Question

IE8-1 Computing the Acquisition Cost, Identifying Capital Expenditures, and Recording Depreciation with a Partial Year under Three Alternative Methods Romero & Kiplinger recently purchased some

IE8-1 Computing the Acquisition Cost, Identifying Capital Expenditures, and Recording Depreciation with a Partial Year under Three Alternative Methods

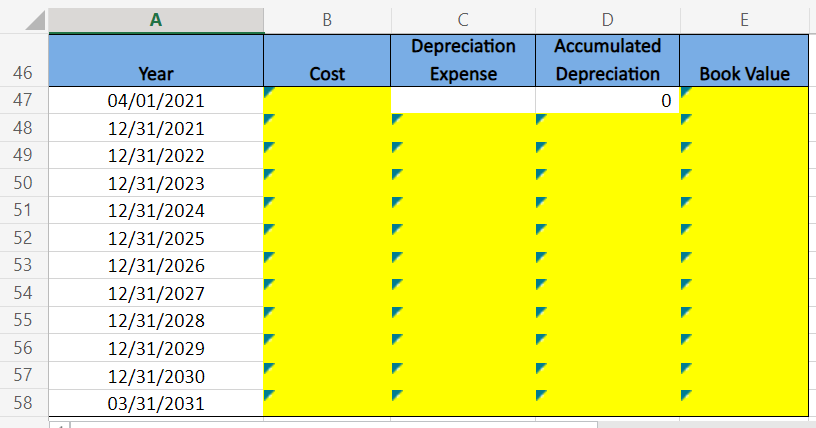

Romero & Kiplinger recently purchased some capital assets and would like to project depreciation amounts. Information about the assets are below:

| Milling Machine | ||

| Date Purchased | 01-Apr | |

|---|---|---|

| Cost | $ 78,523 | |

| Repairs before first use | $ 3,956 | |

| Useful Life | 10 | years |

| Salavage Value | $ 6,859 | |

| Depreciation Method | Straight Line | |

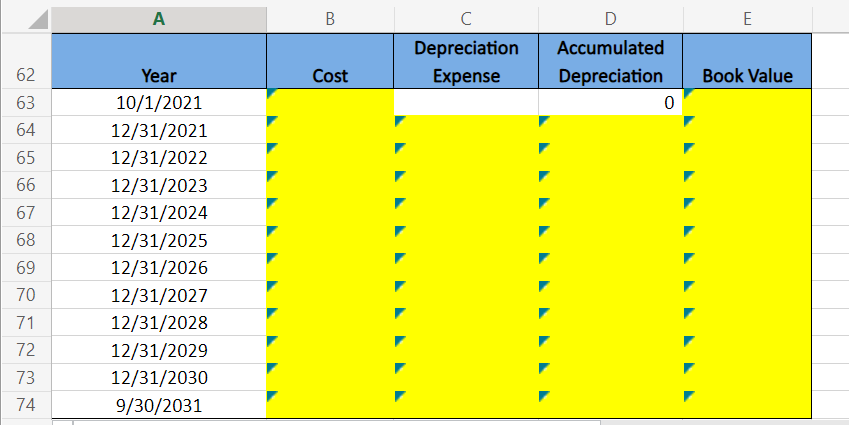

| Forklift | ||

| Date purchased | 01-Oct | |

|---|---|---|

| Cost | $ 34,587 | |

| Protection Plan | $ 3,250 | |

| Gasoline | $ 280 | |

| Useful Life | 15 | years |

| Salvage Value | $ 6,500 | |

| Depreciation Method | Units of Production (hours) | |

| Estimated Total Hours | 28,000 | |

| Year 1 Hours | 1,610 | |

| Year 2 Hours | 3,150 | |

| Year 3 Hours | 2,471 | |

| Year 4 Hours | 2,985 | |

| Year 5 Hours | 3,100 | |

| Year 6 Hours | 2,582 | |

| Year 7 Hours | 2,584 | |

| Year 8 Hours | 3,621 | |

| Year 9 Hours | 2,574 | |

| Year 10 Hours | 2,353 | |

| Year 11 Hours | 970 | |

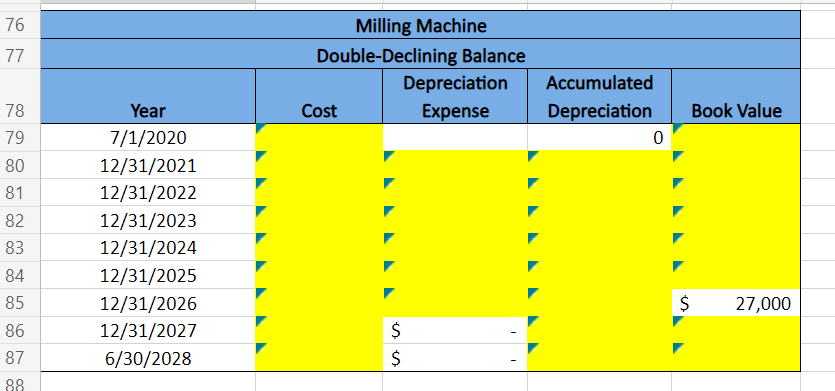

| Supercomputer | ||

| Date Purchased | 01-Jul | |

|---|---|---|

| Cost | $ 126,874 | |

| Annual Maintenance fee | $ 450 | |

| Useful Life | 8 | years |

| Salvage Value | $ 27,000 | |

| Depreciation Method | Double-Declining Balance | |

Required:

Complete the depreciation schedules in the spreadsheet for each of these assets.

Use the Open Excel in New Tab button to launch this question.

When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started