Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i will vote up for correct answer and steps 726 Ahmed & Bro. Co. operates and services snack vending machines located in restaurants, metro stations,

i will vote up for correct answer and steps

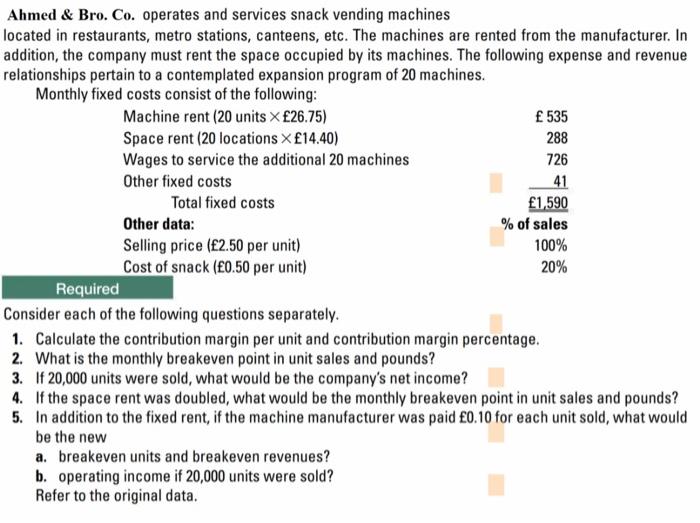

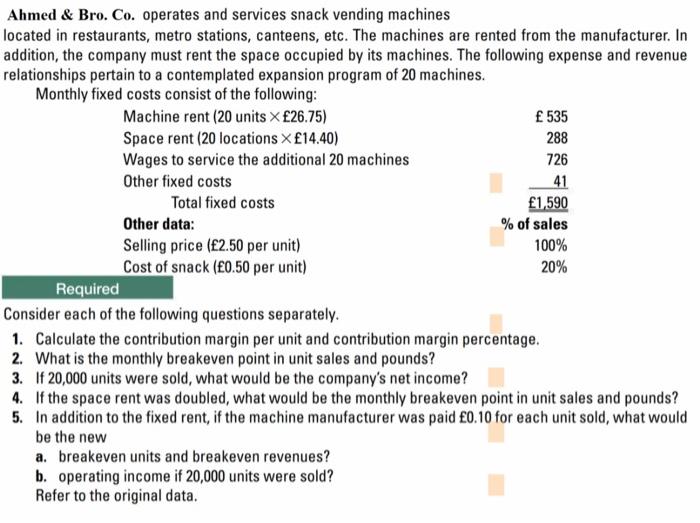

726 Ahmed & Bro. Co. operates and services snack vending machines located in restaurants, metro stations, canteens, etc. The machines are rented from the manufacturer. In addition, the company must rent the space occupied by its machines. The following expense and revenue relationships pertain to a contemplated expansion program of 20 machines. Monthly fixed costs consist of the following: Machine rent (20 units X 26.75) 535 Space rent (20 locations x 14.40) 288 Wages to service the additional 20 machines Other fixed costs 41 Total fixed costs 1,590 Other data: % of sales Selling price (2.50 per unit) 100% Cost of snack (0.50 per unit) 20% Required Consider each of the following questions separately. 1. Calculate the contribution margin per unit and contribution margin percentage. 2. What is the monthly breakeven point in unit sales and pounds? 3. If 20,000 units were sold, what would be the company's net income? 4. If the space rent was doubled, what would be the monthly breakeven point in unit sales and pounds? 5. In addition to the fixed rent, if the machine manufacturer was paid 0.10 for each unit sold, what would be the new a. breakeven units and breakeven revenues? b. operating income if 20,000 units were sold? Refer to the original data

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started