Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will rate you, thanks Consider the annual returns produced by two different active equity portfolio managers (A and B) as well as those to

I will rate you, thanks

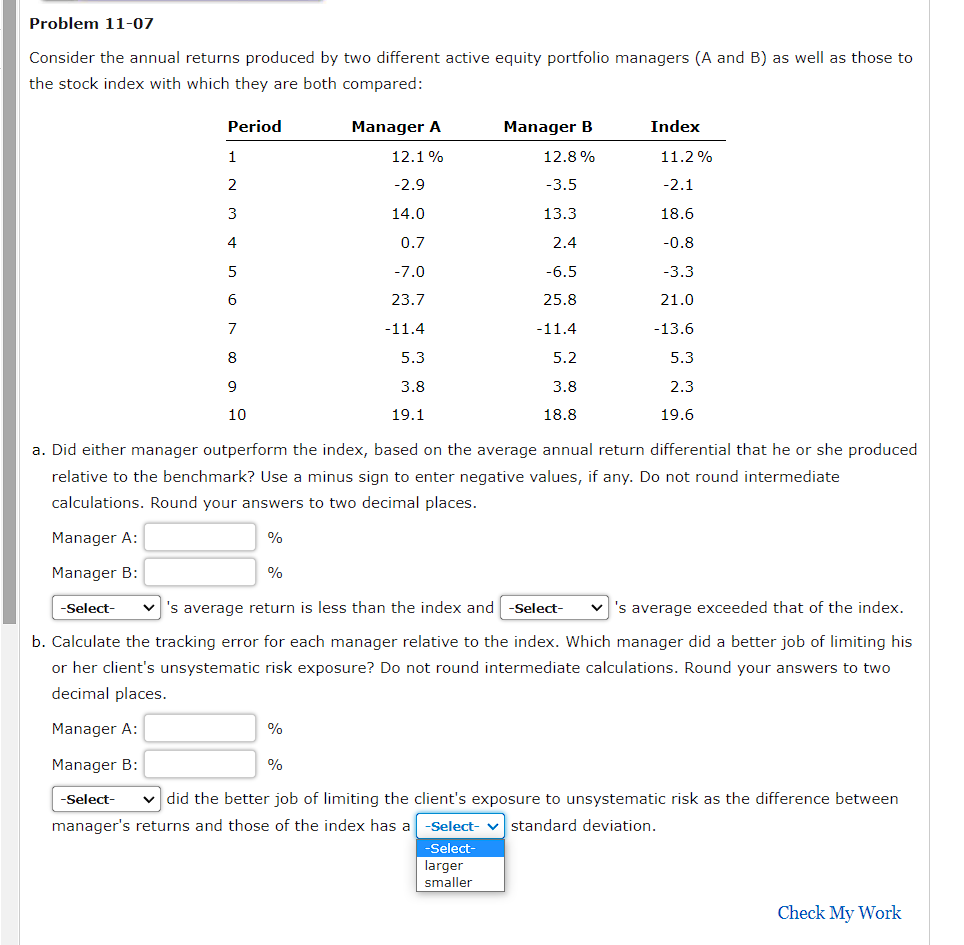

Consider the annual returns produced by two different active equity portfolio managers (A and B) as well as those to the stock index with which they are both compared: a. Did either manager outperform the index, based on the average annual return differential that he or she produced relative to the benchmark? Use a minus sign to enter negative values, if any. Do not round intermediate calculations. Round your answers to two decimal places. Manager A: % Manager B: % 's average return is less than the index and 's average exceeded that of the index. b. Calculate the tracking error for each manager relative to the index. Which manager did a better job of limiting his or her client's unsystematic risk exposure? Do not round intermediate calculations. Round your answers to two decimal places. Manager A: % Manager B: % did the better job of limiting the client's exposure to unsystematic risk as the difference between manager's returns and those of the index has a standard deviation. Consider the annual returns produced by two different active equity portfolio managers (A and B) as well as those to the stock index with which they are both compared: a. Did either manager outperform the index, based on the average annual return differential that he or she produced relative to the benchmark? Use a minus sign to enter negative values, if any. Do not round intermediate calculations. Round your answers to two decimal places. Manager A: % Manager B: % 's average return is less than the index and 's average exceeded that of the index. b. Calculate the tracking error for each manager relative to the index. Which manager did a better job of limiting his or her client's unsystematic risk exposure? Do not round intermediate calculations. Round your answers to two decimal places. Manager A: % Manager B: % did the better job of limiting the client's exposure to unsystematic risk as the difference between manager's returns and those of the index has a standard deviationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started