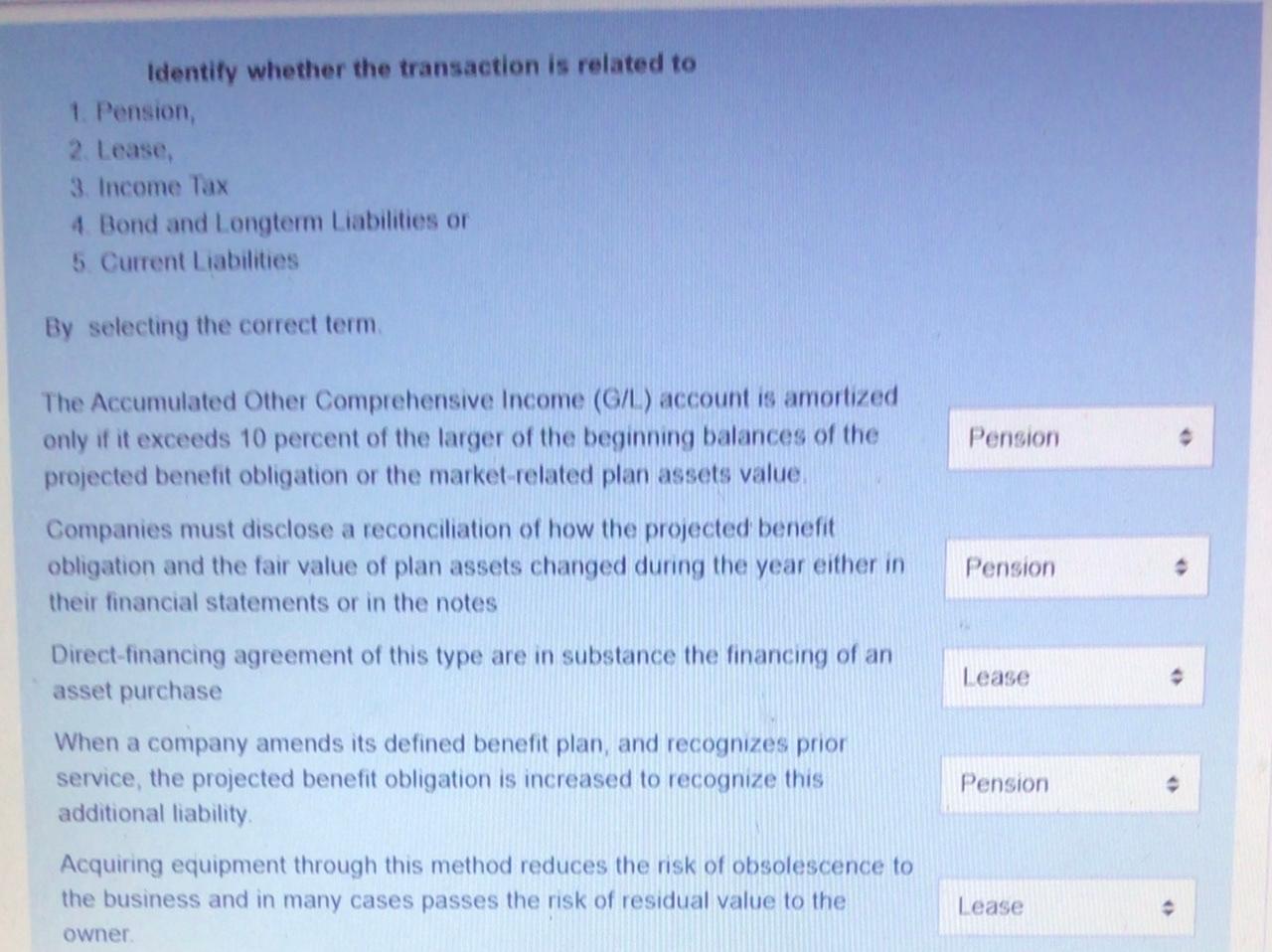

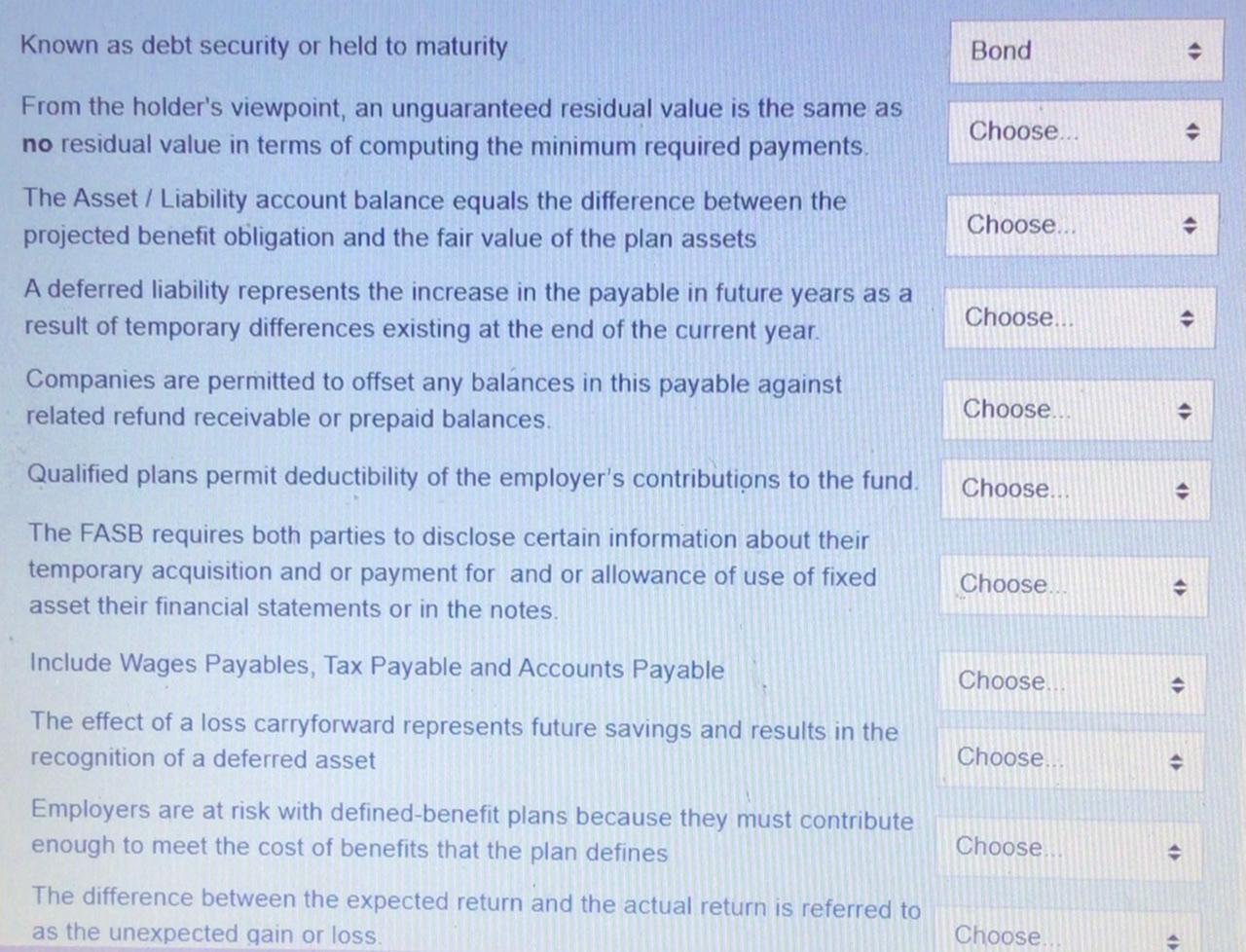

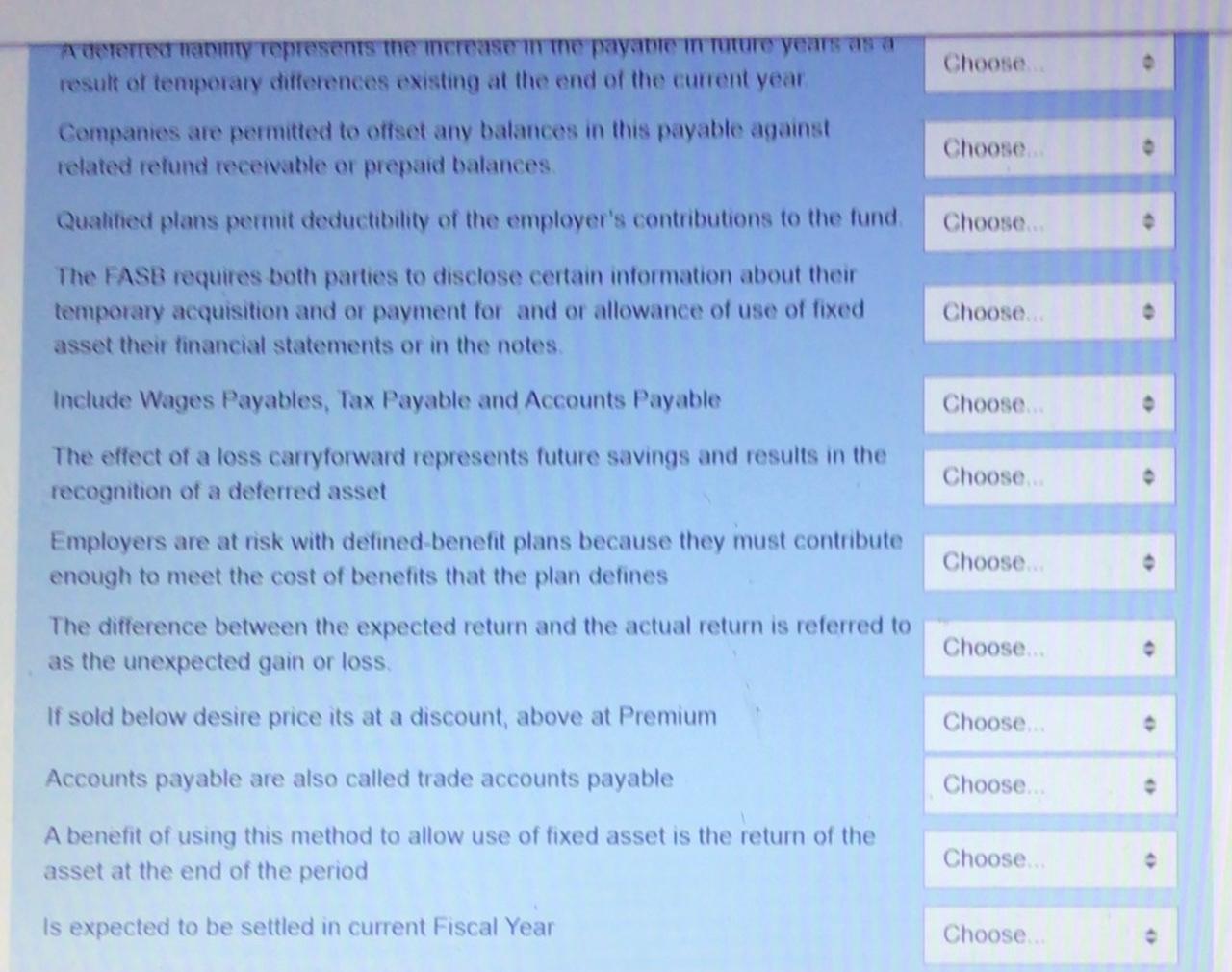

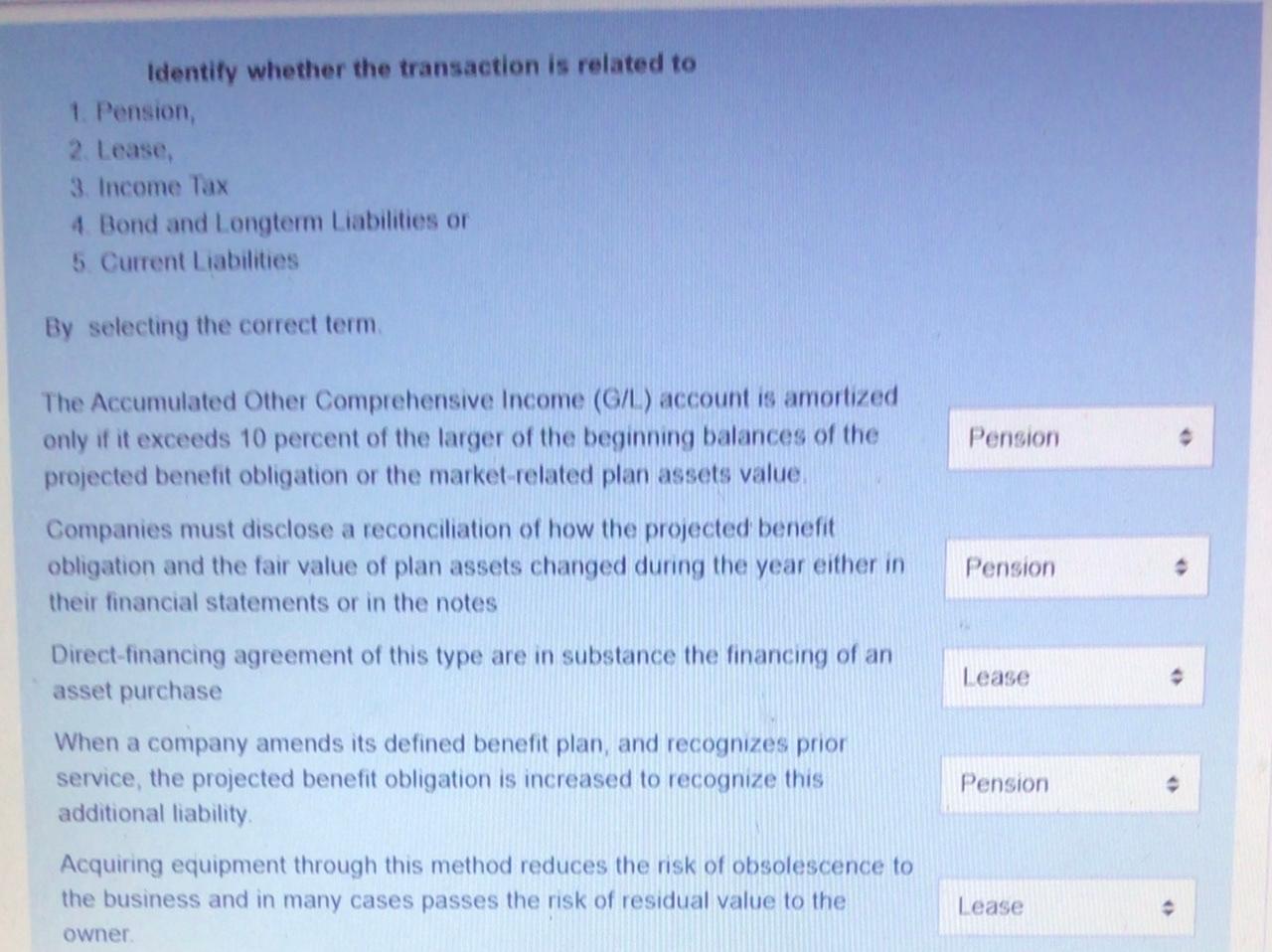

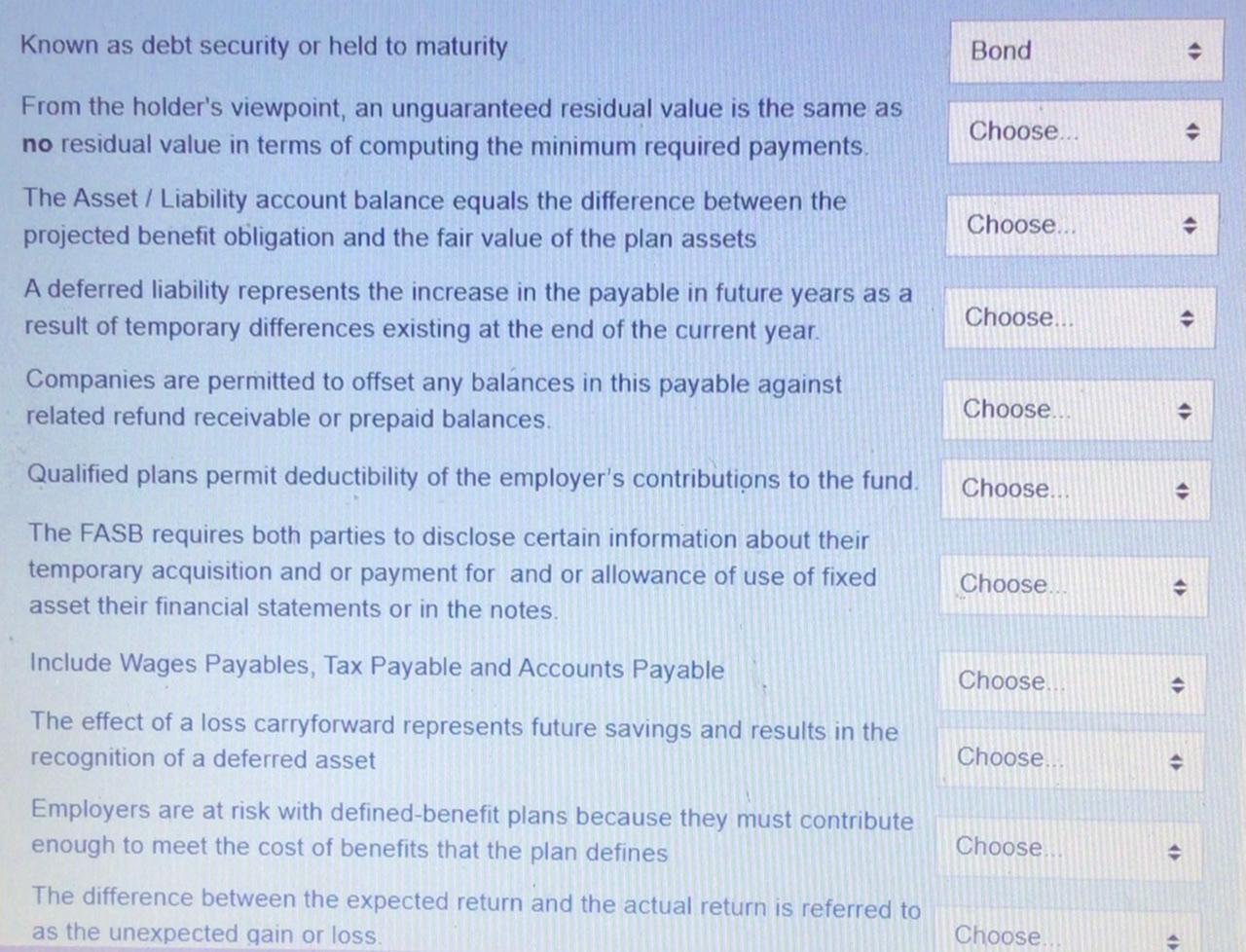

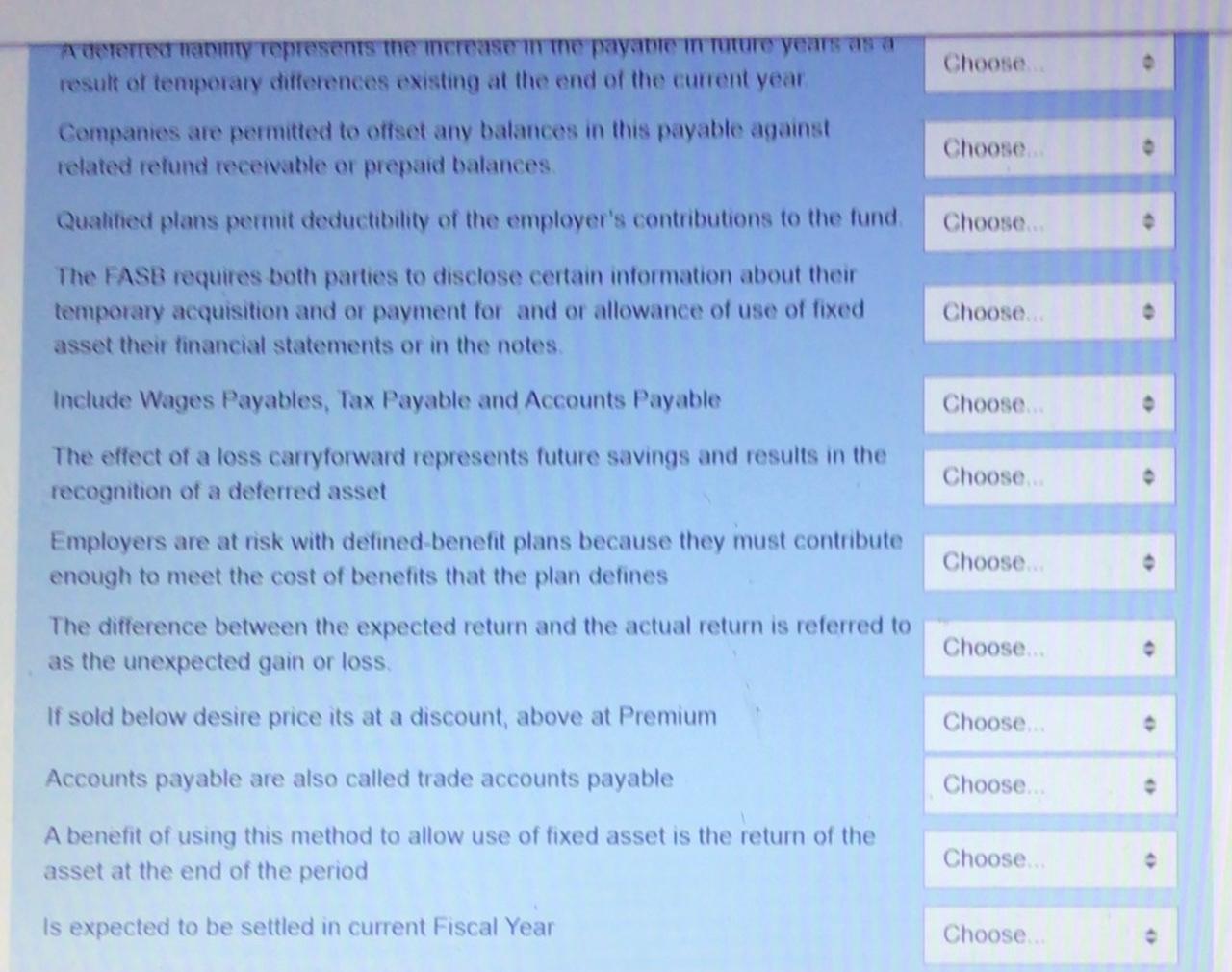

Identify whether the transaction is related to 1. Pension, 2. Lease 3. Income Tax 4 Bond and Longterm Liabilities or 5. Current Liabilities By selecting the correct term The Accumulated Other Comprehensive Income (G/L) account is amortized only if it exceeds 10 percent of the larger of the beginning balances of the projected benefit obligation or the market-related plan assets value Pension Pension Companies must disclose a reconciliation of how the projected benefit obligation and the fair value of plan assets changed during the year either in their financial statements or in the notes Direct-financing agreement of this type are in substance the financing of an asset purchase Lease Pension When a company amends its defined benefit plan, and recognizes prior service, the projected benefit obligation is increased to recognize this additional liability Acquiring equipment through this method reduces the risk of obsolescence to the business and in many cases passes the risk of residual value to the owner Lease Known as debt security or held to maturity Bond > Choose... From the holder's viewpoint, an unguaranteed residual value is the same as no residual value in terms of computing the minimum required payments. The Asset / Liability account balance equals the difference between the projected benefit obligation and the fair value of the plan assets Choose... Choose... A deferred liability represents the increase in the payable in future years as a result of temporary differences existing at the end of the current year. Companies are permitted to offset any balances in this payable against related refund receivable or prepaid balances. Choose Qualified plans permit deductibility of the employer's contributions to the fund. Choose The FASB requires both parties to disclose certain information about their temporary acquisition and or payment for and or allowance of use of fixed asset their financial statements or in the notes. Choose Include Wages Payables, Tax Payable and Accounts Payable Choose The effect of a loss carryforward represents future savings and results in the recognition of a deferred asset Choose Employers are at risk with defined-benefit plans because they must contribute enough to meet the cost of benefits that the plan defines Choose 20 The difference between the expected return and the actual return is referred to as the unexpected gain or loss. Choose A Terre any represents the crease ime payante IT TUTUre years as a result of temporary ditferences existing at the end of the current year Choose Companies are permitted to offset any balances in this payable against related refund receivable or prepaid balances Choose Qualified plans permit deductibility of the employer's contributions to the fund Choose. The FASB requires both parties to disclose certain information about their temporary acquisition and or payment for and or allowance of use of fixed asset their financial statements or in the notes Choose Include Wages Payables, Tax Payable and Accounts Payable Choose The effect of a loss carryforward represents future savings and results in the recognition of a deferred asset Choose Choose Employers are at risk with defined benefit plans because they must contribute enough to meet the cost of benefits that the plan defines The difference between the expected return and the actual return is referred to as the unexpected gain or loss. Choose If sold below desire price its at a discount, above at Premium Choose Accounts payable are also called trade accounts payable Choose A benefit of using this method to allow use of fixed asset is the return of the asset at the end of the period Choose Is expected to be settled in current Fiscal Year Choose