stock is \& (Round to the nearest cent.) and the second photo is the new q

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started