Answered step by step

Verified Expert Solution

Question

1 Approved Answer

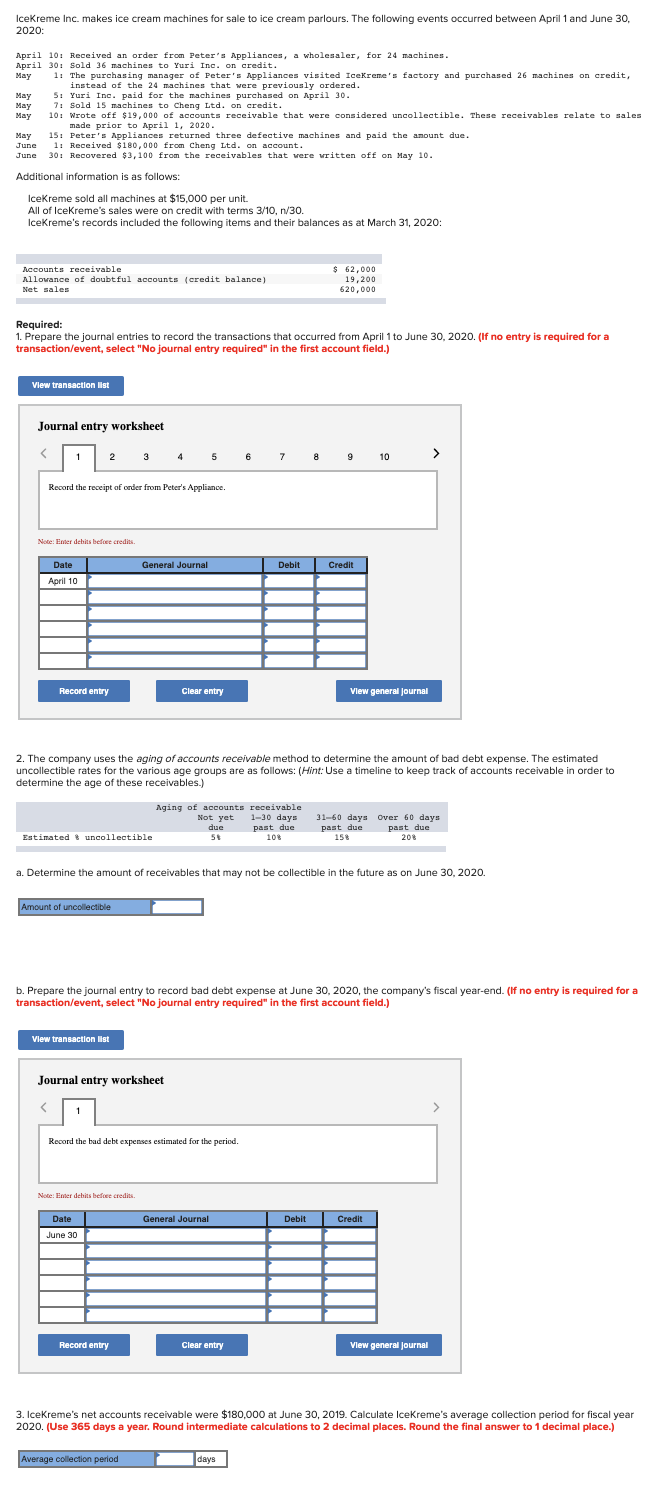

IceKreme Inc. makes ice cream machines for sale to ice cream parlours. The following events occurred between April 1 and June 30, 2020: April 10:

IceKreme Inc. makes ice cream machines for sale to ice cream parlours. The following events occurred between April 1 and June 30, 2020:

| April | 10: | Received an order from Peters Appliances, a wholesaler, for 24 machines. | ||

| April | 30: | Sold 36 machines to Yuri Inc. on credit. | ||

| May | 1: | The purchasing manager of Peters Appliances visited IceKremes factory and purchased 26 machines on credit, instead of the 24 machines that were previously ordered. | ||

| May | 5: | Yuri Inc. paid for the machines purchased on April 30. | ||

| May | 7: | Sold 15 machines to Cheng Ltd. on credit. | ||

| May | 10: | Wrote off $19,000 of accounts receivable that were considered uncollectible. These receivables relate to sales made prior to April 1, 2020. | ||

| May | 15: | Peters Appliances returned three defective machines and paid the amount due. | ||

| June | 1: | Received $180,000 from Cheng Ltd. on account. | ||

| June | 30: | Recovered $3,100 from the receivables that were written off on May 10. |

Additional information is as follows:

- IceKreme sold all machines at $15,000 per unit.

- All of IceKremes sales were on credit with terms 3/10, n/30.

- IceKremes records included the following items and their balances as at March 31, 2020:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started