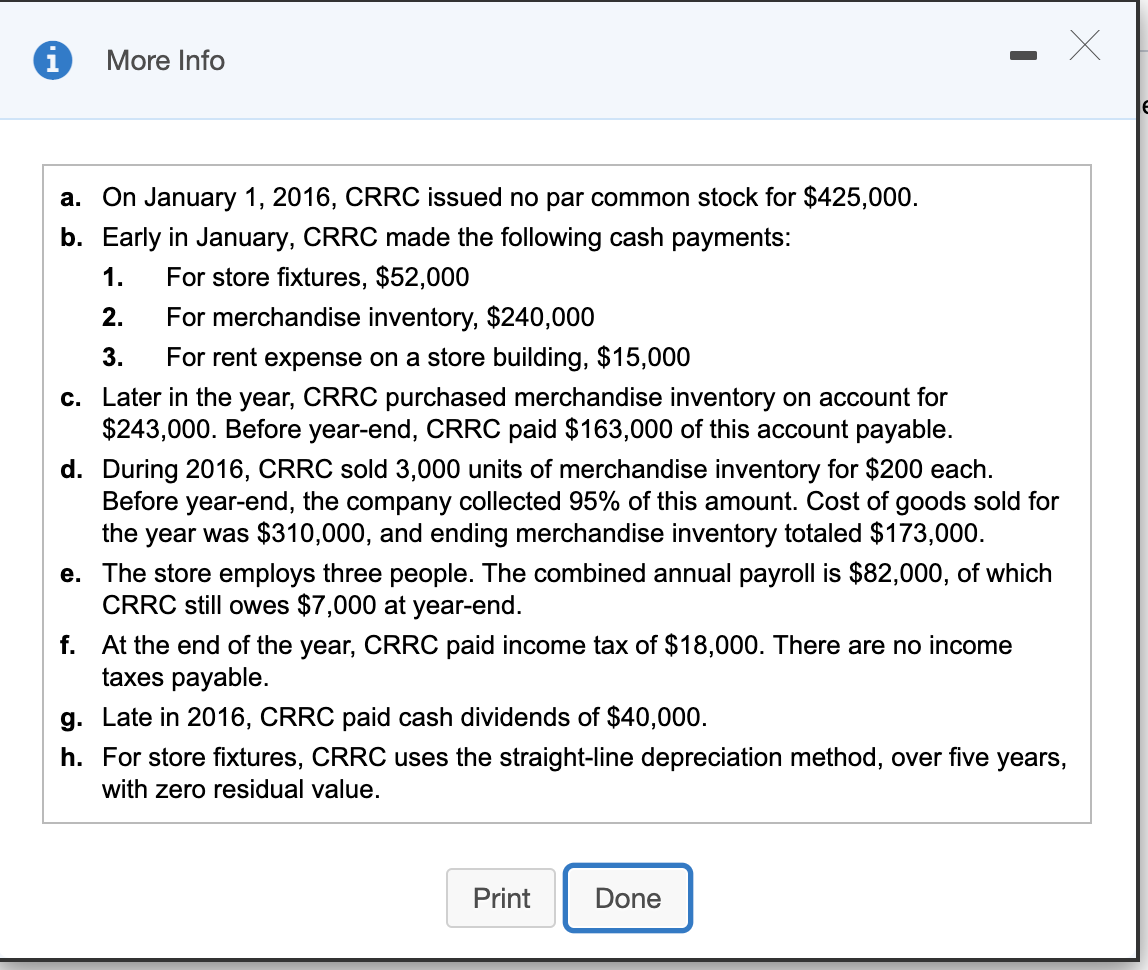

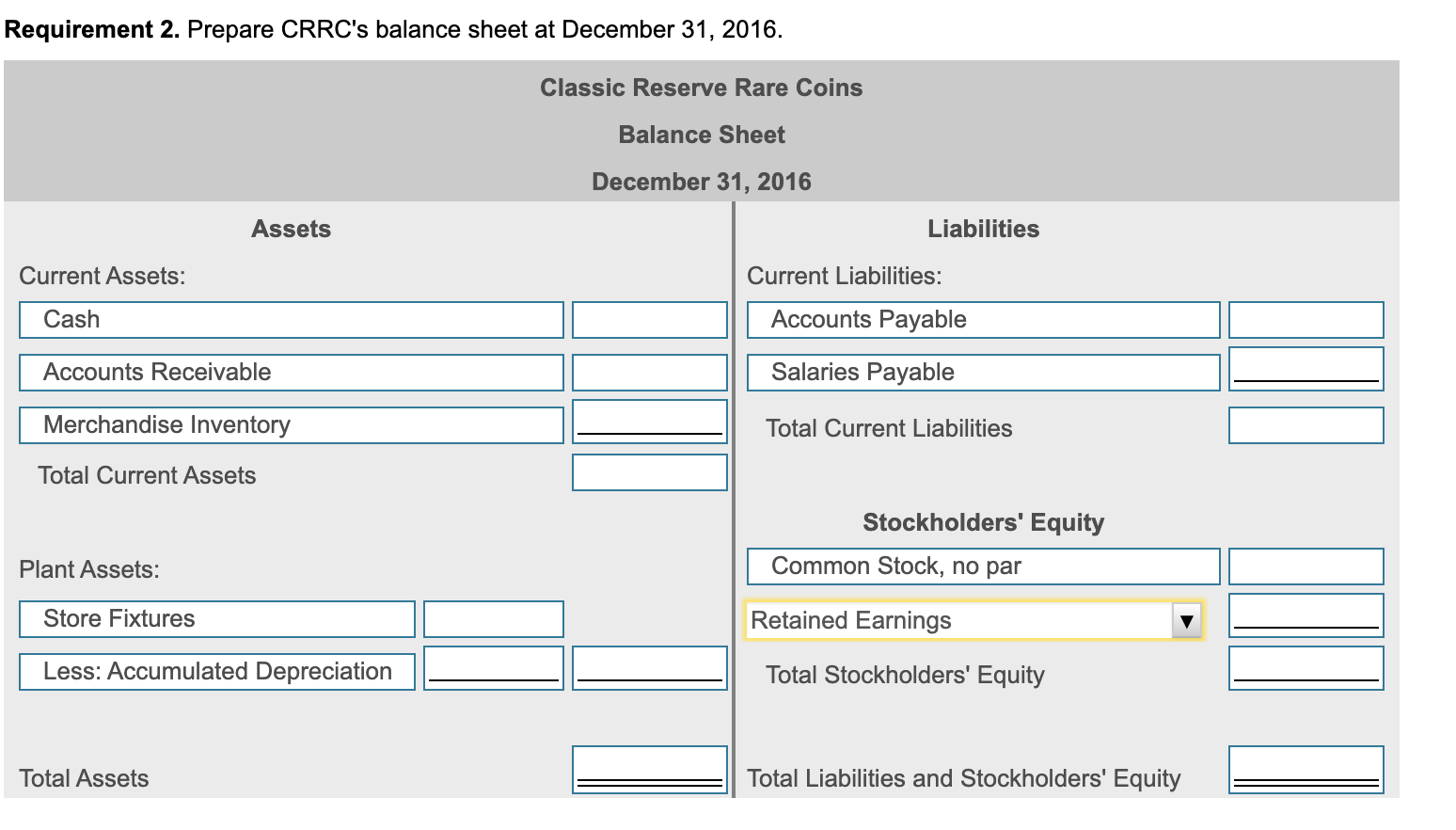

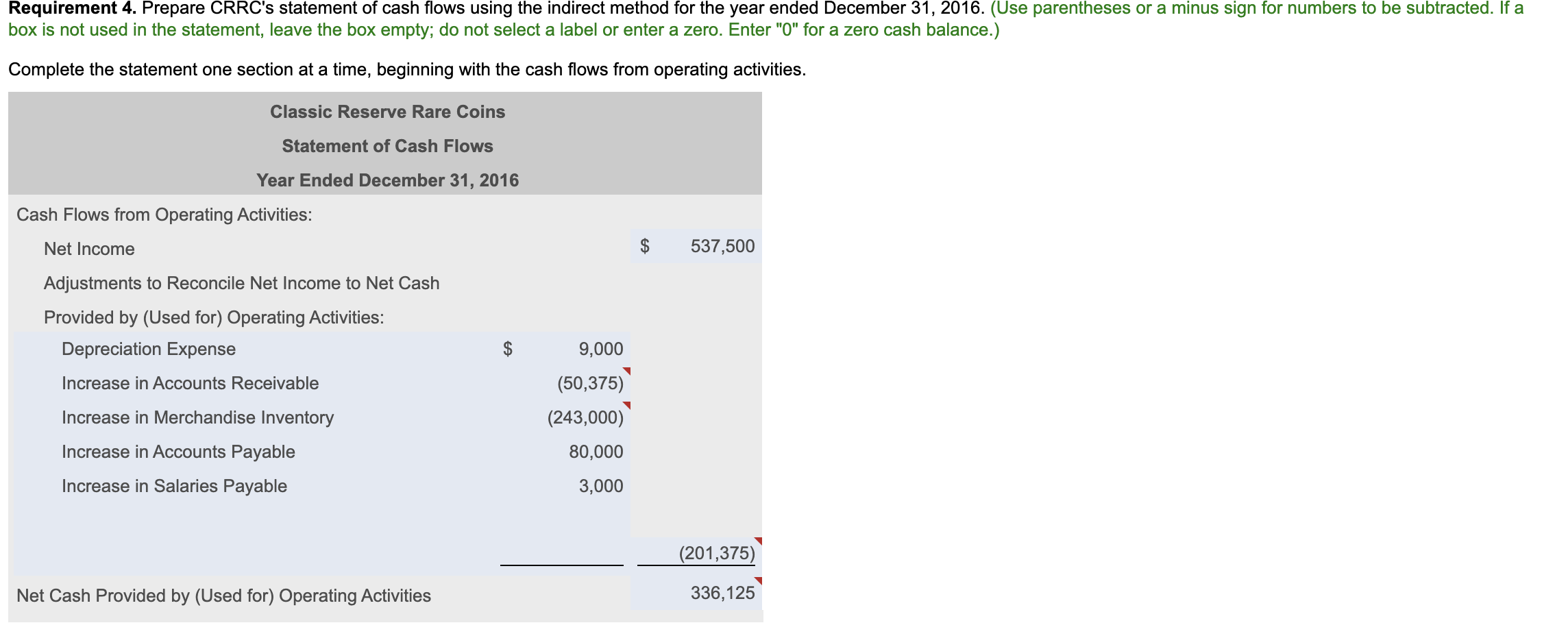

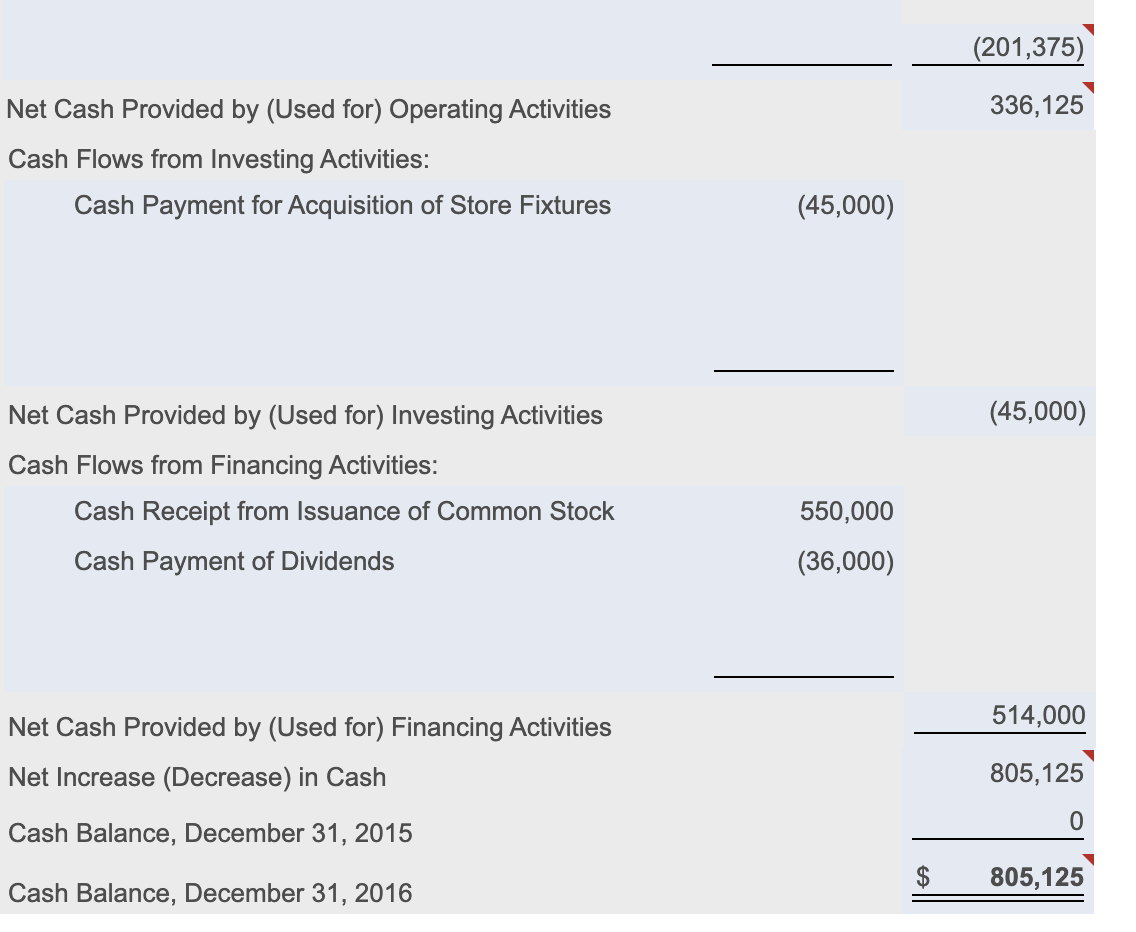

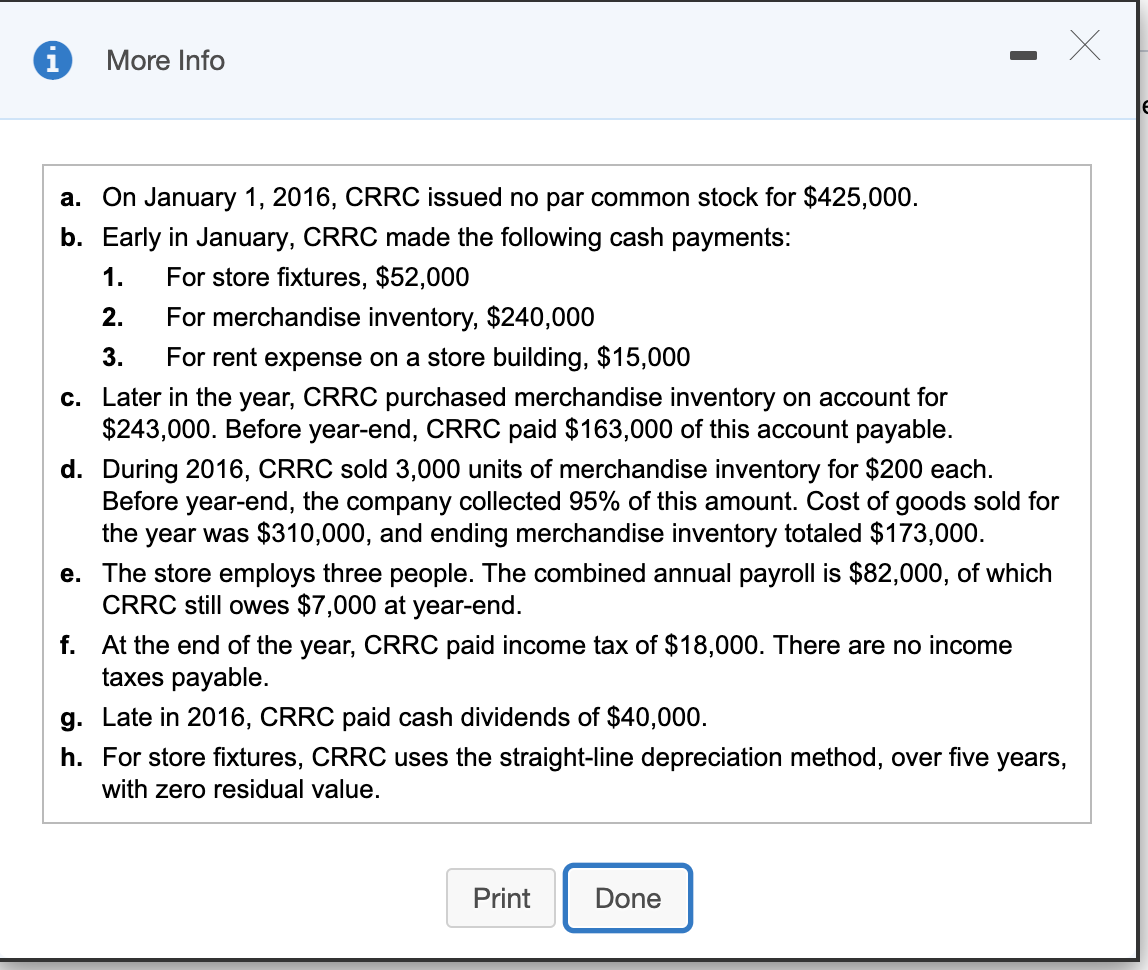

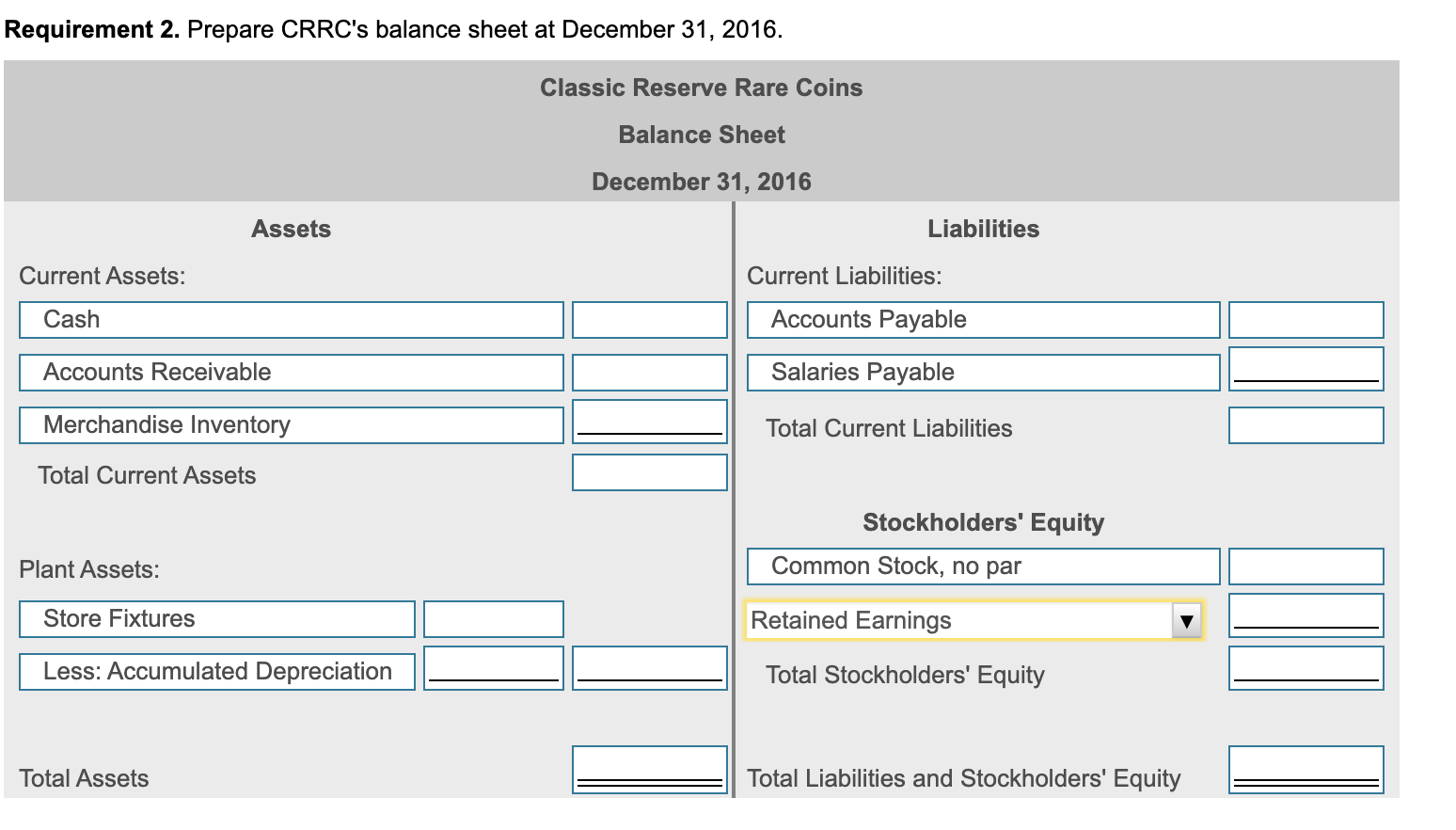

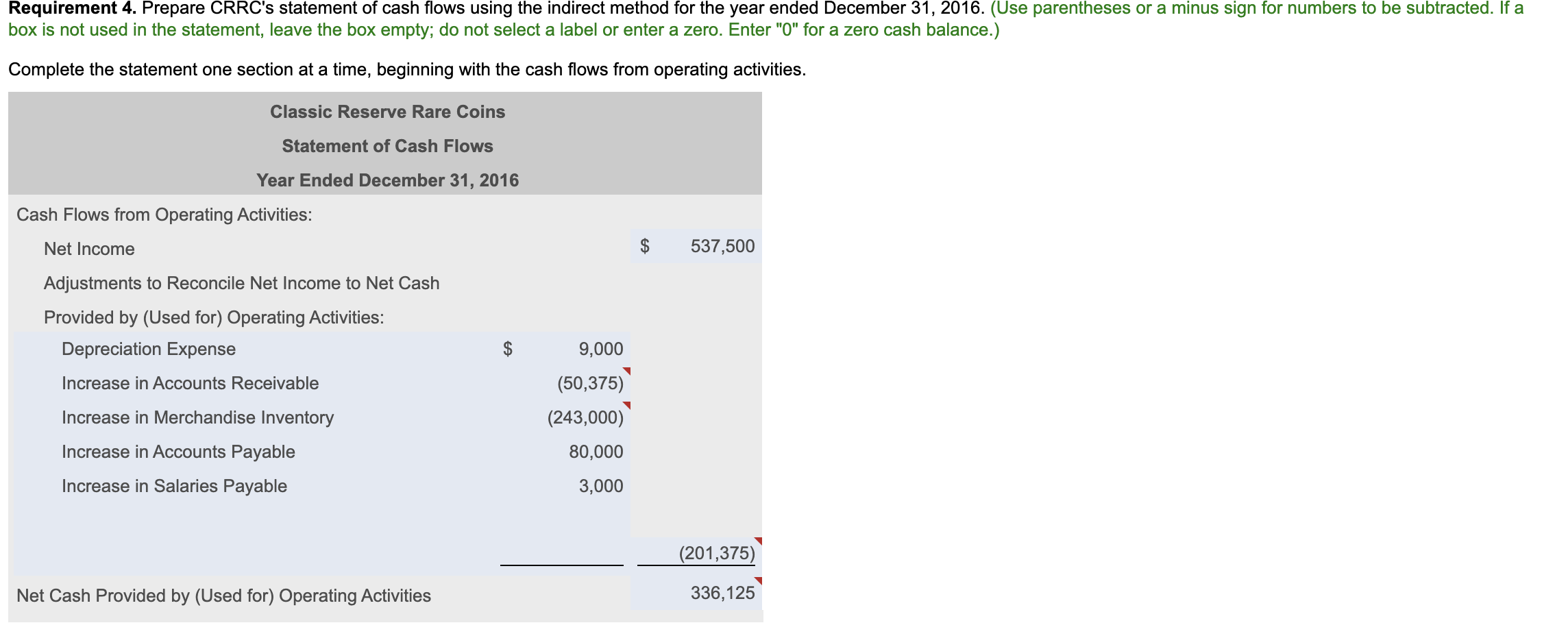

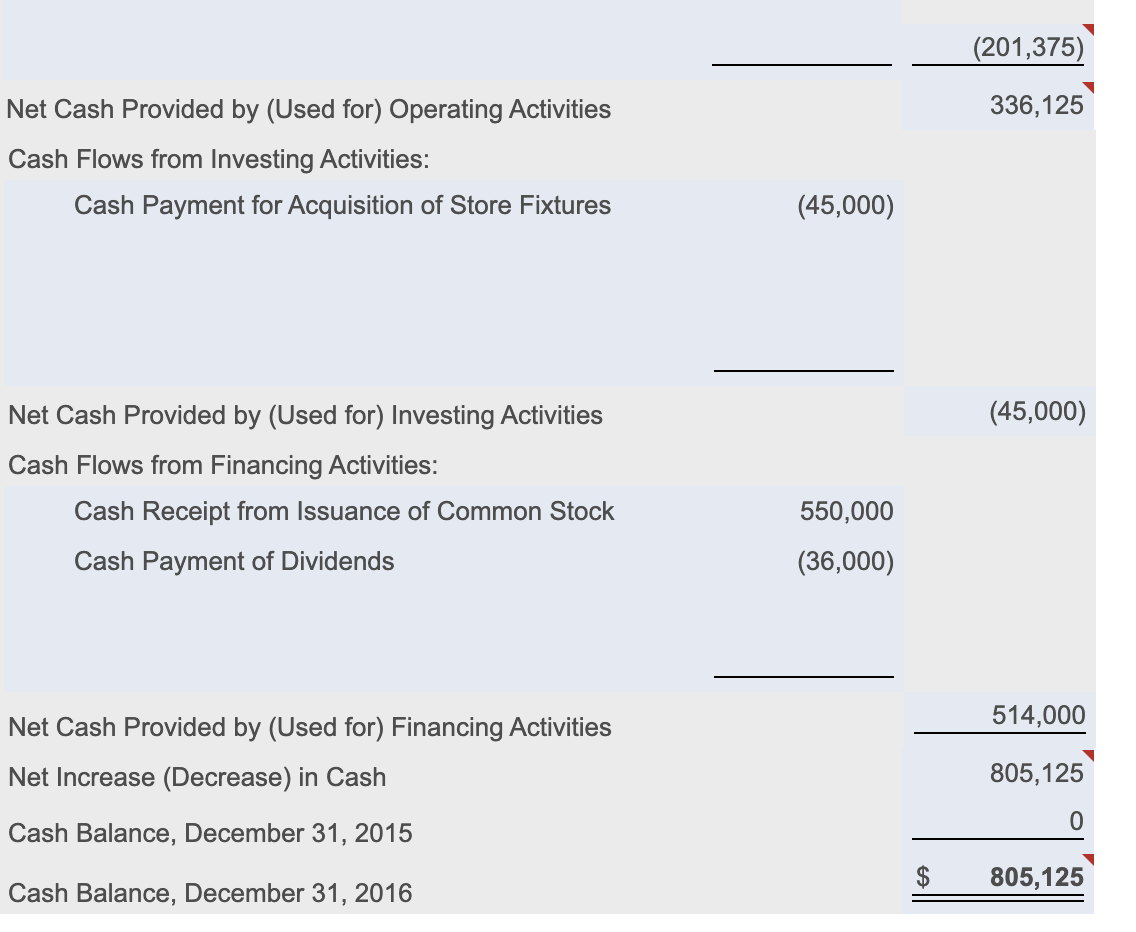

i - X More Info a. On January 1, 2016, CRRC issued no par common stock for $425,000. b. Early in January, CRRC made the following cash payments: 1. For store fixtures, $52,000 2. For merchandise inventory, $240,000 3. For rent expense on a store building, $15,000 c. Later in the year, CRRC purchased merchandise inventory on account for $243,000. Before year-end, CRRC paid $163,000 of this account payable. d. During 2016, CRRC sold 3,000 units of merchandise inventory for $200 each. Before year-end, the company collected 95% of this amount. Cost of goods sold for the year was $310,000, and ending merchandise inventory totaled $173,000. e. The store employs three people. The combined annual payroll is $82,000, of which CRRC still owes $7,000 at year-end. f. At the end of the year, CRRC paid income tax of $18,000. There are no income taxes payable. g. Late in 2016, CRRC paid cash dividends of $40,000. h. For store fixtures, CRRC uses the straight-line depreciation method, over five years, with zero residual value. Print Done Requirement 2. Prepare CRRC's balance sheet at December 31, 2016. Classic Reserve Rare Coins Balance Sheet December 31, 2016 Assets Liabilities Current Assets: Current Liabilities: Cash Accounts Payable Accounts Receivable Salaries Payable Merchandise Inventory Total Current Liabilities Total Current Assets Stockholders' Equity Common Stock, no par Plant Assets: Store Fixtures Retained Earnings Less: Accumulated Depreciation Total Stockholders' Equity TIT Total Assets Total Liabilities and Stockholders' Equity Requirement 4. Prepare CRRC's statement of cash flows using the indirect method for the year ended December 31, 2016. (Use parentheses or a minus sign for numbers to be subtracted. If a box is not used in the statement, leave the box empty; do not select a label or enter a zero. Enter "0" for a zero cash balance.) Complete the statement one section at a time, beginning with the cash flows from operating activities. Classic Reserve Rare Coins Statement of Cash Flows Year Ended December 31, 2016 Cash Flows from Operating Activities: Net Income 537,500 Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities: Depreciation Expense Increase in Accounts Receivable Increase in Merchandise Inventory Increase in Accounts Payable 9,000 (50,375) (243,000) 80,000 3,000 Increase in Salaries Payable (201,375) Net Cash Provided by (Used for) Operating Activities 336,125 (201,375) 1 336,125 Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Cash Payment for Acquisition of Store Fixtures (45,000) (45,000) Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Cash Receipt from Issuance of Common Stock 550,000 (36,000) Cash Payment of Dividends 514,000 Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash 805,125 0 Cash Balance, December 31, 2015 $ 805,125 Cash Balance, December 31, 2016