Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will rate highly if correct, THANK YOU! The Purple Lion Beverage Company expects the following cash flows from its manufacturing plant in Palau over

I will rate highly if correct, THANK YOU!

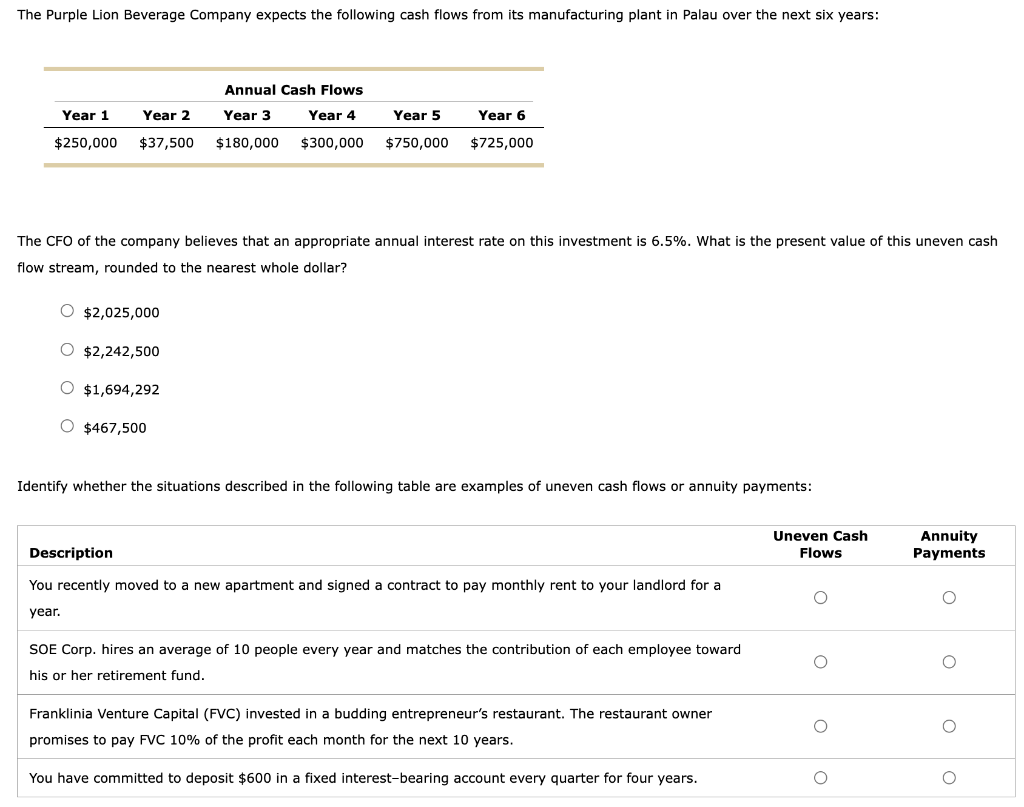

The Purple Lion Beverage Company expects the following cash flows from its manufacturing plant in Palau over the next six years: Annual Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $250,000 $37,500 $180,000 $300,000 $750,000 $725,000 The CFO of the company believes that an appropriate annual interest rate on this investment is 6.5%. What is the present value of this uneven cash flow stream, rounded to the nearest whole dollar? O $2,025,000 O $2,242,500 O $1,694,292 O $467,500 Identify whether the situations described in the following table are examples of uneven cash flows or annuity payments: Uneven Cash Flows Description Annuity Payments You recently moved to a new apartment and signed a contract to pay monthly rent to your landlord for a O year. SOE Corp. hires an average of 10 people every year and matches the contribution of each employee toward his or her retirement fund. Franklinia Venture Capital (FVC) invested in a budding entrepreneur's restaurant. The restaurant owner promises to pay FVC 10% of the profit each month for the next 10 years. O You have committed to deposit $600 in a fixed interest-bearing account every quarter for four years. O OStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started