Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ice Cream Dreams is a company that produces ice cream products for retail in its own chain of ice cream parlours. In the winter, income

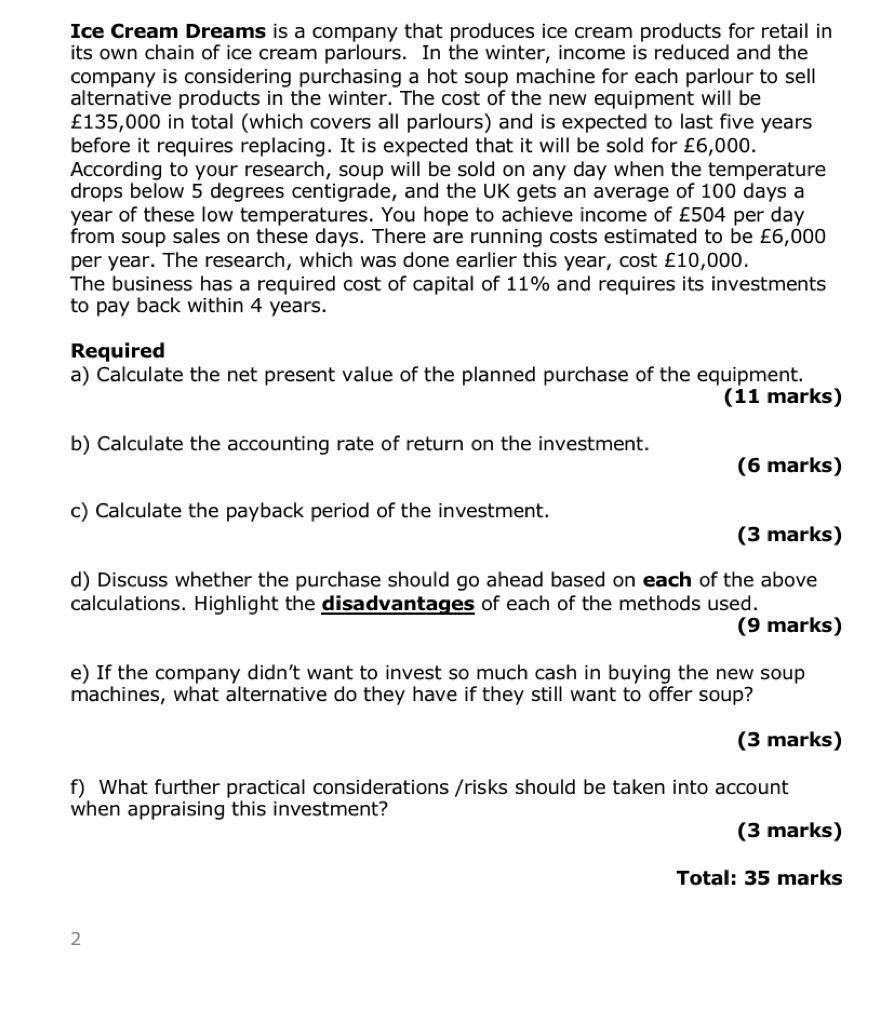

Ice Cream Dreams is a company that produces ice cream products for retail in its own chain of ice cream parlours. In the winter, income is reduced and the company is considering purchasing a hot soup machine for each parlour to sell alternative products in the winter. The cost of the new equipment will be 135,000 in total (which covers all parlours) and is expected to last five years before it requires replacing. It is expected that it will be sold for 6,000. According to your research, soup will be sold on any day when the temperature drops below 5 degrees centigrade, and the UK gets an average of 100 days a year of these low temperatures. You hope to achieve income of 504 per day from soup sales on these days. There are running costs estimated to be 6,000 per year. The research, which was done earlier this year, cost 10,000. The business has a required cost of capital of 11% and requires its investments to pay back within 4 years. Required a) Calculate the net present value of the planned purchase of the equipment. (11 marks) b) Calculate the accounting rate of return on the investment. (6 marks) c) Calculate the payback period of the investment. (3 marks) d) Discuss whether the purchase should go ahead based on each of the above calculations. Highlight the disadvantages of each of the methods used. (9 marks) e) If the company didn't want to invest so much cash in buying the new soup machines, what alternative do they have if they still want to offer soup? (3 marks) f) What further practical considerations /risks should be taken into account when appraising this investment? (3 marks) Total: 35 marks 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started