Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would like the formula in excel to these answers. Thanks you already answer the question where you included the formula & the formula is

I would like the formula in excel to these answers. Thanks

you already answer the question where you included the formula & the formula is not correct.

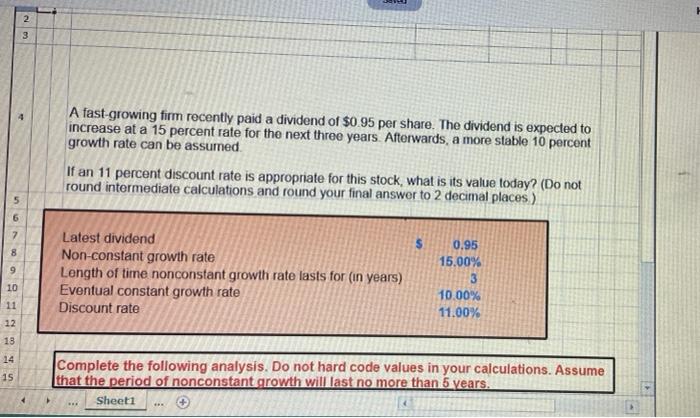

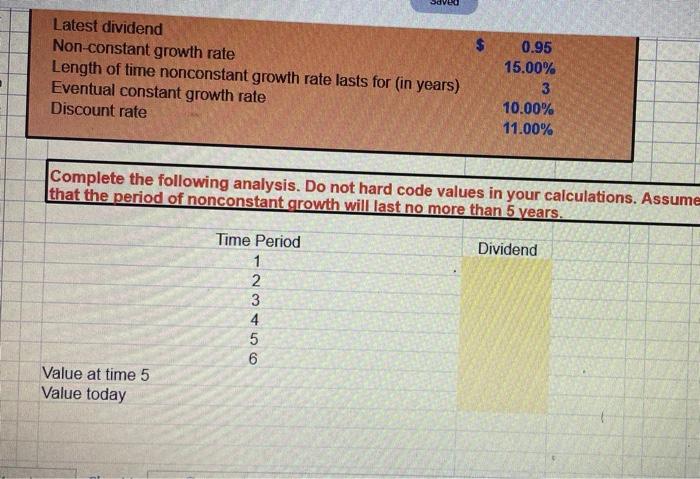

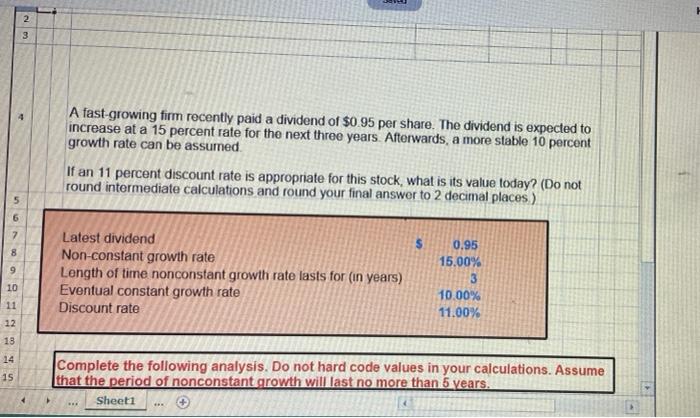

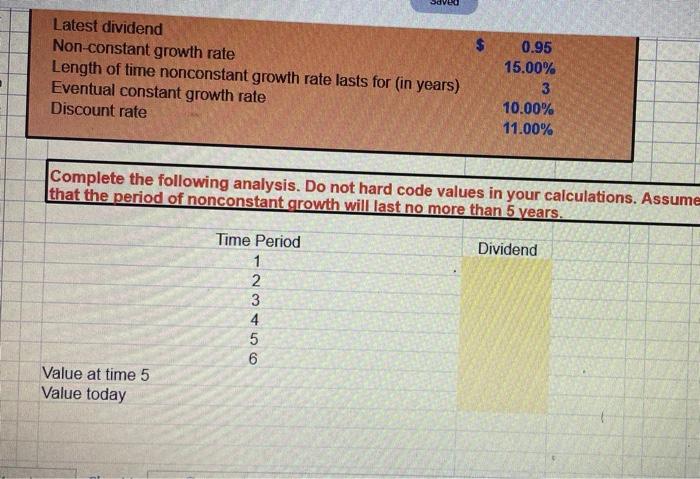

2 3 A fast-growing firm recently paid a dividend of $0.95 per share. The dividend is expected to increase at a 15 percent rate for the next three years. Afterwards a more stable 10 percent growth rate can be assumed. If an 11 percent discount rate is appropriate for this stock, what is its value today? (Do not round intermediate calculations and round your final answer to 2 decimal places) S 8 Latest dividend Non-constant growth rate Length of time nonconstant growth rate lasts for (in years) Eventual constant growth rate Discount rate 0.95 15.00% 3 10.00% 11.00% 10 11 12 18 14 15 Complete the following analysis. Do not hard code values in your calculations. Assume that the period of nonconstant growth will last no more than 5 years. Sheet1 dvere $ Latest dividend Non-constant growth rate Length of time nonconstant growth rate lasts for (in years) Eventual constant growth rate Discount rate 0.95 15.00% 3 10.00% 11.00% Complete the following analysis. Do not hard code values in your calculations. Assume that the period of nonconstant growth will last no more than 5 years. Dividend Time Period 1 2 3 4 5 6 O AWN Value at time 5 Value today 2 3 A fast-growing firm recently paid a dividend of $0.95 per share. The dividend is expected to increase at a 15 percent rate for the next three years. Afterwards a more stable 10 percent growth rate can be assumed. If an 11 percent discount rate is appropriate for this stock, what is its value today? (Do not round intermediate calculations and round your final answer to 2 decimal places) S 8 Latest dividend Non-constant growth rate Length of time nonconstant growth rate lasts for (in years) Eventual constant growth rate Discount rate 0.95 15.00% 3 10.00% 11.00% 10 11 12 18 14 15 Complete the following analysis. Do not hard code values in your calculations. Assume that the period of nonconstant growth will last no more than 5 years. Sheet1 dvere $ Latest dividend Non-constant growth rate Length of time nonconstant growth rate lasts for (in years) Eventual constant growth rate Discount rate 0.95 15.00% 3 10.00% 11.00% Complete the following analysis. Do not hard code values in your calculations. Assume that the period of nonconstant growth will last no more than 5 years. Dividend Time Period 1 2 3 4 5 6 O AWN Value at time 5 Value today Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started