Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I wonder if I understand the problem correctly? To get the interest rates we need to use the bootstrapping formula from the Hull book, but

I wonder if I understand the problem correctly? To get the interest rates we need to use the bootstrapping formula from the Hull book, but in order to do this, we need to have the discount factors from year 1-3. I do not understand where we get those from? The correct result for year one is apparently 2.9559%. Perhaps someone can help me on this?

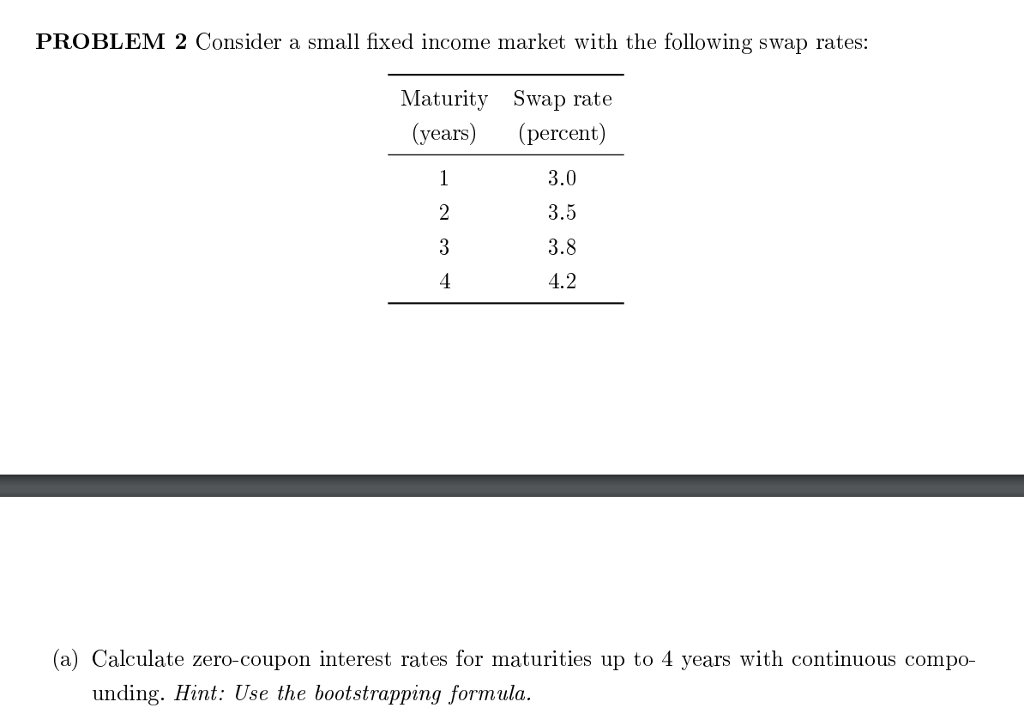

PROBLEM 2 Consider a small fixed income market with the following swap rates: Maturity Swap rate (years) (percent) 3.0 3.5 3.8 4.2 2 (a) Calculate zero-coupon interest rates for maturities up to 4 years with continuous compo- unding. Hint: Use the bootstrapping formulaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started