Question

FRS, an investment advisory firm, relies on mean-variance analysis to advise its clients. One of FRS's clients requests an analysis of two risky mutual

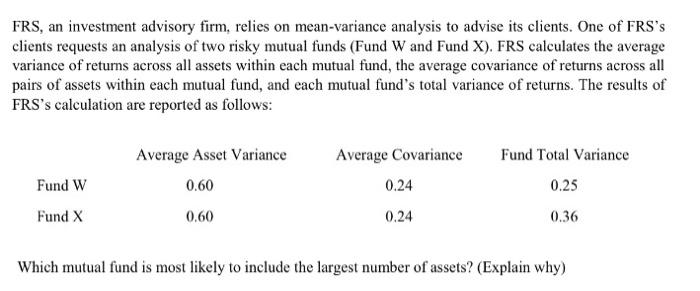

FRS, an investment advisory firm, relies on mean-variance analysis to advise its clients. One of FRS's clients requests an analysis of two risky mutual funds (Fund W and Fund X). FRS calculates the average variance of returns across all assets within each mutual fund, the average covariance of returns across all pairs of assets within each mutual fund, and each mutual fund's total variance of returns. The results of FRS's calculation are reported as follows: Average Asset Variance Average Covariance Fund Total Variance Fund W 0.60 0.24 0.25 Fund X 0.60 0.24 0.36 Which mutual fund is most likely to include the largest number of assets? (Explain why)

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Fund W is likely to have larger number of assets because although both the funds ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial ACCT2

Authors: Norman H. Godwin, C. Wayne Alderman

2nd edition

9781285632544, 1111530769, 1285632540, 978-1111530761

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App