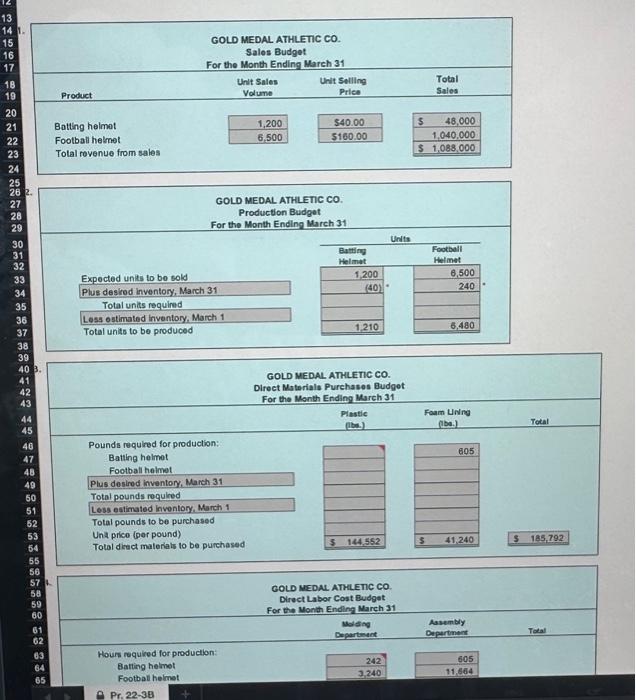

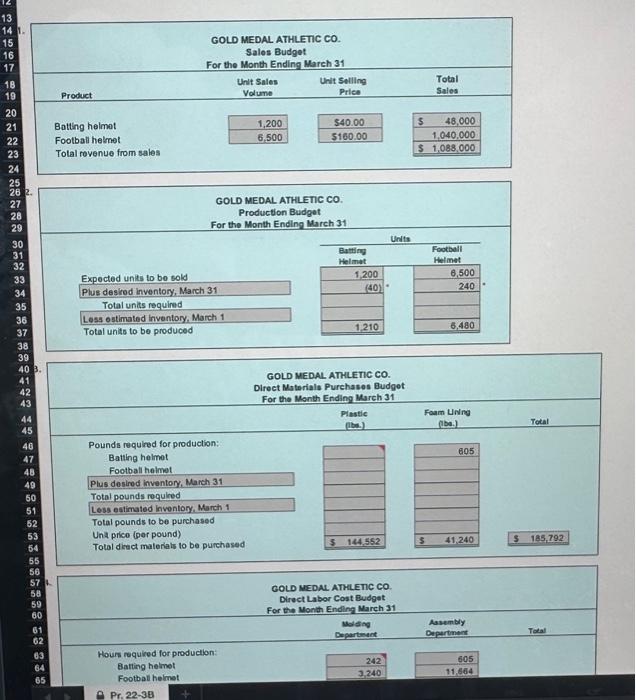

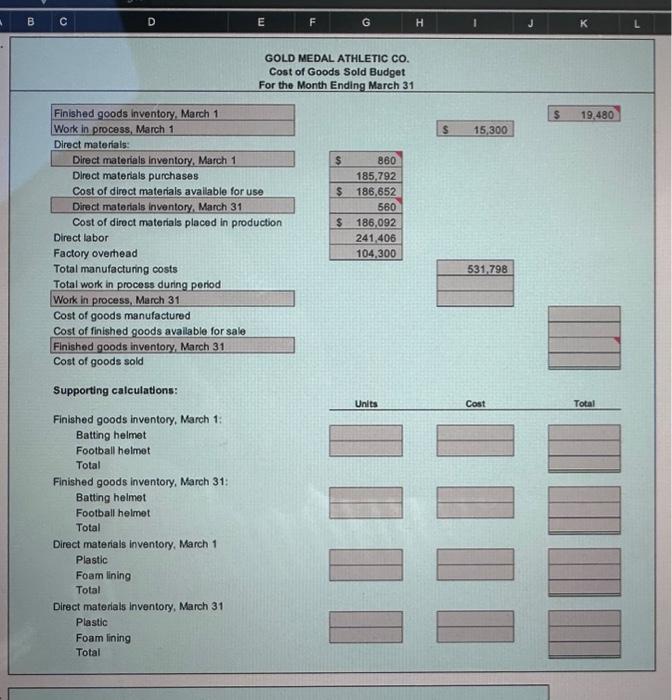

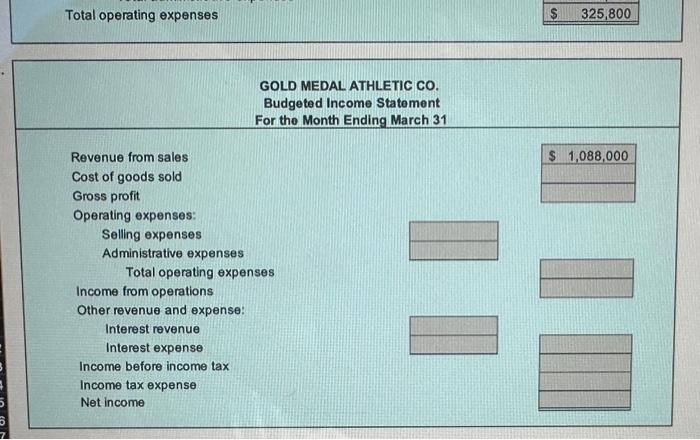

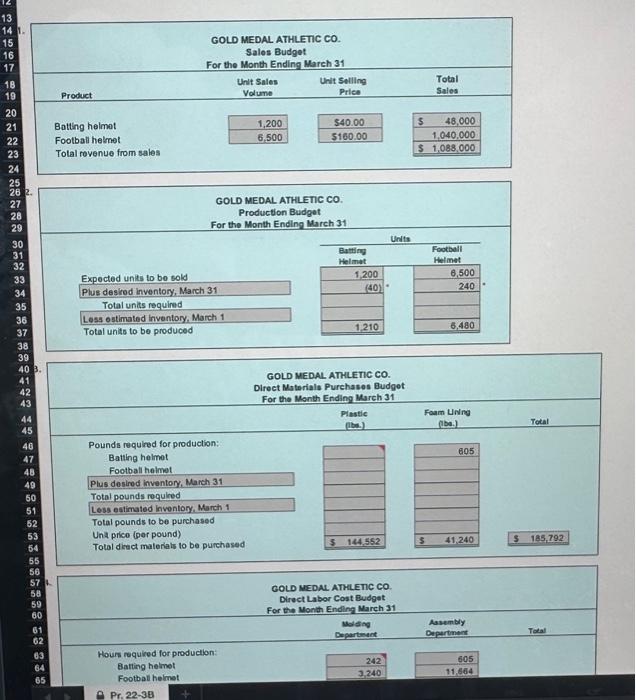

id like some help on the blank boxes, the boxes with red marks require formulas! This chapter is "Budgeting"

GOLD MEDAL ATHLETIC CO. Cost of Goods Sold Budget For the Month Ending March 31 Finished goods inventory, March 1 Work in process, March 1 Direct materials: Direct materials inventory, March 1 Direct materials purchases Cost of direct materials avaliable for use Direct materials inventory, March 31 Cost of diroct materials placed in production Direct labor Factory overhead Total manufacturing costs Total work in process during period Work in process, March 31 Cost of goods manufactured Cost of finished goods avallable for sale Finishod goods inventory, March 31 Cost of goods sold Supporting calculations: Finished goods inventory, March 1: Batting helmet Football heimet Total Finished goods inventory, March 31: Batting helmet Football helmet Total Direct materials inventory, March 1 Plastic Foam lining Total Direct materials inventory, March 31 Plastic Foam lining Total S 19,480 S 15,300 \begin{tabular}{|lr|} \hline$ & 860 \\ \hline & 185,792 \\ \hline$ & 186,652 \\ \hline & 560 \\ \hline$ & 186,092 \\ \hline & 241,406 \\ \hline & 104,300 \\ \hline \end{tabular} Units Cost Total \begin{tabular}{|} \hline \\ \hline \end{tabular} \begin{tabular}{|} \hline \\ \\ \hline \end{tabular} \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \end{tabular} \begin{tabular}{|r|} \hline 531,798 \\ \hline \\ \hline \end{tabular} \begin{tabular}{lll} Units & Cost & Total \\ \hline & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} GOLD MEDAL ATHLETIC CO. Salos Budget For the Month Ending March 31 \begin{tabular}{|c|c|c|c|} \hline \begin{tabular}{l} Unit Sales \\ Volume \end{tabular} & \begin{tabular}{c} Unit Selling \\ Priee \end{tabular} & & Total \\ \hline 1,200 & $40.00 & 5 & 48,000 \\ \hline 6.500 & $160.00 & & 040,000 \\ \hline & & & 088.000 \\ \hline \end{tabular} Batting helmat Football helnet Tolal revenue from sales GOLD MEDAL ATHLETIC CO. Production Budget For the Month Ending March 31 Product 2. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{\begin{tabular}{l} GOLD MEDAL ATHLETic CO. \\ Production Budget \\ For the Month Ending March 31 \end{tabular}} \\ \hline & \multicolumn{2}{|c|}{ Unils } \\ \hline & \begin{tabular}{l} Batting \\ Helmat \end{tabular} & \begin{tabular}{l} Football \\ Helmet \end{tabular} \\ \hline Expected units to be sold & 1,200 & 6,500 \\ \hline \multicolumn{3}{|l|}{ Plus desired inventory, March 31} \\ \hline \multicolumn{3}{|l|}{ Total units requined } \\ \hline \multicolumn{3}{|l|}{\begin{tabular}{l} Total units requined \\ Less estimated inventory, March 1 \end{tabular}} \\ \hline Total units to be produced & 1.210 & 6,480 \\ \hline \end{tabular} 3. 1. Total operating expenses \begin{tabular}{|l|l|} \hline$ & 325,800 \\ \hline \end{tabular} GOLD MEDAL ATHLETIC CO. Budgeted Income Statement For the Month Ending March 31 Revenue from sales Cost of goods sold Gross profit Operating expenses: Selling expenses Administrative expenses Total operating expenses Income from operations Other revenue and expense: Interest revenue Interest expense Income before income tax Income tax expense Net income \begin{tabular}{|l|} \hline$1,088,000 \\ \hline \\ \hline \end{tabular} \begin{tabular}{|} \hline \\ \hline \\ \hline \\ \hline \end{tabular} GOLD MEDAL ATHLETIC CO. Cost of Goods Sold Budget For the Month Ending March 31 Finished goods inventory, March 1 Work in process, March 1 Direct materials: Direct materials inventory, March 1 Direct materials purchases Cost of direct materials avaliable for use Direct materials inventory, March 31 Cost of diroct materials placed in production Direct labor Factory overhead Total manufacturing costs Total work in process during period Work in process, March 31 Cost of goods manufactured Cost of finished goods avallable for sale Finishod goods inventory, March 31 Cost of goods sold Supporting calculations: Finished goods inventory, March 1: Batting helmet Football heimet Total Finished goods inventory, March 31: Batting helmet Football helmet Total Direct materials inventory, March 1 Plastic Foam lining Total Direct materials inventory, March 31 Plastic Foam lining Total S 19,480 S 15,300 \begin{tabular}{|lr|} \hline$ & 860 \\ \hline & 185,792 \\ \hline$ & 186,652 \\ \hline & 560 \\ \hline$ & 186,092 \\ \hline & 241,406 \\ \hline & 104,300 \\ \hline \end{tabular} Units Cost Total \begin{tabular}{|} \hline \\ \hline \end{tabular} \begin{tabular}{|} \hline \\ \\ \hline \end{tabular} \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \end{tabular} \begin{tabular}{|r|} \hline 531,798 \\ \hline \\ \hline \end{tabular} \begin{tabular}{lll} Units & Cost & Total \\ \hline & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} GOLD MEDAL ATHLETIC CO. Salos Budget For the Month Ending March 31 \begin{tabular}{|c|c|c|c|} \hline \begin{tabular}{l} Unit Sales \\ Volume \end{tabular} & \begin{tabular}{c} Unit Selling \\ Priee \end{tabular} & & Total \\ \hline 1,200 & $40.00 & 5 & 48,000 \\ \hline 6.500 & $160.00 & & 040,000 \\ \hline & & & 088.000 \\ \hline \end{tabular} Batting helmat Football helnet Tolal revenue from sales GOLD MEDAL ATHLETIC CO. Production Budget For the Month Ending March 31 Product 2. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{\begin{tabular}{l} GOLD MEDAL ATHLETic CO. \\ Production Budget \\ For the Month Ending March 31 \end{tabular}} \\ \hline & \multicolumn{2}{|c|}{ Unils } \\ \hline & \begin{tabular}{l} Batting \\ Helmat \end{tabular} & \begin{tabular}{l} Football \\ Helmet \end{tabular} \\ \hline Expected units to be sold & 1,200 & 6,500 \\ \hline \multicolumn{3}{|l|}{ Plus desired inventory, March 31} \\ \hline \multicolumn{3}{|l|}{ Total units requined } \\ \hline \multicolumn{3}{|l|}{\begin{tabular}{l} Total units requined \\ Less estimated inventory, March 1 \end{tabular}} \\ \hline Total units to be produced & 1.210 & 6,480 \\ \hline \end{tabular} 3. 1. Total operating expenses \begin{tabular}{|l|l|} \hline$ & 325,800 \\ \hline \end{tabular} GOLD MEDAL ATHLETIC CO. Budgeted Income Statement For the Month Ending March 31 Revenue from sales Cost of goods sold Gross profit Operating expenses: Selling expenses Administrative expenses Total operating expenses Income from operations Other revenue and expense: Interest revenue Interest expense Income before income tax Income tax expense Net income \begin{tabular}{|l|} \hline$1,088,000 \\ \hline \\ \hline \end{tabular} \begin{tabular}{|} \hline \\ \hline \\ \hline \\ \hline \end{tabular}