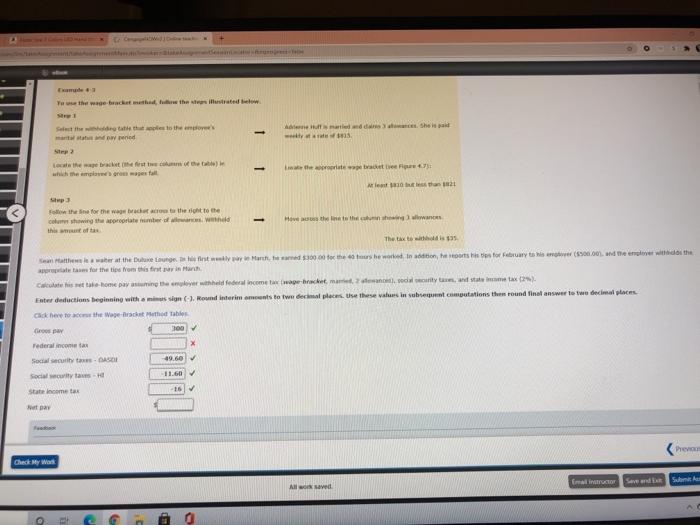

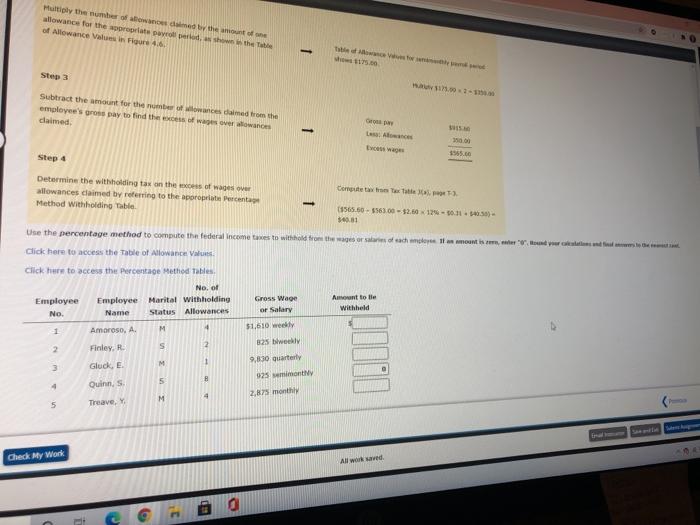

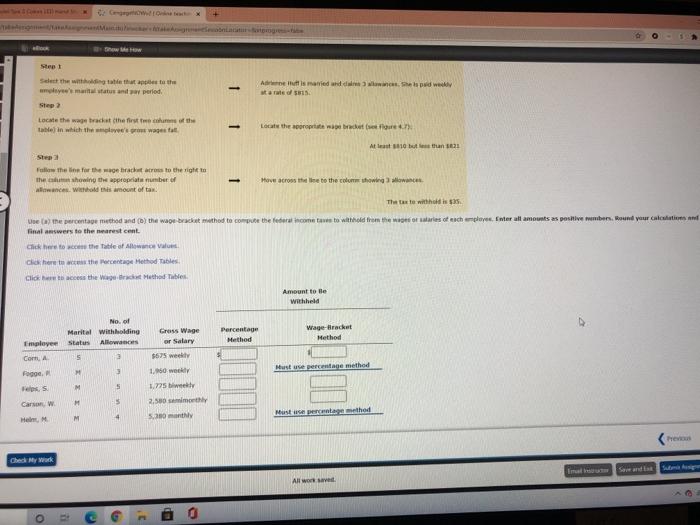

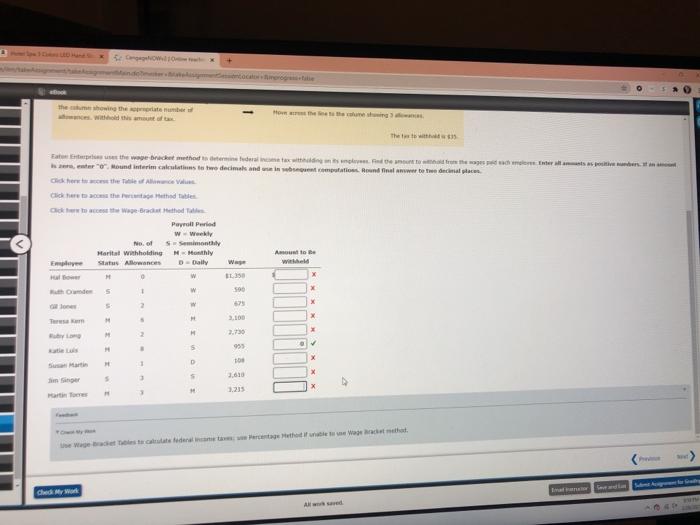

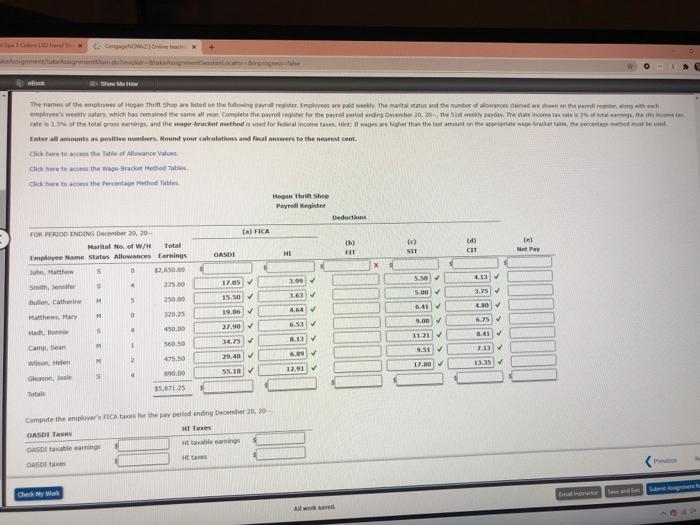

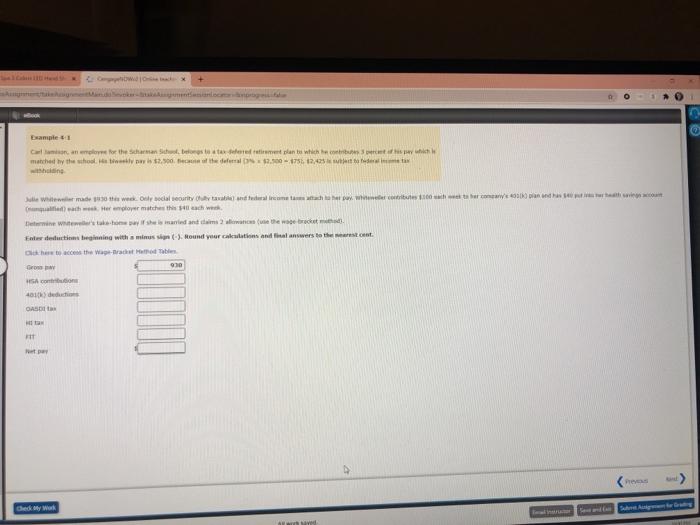

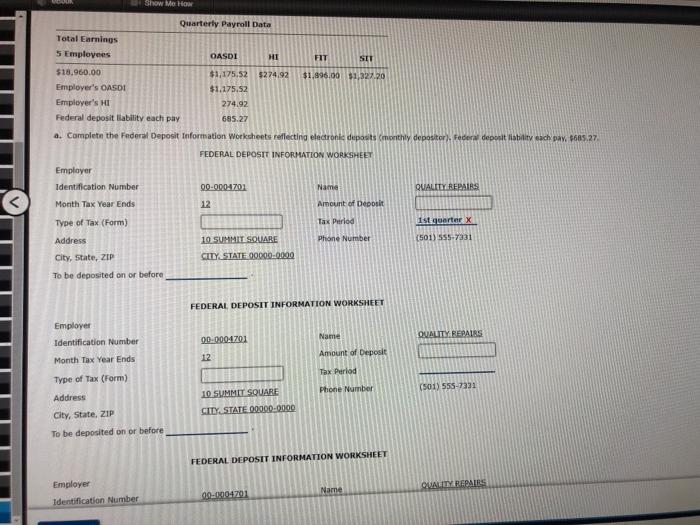

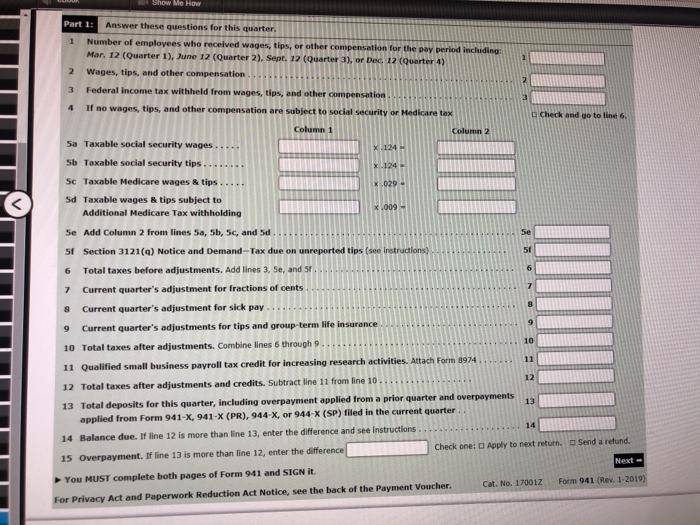

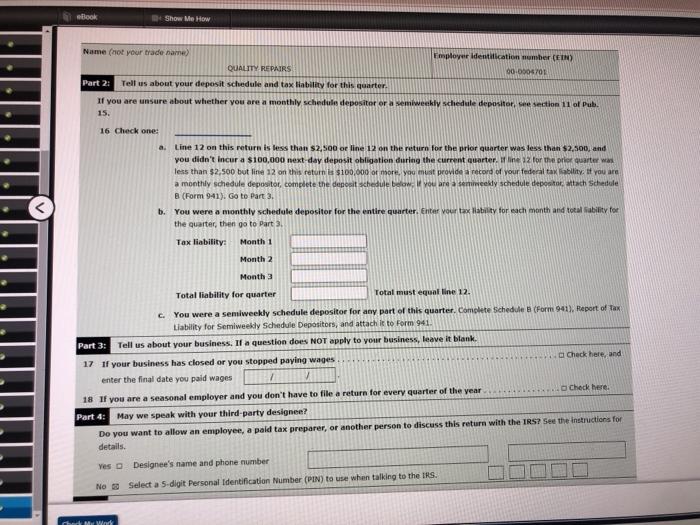

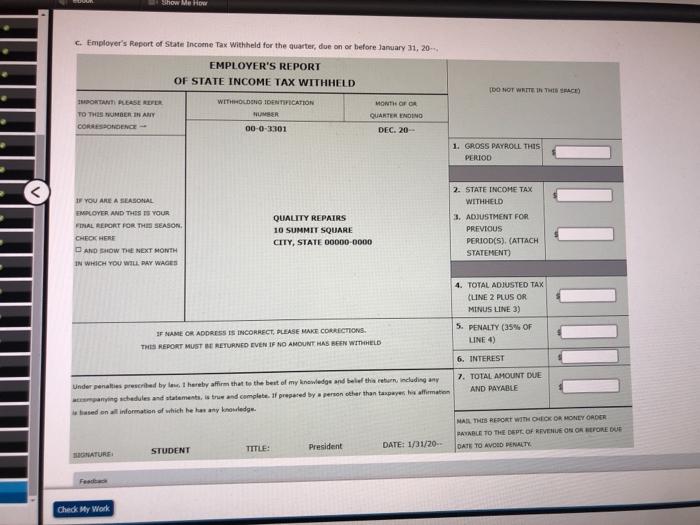

rum You the wage bracket that the state Set the other mara weed we had shed ws the perform mettere - At least 1821 Sp Follow these for the water conto the right to the colure showing the appropriate mer own with How that the chances that of The tax to his 135 San Matthew water at the Dune Listwyt Marte 10000 for the she worked in adition, this is for forry to his (90000) en wis the am for the tips on his first in Man Clothis two homepage verwheld federal income wapbracket med lys, statime x2 Enter deductions beginning with a mission (Round interim mats to detalles. Use these valus in subregut computations the round final answer to two decimal places Gick here to the Wage-chat the tables Group 100 Federal income Socialty ASOR 49.60 Sociacity to 11.60 -16 Statemetar F Prevc Check War Emain Save and Sun Alle Select the watching that apostat um mailatus and period As mane and Shapewe tara Step Locate the wage bracket the first to share of the te in which the verwagefal Locate the competente en At least 10 best thun Follow the line for the others to the right to the showing the appropriate number of wance with this amount of to - Move across the line to the color towing allowances That wholds Use the percentage method and (b) the wagen mited to come the federal come to withhold from the res of champleves, Enter all amounts as positive members. Round your calcio Tinatanswers to the nearest cent Click here to the title of Allowance Click here to the recente Method Tables Click here to the Wage Method bles Amount to be withheld No. of Marital withholding Status Allowances Percentage Method Wage-Bracket Method Employee 5 Gross Wage ar Salary $575 week 1.60 w 1.725 weekly 2.500 ml 3 Com Fogge es Must use percentage method M 5 5 M Cars W Mustantaa method M He 4 Samanth ched My Work Allwaves O 2 G Show the showing the laten How where the That the Eat the end method Gerederal nome tax wet de meeste mens ser Mound interim case we decimals and get composed inalta decimal Payroll Period w Weekly No. of Simonthly Harital withholding Monthly Eme Status Allowances Daily w Auto W 1 w 2 w 675 3.100 x Trum H 2 H M H 5 950 D 5 1.215 Chidi My Award C. The names the employees of Hogan thin shop wested on the follow. Eriopes ut paid weekly. The mantalanes and the number of allowance claimed that this periode, emple would salary, which has remained the same all your complete the parts for the operanding Dec 20,20 then we day. The the te is 13o the total group and the wage bracket method wie for federal income tal wages within the testament on the state, som Thermounts as positive nombers found your calculations and final answers to the nearest cant. Click here to come of lowance Value Click here to the wae Bracket Methode cida com the Pathod Hogan Thit Shop Payroll Register Deductions (a) FICA (1) FIT (d) CIT el Net Pay FOR PERIOD ENDING December 20, 20 Marital No. of W/H Total Employee Name Status Allowances Earnings o the 5 0 650.00 STI OASDI HI x 5.50 275.00 5.00 3.75 3.63 15.50 Bu Cath M 5 250.00 6:41 LO M 0 320.25 Matthew Mary 19.00 9.00 5.75 6.53 5 4 450.00 27.90 Habo 11:21 31.41 8.13 1 M 560.0 34.75 Cam Se 9.51 71 6. M 2 29.40 17.00 13.35 S 12.01 55.10 890.00 Goose 35.671.25 Total Compute the power ICAs for the period in December 20, 20 OASDIT HIT GASOI beaming able carming CAO All we . Example Come for the charman School Belomes to store retirement plants which control his matched hy the hool. Het 52.500 the defa 2.00 - 1756 12,40 m haline w Julle wil made this week or social security and remaches Cacher player matches the check Determine who wishes and anime was the work Ended beginning with a mission). Hound your calls and answers to the rest Die to the Wagradbe Com 30 SAC 4011 de GASOL Show Me How Quarterly Payroll Data Total Earnings 5 Employees OASDI HI FIT SIT $18.960.00 $1,175,52 $274.92 $1.996.00 $1,327.20 Employer's OASDI $1.175.52 Employer's HD 274.92 Federal deposit liability each pay 685.22 a. Complete the Federal Deposit Information Worksheets reflecting electronk deposits monthly depositor). Federal deposit lability each pay $605.27. FEDERAL DEPOSIT INFORMATION WORKSHEET Employer Identification Number 00-0004701 Name QUALITY REPAIRS Month Tax Year Ends 12 Amount of Depok Type of Tax (Form) Tax Period 1st quarter x Address 10 SUMMIT SQUARE Phone Number (501) 555-7331 City, State, ZIP CITY STATE 00000-0000 To be deposited on or before FEDERAL DEPOSIT INFORMATION WORKSHEET Employer Identification Number Name 00-0004701 QUALITY REPAIRS Amount of Deposit Month Tax Year Ends Tax Period Phone Number (501) 555-7331 Type of Tax (Form) Address City, State, ZIP To be deposited on or before LO SUMMIT SQUARE CITY STATE 00000-0000 FEDERAL DEPOSIT INFORMATION WORKSHEET Employer Identification Number Name QUALITY REPAIR 00-0004701 Show Me How 2 Part 1: Answer these questions for this quarter, 1 Number of employees who received wages, tips, or other compensation for the pay period including: Mar 12 (Quarter 1), June 12 (Quarter 2). Sept. 12 (Quarter 3), or Dec 12 (Quarter 4) 2 Wages, tips, and other compensation 3 Federal income tax withheld from wages, tips, and other compensation 4 If no wages, tips, and other compensation are subject to social security or Medicare tax Column 1 Column 2 Sa Taxable social security wages..... X1M Sb Taxable social security tips X 124 Sc Taxable Medicare wages & tips Check and go to line 6 * 029 Sd Taxable wages & tips subject to Additional Medicare Tax withholding x.009 Se 51 6 Se Add Column 2 from lines 50, 55, 5c, and 5d. Sf Section 3121(9) Notice and Demand-Tax due on unreported tips (see instructions) 6 Total taxes before adjustments. Add lines 3. Se, and Sf. 7 Current quarter's adjustment for fractions of cents 8 Current quarter's adjustment for sick pay. 7 9 9 Current quarter's adjustments for tips and group-term life insurance 9 10 Total taxes after adjustments. Combine lines 6 through 9. 10 11 Qualified small business payroll tax credit for increasing research activities. Attach Form 9974 11 12 Total taxes after adjustments and credits. Subtract line 11 from line 10 12 13 Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments 13 applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter 14 Balance due. If line 12 is more than line 13, enter the difference and see instructions 14 15 Overpayment. If line 13 is more than line 12, enter the difference Check one: Apply to next return. Send a refund. You MUST complete both pages of Form 941 and SIGN it. Next- Cat No. 17001Z Form 941 (Rev. 1-2019) For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher ook 4 Show Me How Name (not your trade name) Employer identification number (EN) QUALITY REPAIRS 00.0005702 Part 2 Tell us about your deposit schedule and tax liability for this quarter. If you are unsure about whether you are a monthly schedule depositor or a semiweekly schedule depositor, see section 11 of Pub 15. 16 Check one: a. Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500, and you didn't incur a $100,000 next day deposit obligation during the current quarter. I line for the per quarter was less than $2,500 but line 12 on this return is $100,000 or more, you must provide a record of your federal tax ability. If you are a monthly schedule depositor, complete the deposit schedule below. You are a senweeldy schedule depositor attach Schedule B (Form 941). Go to Part 3 b. You were a monthly schedule depositor for the entire quarter. Enter your tax ability for each month and total ability for the quarter, then go to Part 3 Tax liability: Month 1 Month 2 Month 3 Total liability for quarter Total must equal line 12 You were a semiweekly schedule depositor for any part of this quarter. Complete Schedule (Form 941). Report of Tax Liability for Semiweekly schedule Depositors, and attach it to Form 941 Part 3: Tell us about your business. If a question does NOT apply to your business, leave it blank. 17 If your business has closed or you stopped paying wages Check here, and enter the final date you paid wages 1 18 If you are a seasonal employer and you don't have to file a return for every quarter of the year Check here Part 4: May we speak with your third-party designee? Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details. Yes Designee's name and phone number No Select a S-digit Personal Identification Number (PIN) to use when talking to the IRS Wor Show Me How c. Employer's Report of State Income Tax withheld for the quarter, due on or before January 31, 20 EMPLOYER'S REPORT OF STATE INCOME TAX WITHHELD DO NOT WRITE THIS ACE) IMPORTANT PLEASE REVER TO THE NUMBER IN ANY CORRESPONDENCE WITHHOLDING IDENTIFICATION NUMBER 00-0-3101 MONTH OF OR QUARTER ENDINO DEC. 20- 1. GROSS PAYROLL THIS PERIOD IF YOU ARE A SEASONAL EMPLOYER AND THIS IS YOUR FINAL REPORT FOR THE SEASON. CHECK HERE AND HOW THE NEXT MONTH IN WHICH YOU WILL PAY WAGES QUALITY REPAIRS 10 SUMMIT SQUARE CITY, STATE 00000-0000 2. STATE INCOME TAX WITHHELD 3. ADJUSTMENT FOR PREVIOUS PERIOD(S). (ATTACH STATEMENT) 4. TOTAL ADJUSTED TAX (LINE 2 PLUS OR MINUS LINE 3) 5. PENALTY (35% OF LINE 4) IF NAME OR ADDRESS IS INCORRECT, PLEASE MAKE CORRECTIONS THIS REPORT MUST RETURNED EVEN IF NO AMOUNT HAS BEEN WILD 6. INTEREST Under penalties pretred by thereby affirm that to the best of my knowledge and belief that including any 7. TOTAL AMOUNT DUE nying schedules and statements, true and complete prepared by a person other than tapuyer his almatien AND PAYABLE based on all information of which he has any knowledge MAIL THIS REPORT WITH OOK OR MONEY ORDER PAYABLE TO THE DEPT OF REVENUE ON OR BEFORE DUE SIGNATURE STUDENT TITLE: President DATE: 1/31/20 DATE TO AVOID PENALTY Check My Work rum You the wage bracket that the state Set the other mara weed we had shed ws the perform mettere - At least 1821 Sp Follow these for the water conto the right to the colure showing the appropriate mer own with How that the chances that of The tax to his 135 San Matthew water at the Dune Listwyt Marte 10000 for the she worked in adition, this is for forry to his (90000) en wis the am for the tips on his first in Man Clothis two homepage verwheld federal income wapbracket med lys, statime x2 Enter deductions beginning with a mission (Round interim mats to detalles. Use these valus in subregut computations the round final answer to two decimal places Gick here to the Wage-chat the tables Group 100 Federal income Socialty ASOR 49.60 Sociacity to 11.60 -16 Statemetar F Prevc Check War Emain Save and Sun Alle Select the watching that apostat um mailatus and period As mane and Shapewe tara Step Locate the wage bracket the first to share of the te in which the verwagefal Locate the competente en At least 10 best thun Follow the line for the others to the right to the showing the appropriate number of wance with this amount of to - Move across the line to the color towing allowances That wholds Use the percentage method and (b) the wagen mited to come the federal come to withhold from the res of champleves, Enter all amounts as positive members. Round your calcio Tinatanswers to the nearest cent Click here to the title of Allowance Click here to the recente Method Tables Click here to the Wage Method bles Amount to be withheld No. of Marital withholding Status Allowances Percentage Method Wage-Bracket Method Employee 5 Gross Wage ar Salary $575 week 1.60 w 1.725 weekly 2.500 ml 3 Com Fogge es Must use percentage method M 5 5 M Cars W Mustantaa method M He 4 Samanth ched My Work Allwaves O 2 G Show the showing the laten How where the That the Eat the end method Gerederal nome tax wet de meeste mens ser Mound interim case we decimals and get composed inalta decimal Payroll Period w Weekly No. of Simonthly Harital withholding Monthly Eme Status Allowances Daily w Auto W 1 w 2 w 675 3.100 x Trum H 2 H M H 5 950 D 5 1.215 Chidi My Award C. The names the employees of Hogan thin shop wested on the follow. Eriopes ut paid weekly. The mantalanes and the number of allowance claimed that this periode, emple would salary, which has remained the same all your complete the parts for the operanding Dec 20,20 then we day. The the te is 13o the total group and the wage bracket method wie for federal income tal wages within the testament on the state, som Thermounts as positive nombers found your calculations and final answers to the nearest cant. Click here to come of lowance Value Click here to the wae Bracket Methode cida com the Pathod Hogan Thit Shop Payroll Register Deductions (a) FICA (1) FIT (d) CIT el Net Pay FOR PERIOD ENDING December 20, 20 Marital No. of W/H Total Employee Name Status Allowances Earnings o the 5 0 650.00 STI OASDI HI x 5.50 275.00 5.00 3.75 3.63 15.50 Bu Cath M 5 250.00 6:41 LO M 0 320.25 Matthew Mary 19.00 9.00 5.75 6.53 5 4 450.00 27.90 Habo 11:21 31.41 8.13 1 M 560.0 34.75 Cam Se 9.51 71 6. M 2 29.40 17.00 13.35 S 12.01 55.10 890.00 Goose 35.671.25 Total Compute the power ICAs for the period in December 20, 20 OASDIT HIT GASOI beaming able carming CAO All we . Example Come for the charman School Belomes to store retirement plants which control his matched hy the hool. Het 52.500 the defa 2.00 - 1756 12,40 m haline w Julle wil made this week or social security and remaches Cacher player matches the check Determine who wishes and anime was the work Ended beginning with a mission). Hound your calls and answers to the rest Die to the Wagradbe Com 30 SAC 4011 de GASOL Show Me How Quarterly Payroll Data Total Earnings 5 Employees OASDI HI FIT SIT $18.960.00 $1,175,52 $274.92 $1.996.00 $1,327.20 Employer's OASDI $1.175.52 Employer's HD 274.92 Federal deposit liability each pay 685.22 a. Complete the Federal Deposit Information Worksheets reflecting electronk deposits monthly depositor). Federal deposit lability each pay $605.27. FEDERAL DEPOSIT INFORMATION WORKSHEET Employer Identification Number 00-0004701 Name QUALITY REPAIRS Month Tax Year Ends 12 Amount of Depok Type of Tax (Form) Tax Period 1st quarter x Address 10 SUMMIT SQUARE Phone Number (501) 555-7331 City, State, ZIP CITY STATE 00000-0000 To be deposited on or before FEDERAL DEPOSIT INFORMATION WORKSHEET Employer Identification Number Name 00-0004701 QUALITY REPAIRS Amount of Deposit Month Tax Year Ends Tax Period Phone Number (501) 555-7331 Type of Tax (Form) Address City, State, ZIP To be deposited on or before LO SUMMIT SQUARE CITY STATE 00000-0000 FEDERAL DEPOSIT INFORMATION WORKSHEET Employer Identification Number Name QUALITY REPAIR 00-0004701 Show Me How 2 Part 1: Answer these questions for this quarter, 1 Number of employees who received wages, tips, or other compensation for the pay period including: Mar 12 (Quarter 1), June 12 (Quarter 2). Sept. 12 (Quarter 3), or Dec 12 (Quarter 4) 2 Wages, tips, and other compensation 3 Federal income tax withheld from wages, tips, and other compensation 4 If no wages, tips, and other compensation are subject to social security or Medicare tax Column 1 Column 2 Sa Taxable social security wages..... X1M Sb Taxable social security tips X 124 Sc Taxable Medicare wages & tips Check and go to line 6 * 029 Sd Taxable wages & tips subject to Additional Medicare Tax withholding x.009 Se 51 6 Se Add Column 2 from lines 50, 55, 5c, and 5d. Sf Section 3121(9) Notice and Demand-Tax due on unreported tips (see instructions) 6 Total taxes before adjustments. Add lines 3. Se, and Sf. 7 Current quarter's adjustment for fractions of cents 8 Current quarter's adjustment for sick pay. 7 9 9 Current quarter's adjustments for tips and group-term life insurance 9 10 Total taxes after adjustments. Combine lines 6 through 9. 10 11 Qualified small business payroll tax credit for increasing research activities. Attach Form 9974 11 12 Total taxes after adjustments and credits. Subtract line 11 from line 10 12 13 Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments 13 applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter 14 Balance due. If line 12 is more than line 13, enter the difference and see instructions 14 15 Overpayment. If line 13 is more than line 12, enter the difference Check one: Apply to next return. Send a refund. You MUST complete both pages of Form 941 and SIGN it. Next- Cat No. 17001Z Form 941 (Rev. 1-2019) For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher ook 4 Show Me How Name (not your trade name) Employer identification number (EN) QUALITY REPAIRS 00.0005702 Part 2 Tell us about your deposit schedule and tax liability for this quarter. If you are unsure about whether you are a monthly schedule depositor or a semiweekly schedule depositor, see section 11 of Pub 15. 16 Check one: a. Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500, and you didn't incur a $100,000 next day deposit obligation during the current quarter. I line for the per quarter was less than $2,500 but line 12 on this return is $100,000 or more, you must provide a record of your federal tax ability. If you are a monthly schedule depositor, complete the deposit schedule below. You are a senweeldy schedule depositor attach Schedule B (Form 941). Go to Part 3 b. You were a monthly schedule depositor for the entire quarter. Enter your tax ability for each month and total ability for the quarter, then go to Part 3 Tax liability: Month 1 Month 2 Month 3 Total liability for quarter Total must equal line 12 You were a semiweekly schedule depositor for any part of this quarter. Complete Schedule (Form 941). Report of Tax Liability for Semiweekly schedule Depositors, and attach it to Form 941 Part 3: Tell us about your business. If a question does NOT apply to your business, leave it blank. 17 If your business has closed or you stopped paying wages Check here, and enter the final date you paid wages 1 18 If you are a seasonal employer and you don't have to file a return for every quarter of the year Check here Part 4: May we speak with your third-party designee? Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details. Yes Designee's name and phone number No Select a S-digit Personal Identification Number (PIN) to use when talking to the IRS Wor Show Me How c. Employer's Report of State Income Tax withheld for the quarter, due on or before January 31, 20 EMPLOYER'S REPORT OF STATE INCOME TAX WITHHELD DO NOT WRITE THIS ACE) IMPORTANT PLEASE REVER TO THE NUMBER IN ANY CORRESPONDENCE WITHHOLDING IDENTIFICATION NUMBER 00-0-3101 MONTH OF OR QUARTER ENDINO DEC. 20- 1. GROSS PAYROLL THIS PERIOD IF YOU ARE A SEASONAL EMPLOYER AND THIS IS YOUR FINAL REPORT FOR THE SEASON. CHECK HERE AND HOW THE NEXT MONTH IN WHICH YOU WILL PAY WAGES QUALITY REPAIRS 10 SUMMIT SQUARE CITY, STATE 00000-0000 2. STATE INCOME TAX WITHHELD 3. ADJUSTMENT FOR PREVIOUS PERIOD(S). (ATTACH STATEMENT) 4. TOTAL ADJUSTED TAX (LINE 2 PLUS OR MINUS LINE 3) 5. PENALTY (35% OF LINE 4) IF NAME OR ADDRESS IS INCORRECT, PLEASE MAKE CORRECTIONS THIS REPORT MUST RETURNED EVEN IF NO AMOUNT HAS BEEN WILD 6. INTEREST Under penalties pretred by thereby affirm that to the best of my knowledge and belief that including any 7. TOTAL AMOUNT DUE nying schedules and statements, true and complete prepared by a person other than tapuyer his almatien AND PAYABLE based on all information of which he has any knowledge MAIL THIS REPORT WITH OOK OR MONEY ORDER PAYABLE TO THE DEPT OF REVENUE ON OR BEFORE DUE SIGNATURE STUDENT TITLE: President DATE: 1/31/20 DATE TO AVOID PENALTY Check My Work