Answered step by step

Verified Expert Solution

Question

1 Approved Answer

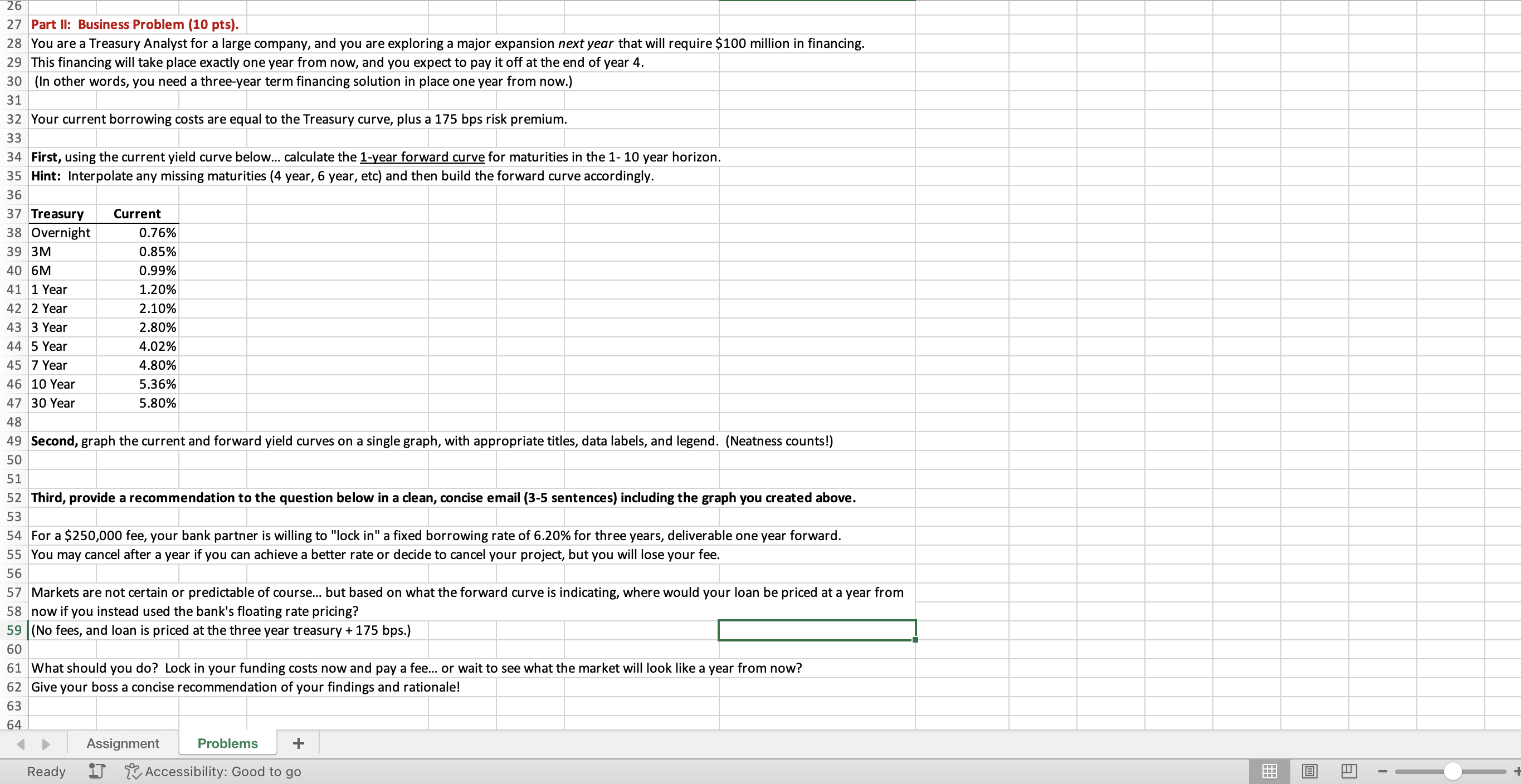

I would appreciate if I could get help with the forward rates, and interpolating the missing years , 4, 6, 8,9 year thank you 26

I would appreciate if I could get help with the forward rates, and interpolating the missing years , 4, 6, 8,9 year thank you

26 Part II: Business Problem (10 pts). 28 You are a Treasury Analyst for a large company, and you are exploring a major expansion next year that will require $100 million in financing. 29 This financing will take place exactly one year from now, and you expect to pay it off at the end of year 4. 30 31 32 Your current borrowing costs are equal to the Treasury curve, plus a 175 bps risk premium. 33 34 First, using the current yield curve below... calculate the 1-year forward curve for maturities in the 1- 10 year horizon. 35 Hint: Interpolate any missing maturities ( 4 year, 6 year, etc) and then build the forward curve accordingly. 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Second, graph the current and forward yield curves on a single graph, with appropriate titles, data labels, and legend. (Neatness counts!) 50 52 53 54 For a $250,000 fee, your bank partner is willing to "lock in" a fixed borrowing rate of 6.20% for three years, deliverable one year forward. 55 You may cancel after a year if you can achieve a better rate or decide to cancel your project, but you will lose your fee. 56 57 Markets are not certain or predictable of course... but based on what the forward curve is indicating, where would your loan be priced at a year from 58 now if you instead used the bank's floating rate pricing? 59 (No fees, and loan is priced at the three year treasury +175 bps.) 60 61 What should you do? Lock in your funding costs now and pay a fee... or wait to see what the market will look like a year from now? 62 Give your boss a concise recommendation of your findings and rationale! 63 64 64 Ready is Assignment Accessibility: Good to go 26 Part II: Business Problem (10 pts). 28 You are a Treasury Analyst for a large company, and you are exploring a major expansion next year that will require $100 million in financing. 29 This financing will take place exactly one year from now, and you expect to pay it off at the end of year 4. 30 31 32 Your current borrowing costs are equal to the Treasury curve, plus a 175 bps risk premium. 33 34 First, using the current yield curve below... calculate the 1-year forward curve for maturities in the 1- 10 year horizon. 35 Hint: Interpolate any missing maturities ( 4 year, 6 year, etc) and then build the forward curve accordingly. 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Second, graph the current and forward yield curves on a single graph, with appropriate titles, data labels, and legend. (Neatness counts!) 50 52 53 54 For a $250,000 fee, your bank partner is willing to "lock in" a fixed borrowing rate of 6.20% for three years, deliverable one year forward. 55 You may cancel after a year if you can achieve a better rate or decide to cancel your project, but you will lose your fee. 56 57 Markets are not certain or predictable of course... but based on what the forward curve is indicating, where would your loan be priced at a year from 58 now if you instead used the bank's floating rate pricing? 59 (No fees, and loan is priced at the three year treasury +175 bps.) 60 61 What should you do? Lock in your funding costs now and pay a fee... or wait to see what the market will look like a year from now? 62 Give your boss a concise recommendation of your findings and rationale! 63 64 64 Ready is Assignment Accessibility: Good to goStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started