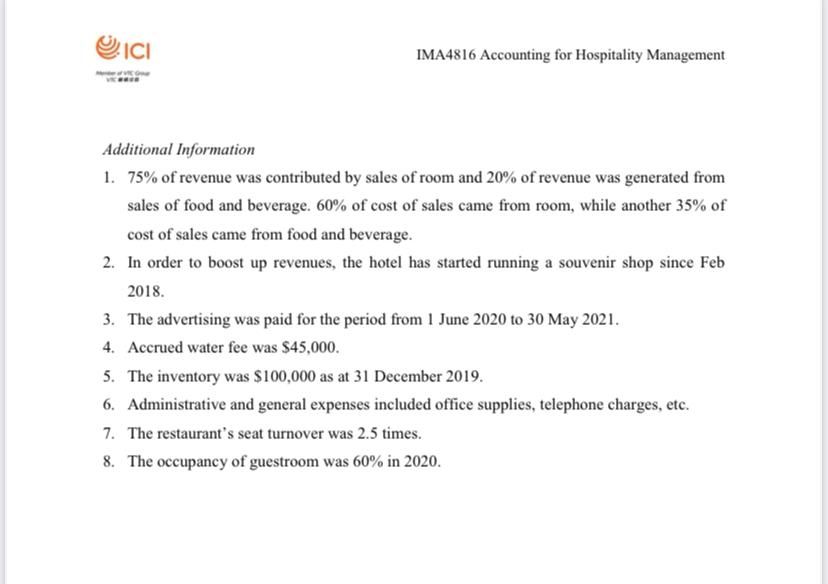

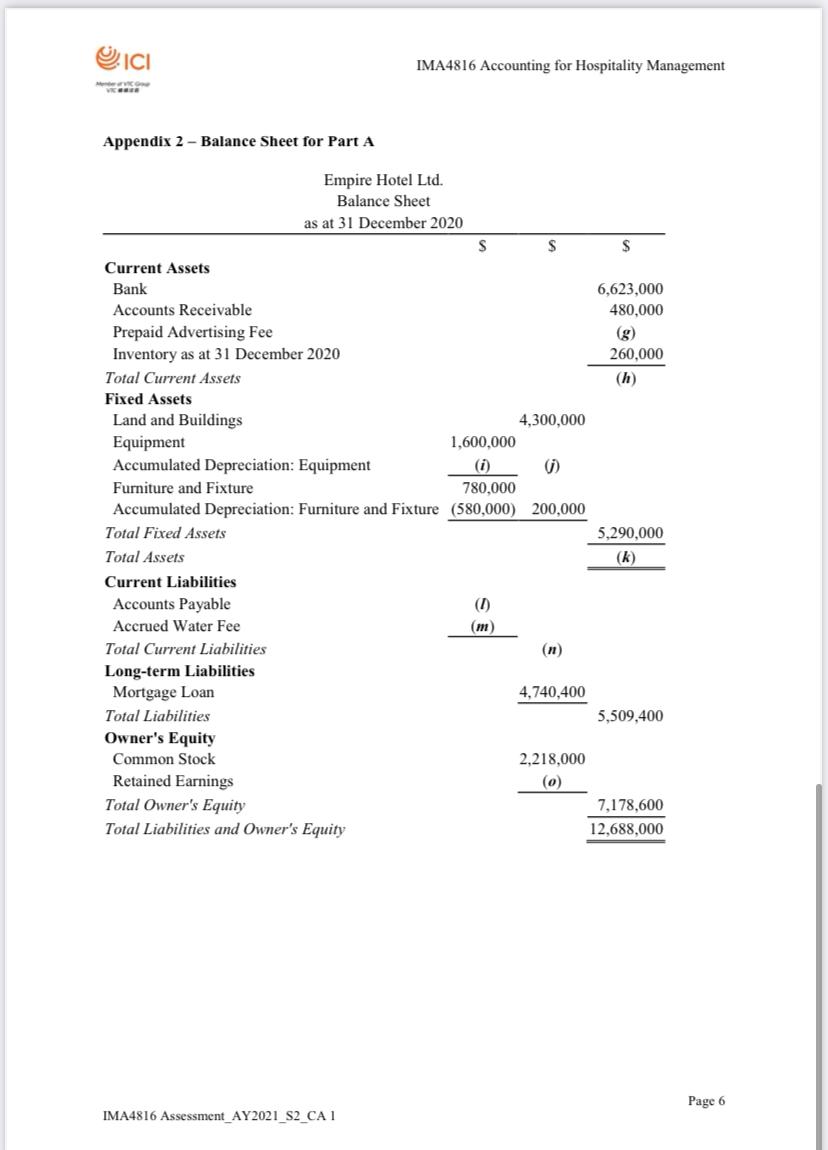

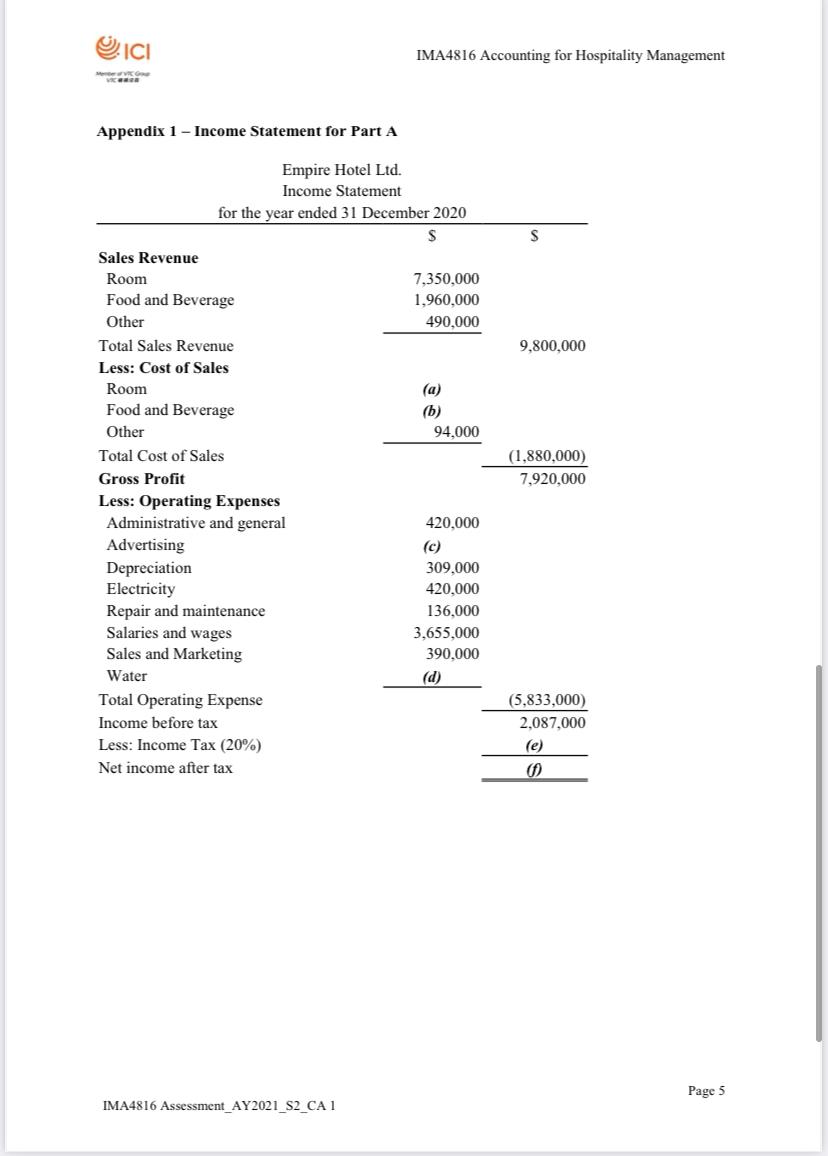

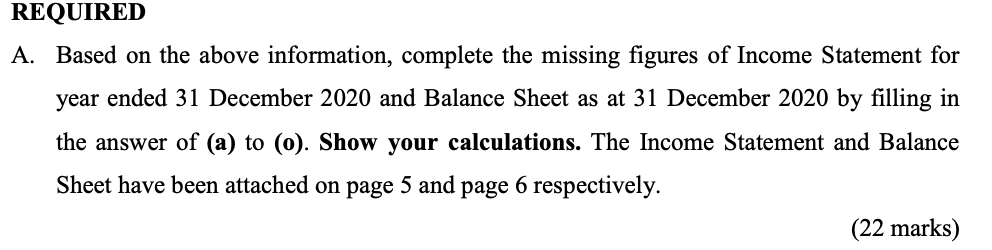

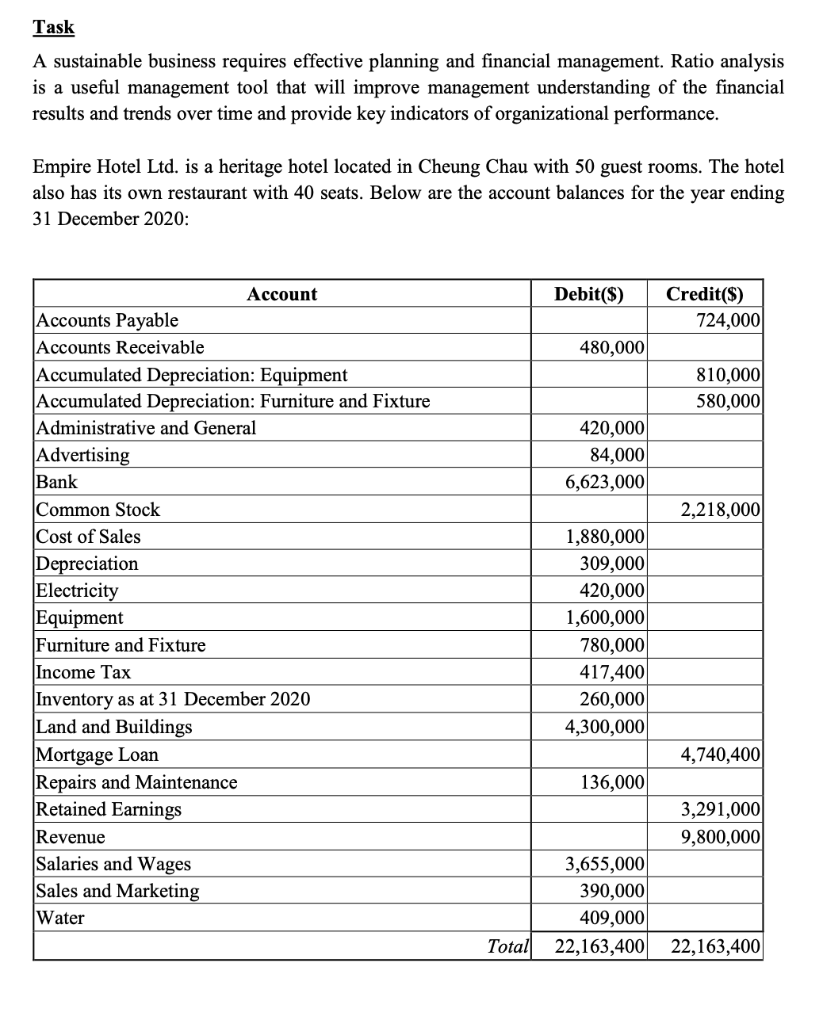

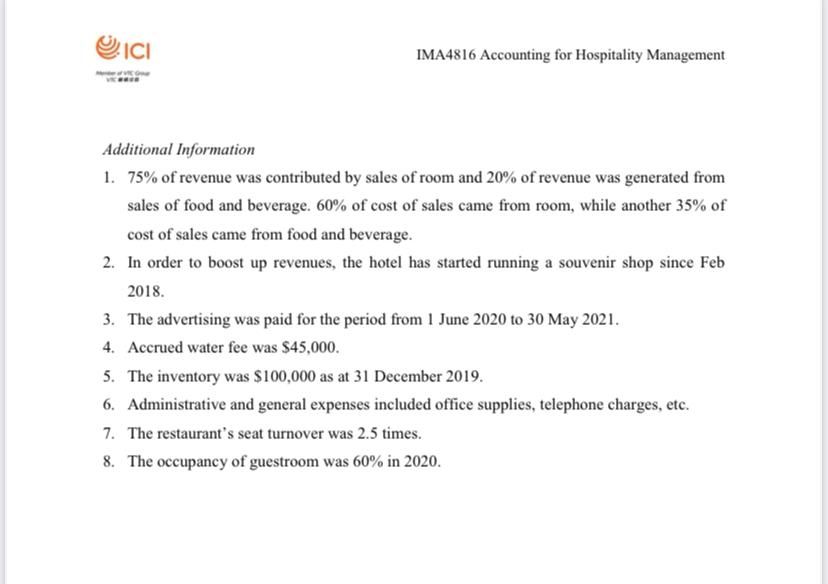

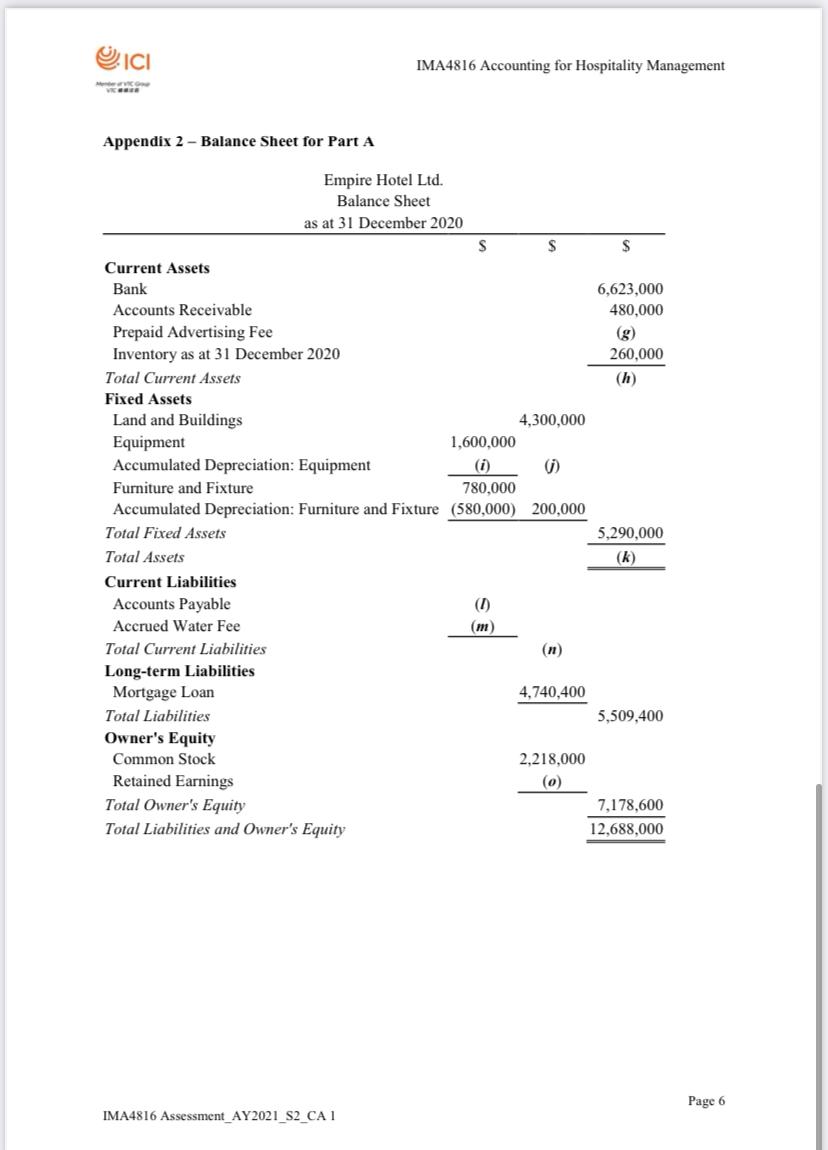

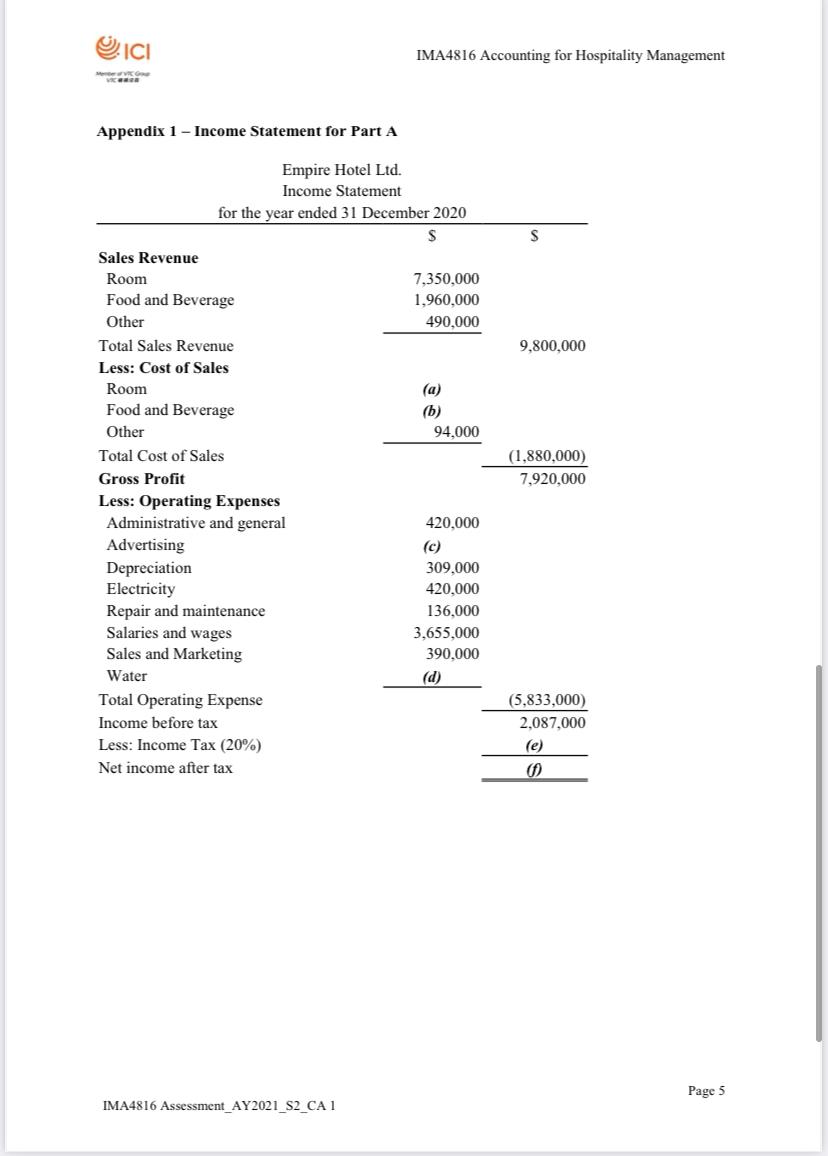

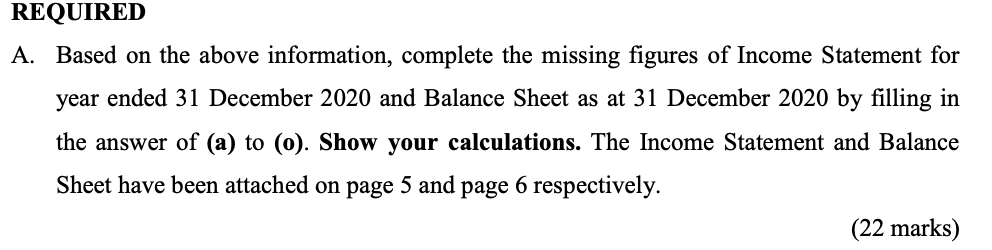

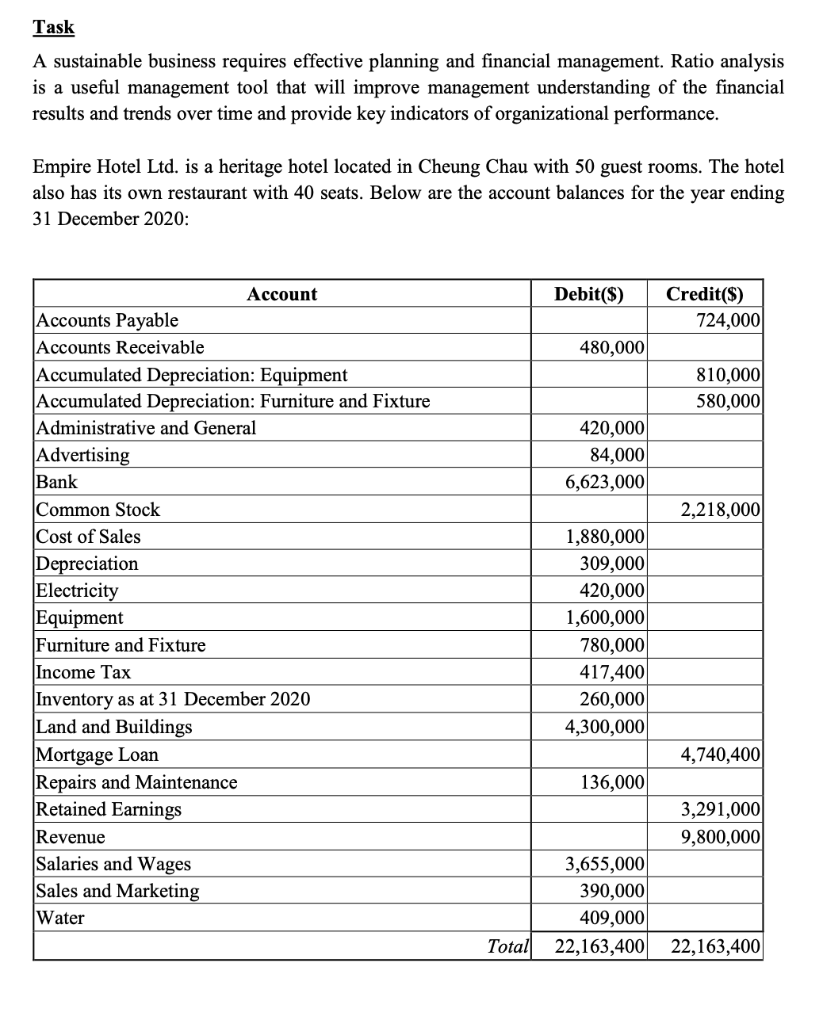

ICI IMA4816 Accounting for Hospitality Management Additional Information 1. 75% of revenue was contributed by sales of room and 20% of revenue was generated from sales of food and beverage. 60% of cost of sales came from room, while another 35% of cost of sales came from food and beverage. 2. In order to boost up revenues, the hotel has started running a souvenir shop since Feb 2018. 3. The advertising was paid for the period from 1 June 2020 to 30 May 2021. 4. Accrued water fee was $45,000. 5. The inventory was $100,000 as at 31 December 2019. 6. Administrative and general expenses included office supplies, telephone charges, etc. 7. The restaurant's seat turnover was 2.5 times. 8. The occupancy of guestroom was 60% in 2020. IMA4816 Accounting for Hospitality Management Appendix 2 - Balance Sheet for Part A Empire Hotel Ltd. Balance Sheet as at 31 December 2020 S S S Current Assets Bank 6,623,000 Accounts Receivable 480,000 Prepaid Advertising Fee (g) Inventory as at 31 December 2020 260,000 Total Current Assets (h) Fixed Assets Land and Buildings 4,300,000 Equipment 1,600,000 Accumulated Depreciation: Equipment (i) (1) Furniture and Fixture 780,000 Accumulated Depreciation: Furniture and Fixture (580,000) 200,000 Total Fixed Assets 5,290,000 Total Assets Current Liabilities Accounts Payable (1) Accrued Water Fee (m) Total Current Liabilities (n) Long-term Liabilities Mortgage Loan 4.740.400 Total Liabilities 5,509,400 Owner's Equity Common Stock 2.218.000 Retained Earnings (0) Total Owner's Equity 7,178,600 Total Liabilities and Owner's Equity 12,688,000 isanom Page 6 IMA4816 Assessment_AY 2021_S2_CA 1 ICI IMA4816 Accounting for Hospitality Management AMER Appendix 1 - Income Statement for Part A Empire Hotel Ltd. Income Statement for the year ended 31 December 2020 S 7,350,000 1,960,000 490,000 9,800,000 (a) (b) 94,000 (1,880,000) 7.920,000 Sales Revenue Room Food and Beverage Other Total Sales Revenue Less: Cost of Sales Room Food and Beverage Other Total Cost of Sales Gross Profit Less: Operating Expenses Administrative and general Advertising Depreciation Electricity Repair and maintenance Salaries and wages Sales and Marketing Water Total Operating Expense Income before tax Less: Income Tax (20%) Net income after tax 420,000 (c) 309,000 420,000 136,000 3,655,000 390,000 (5,833,000) 2,087,000 (e) Page 5 IMA4816 Assessment_AY2021_S2_CA 1 REQUIRED A. Based on the above information, complete the missing figures of Income Statement for year ended 31 December 2020 and Balance Sheet as at 31 December 2020 by filling in the answer of (a) to (o). Show your calculations. The Income Statement and Balance Sheet have been attached on page 5 and page 6 respectively. (22 marks) Task A sustainable business requires effective planning and financial management. Ratio analysis is a useful management tool that will improve management understanding of the financial results and trends over time and provide key indicators of organizational performance. Empire Hotel Ltd. is a heritage hotel located in Cheung Chau with 50 guest rooms. The hotel also has its own restaurant with 40 seats. Below are the account balances for the year ending 31 December 2020: Account Accounts Payable Accounts Receivable Accumulated Depreciation: Equipment Accumulated Depreciation: Furniture and Fixture Administrative and General Advertising Bank Common Stock Cost of Sales Depreciation Electricity Equipment Furniture and Fixture Income Tax Inventory as at 31 December 2020 Land and Buildings Mortgage Loan Repairs and Maintenance Retained Earnings Revenue Salaries and Wages Sales and Marketing Water Debit($) Credit($) 724,000 480,000 810,000 580,000 420,000 84,000 6,623,000 2,218,000 1,880,000 309,000 420,000 1,600,000 780,000 417,400 260,000 4,300,000 4,740,400 136,000 3,291,000 9,800,000 3,655,000 390,000 409,000 Total 22,163,400 22,163,400