Question

i). You seek to immunize the liabilities using the 3 year zero coupon bond and the perpetuity. What would be the weighting given to your

i). You seek to immunize the liabilities using the 3 year zero coupon bond and the perpetuity. What would be the weighting given to your investment in the 3 year zero coupon bond? (1 mark)

j). You seek to immunize the liabilities using the 3 year zero coupon bond and the perpetuity. What would be the weighting given to your investment in the perpetuity? (1 mark)

k).Assuming you can purchase fractions of bonds, in order to immunize your portfolio, the number of 3 year zero coupon bonds you would buy will be ____________ and the number of perpetuities you would buy will be _____________. (2 marks)

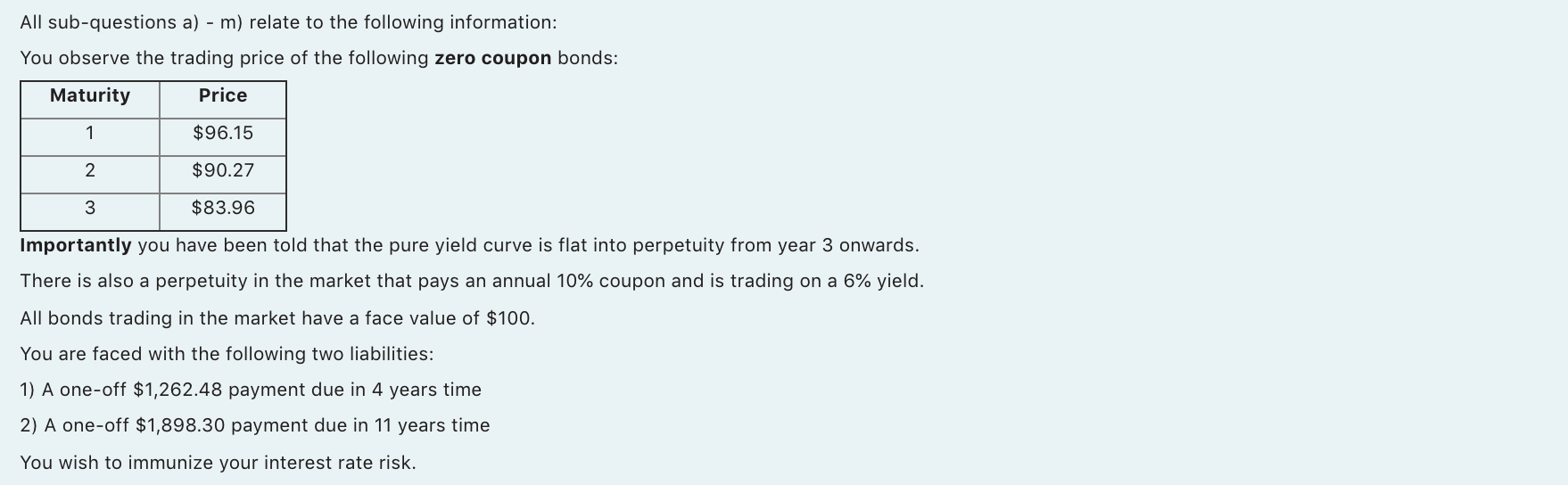

All sub-questions a) - m) relate to the following information: You observe the trading price of the following zero coupon bonds: Maturity Price 1 $96.15 2 $90.27 3 $83.96 Importantly you have been told that the pure yield curve is flat into perpetuity from year 3 onwards. There is also a perpetuity in the market that pays an annual 10% coupon and is trading on a 6% yield. All bonds trading in the market have a face value of $100. You are faced with the following two liabilities: 1) A one-off $1,262.48 payment due in 4 years time 2) A one-off $1,898.30 payment due in 11 years time You wish to immunize your interest rate riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started