Answered step by step

Verified Expert Solution

Question

1 Approved Answer

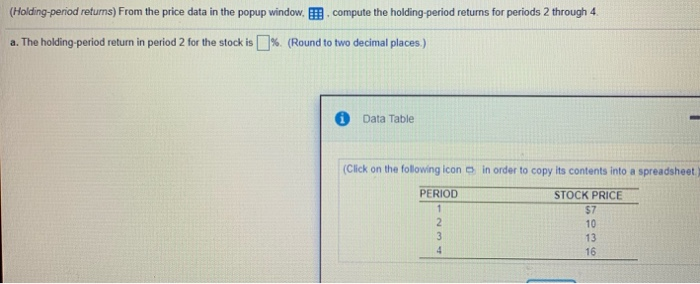

Those are 2 different questions (Holding-period returns) From the price data in the popup window. .compute the holding period returns for periods 2 through 4

Those are 2 different questions

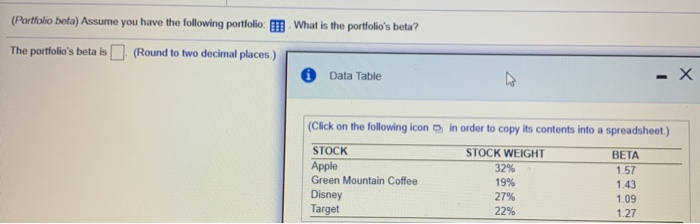

(Holding-period returns) From the price data in the popup window. .compute the holding period returns for periods 2 through 4 a. The holding period return in period 2 for the stock is % (Round to two decimal places.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet PERIOD STOCK PRICE 10 16 (Portfolio bota) Assume you have the following portfolio | What is the portfolio's beta? The portfolio's beta is (Round to two decimal places.) 0 Data Table - X (Click on the following icon STOCK Apple Green Mountain Coffee Disney Target in order to copy its contents into a spreadsheet) STOCK WEIGHT BETA 32% 1.57 19% 1.43 27% 1.09 22% 1.27 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started