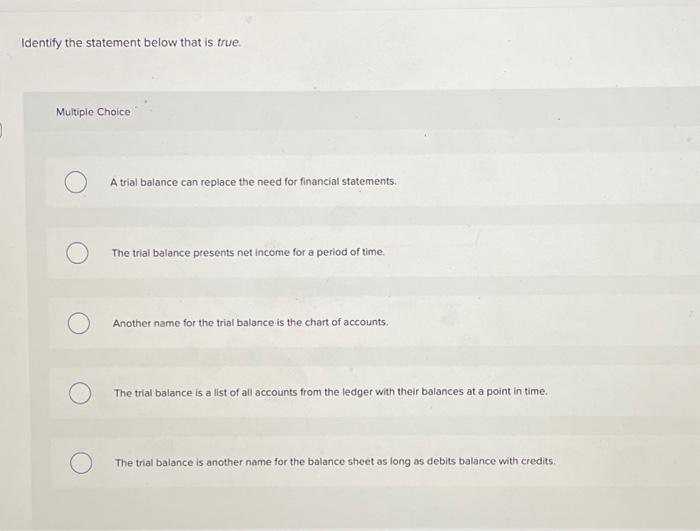

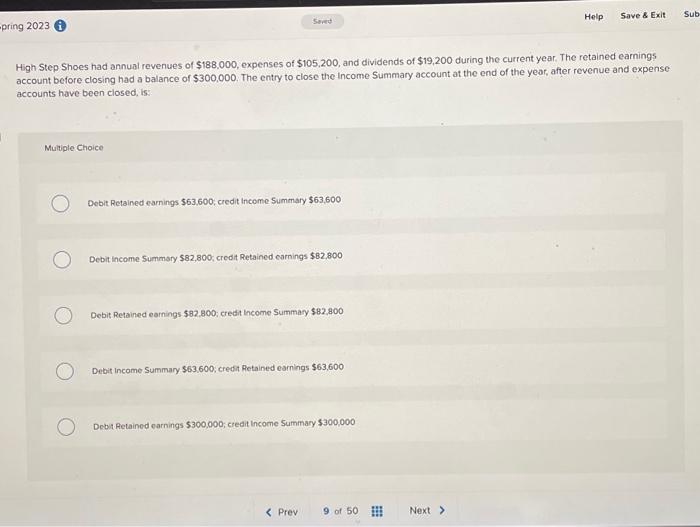

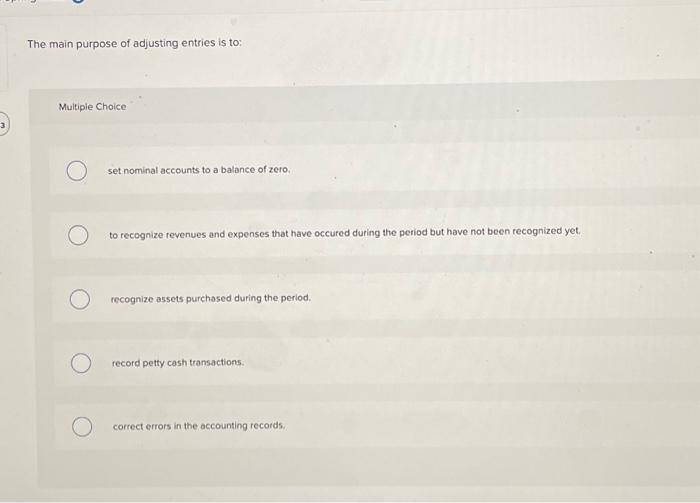

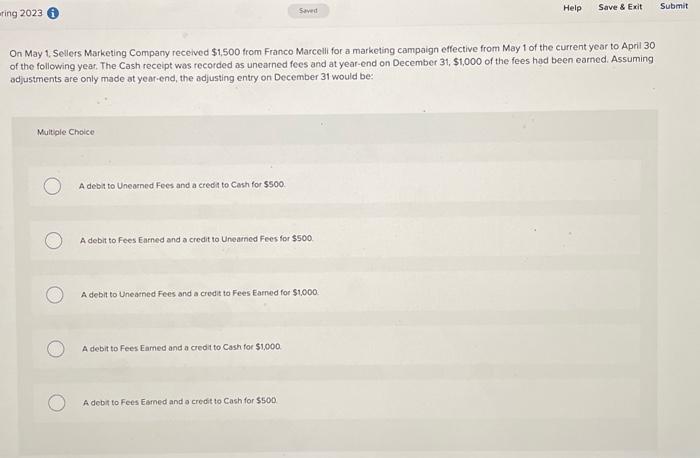

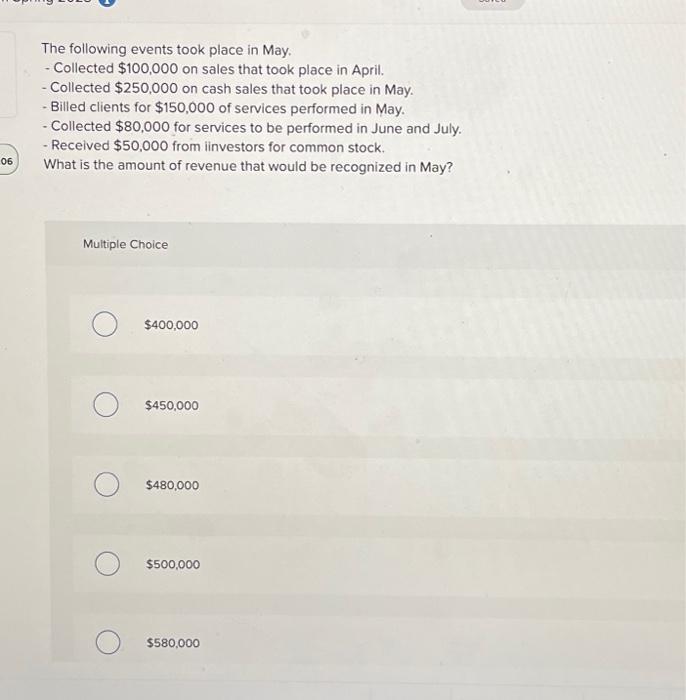

Identify the statement below that is true. Multiple Choice A trial balance can replace the need for financial statements. The trial balance presents net income for a period of time. Another name for the trial balance is the chart of accounts. The trial balance is a list of all accounts from the ledger with their balances at a point in time. The trial balance is another name for the balance sheet as long as debits balance with credits. High Step Shoes had annual revenues of $188,000, expenses of $105,200, and dividends of $19,200 during the current year. The retained earnings account betore closing had a balance of $300,000. The entry to close the income Summary account at the end of the year, after revenue and expense accounts have been closed, is: Multiple Choice Debit Retained earnings $63,600; credit income summary $63,600 Debit income Summory $82,800, credit Retained carnings $82,800 Debit Retained earnings $82.800; credit lncome Summayy $82.800 Debit income Summary $63,600, credi Aetained earnings $63,600 Debit Retained earnings $300,000; credit income Summary $300,000 The main purpose of adjusting entries is to: Multiple Choice set nominal accounts to a balance of zero. to recognize revenues and expenses that have occured during the period but have not been recognized yet. recognize assets purchased during the period. record petty cash transactions. correct errors in the accounting records On May 1. Sellers Marketing Company recelved $1,500 from Franco Marcelli for a marketing campaign effective from May 1 of the current year to April 30 of the following year. The Cash receipt wos recorded as unearned fees and at year-end on December 31, $1,000 of the fees had been eamed. Assuming adjustments are only made at year-end, the adjusting entry on December 31 would be: Multiple Choice A debit to Unearned Fees and a credt to Cesh for $500 A debit to Fees Earned and a credit to Unearned Fees for $500. A debit to Unearned Fees and a credit to Fees Earned for $1,000 A debit to Fees Eamed and a credit to Cash for $1,000 A debit to Fees Earned and a credit to Cash for $500. The following events took place in May. - Collected $100,000 on sales that took place in April. - Collected $250,000 on cash sales that took place in May. - Billed clients for $150,000 of services performed in May. - Collected $80,000 for services to be performed in June and July. - Received $50,000 from linvestors for common stock. What is the amount of revenue that would be recognized in May? Muitiple Choice $400,000 $450,000 $480,000 $500,000 $580,000