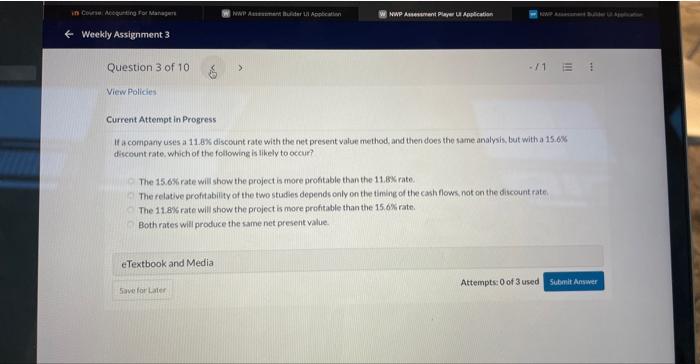

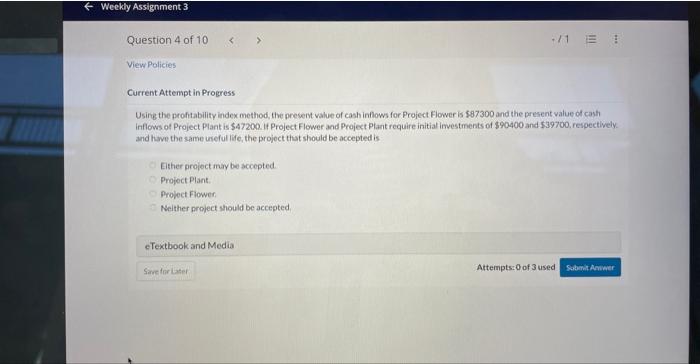

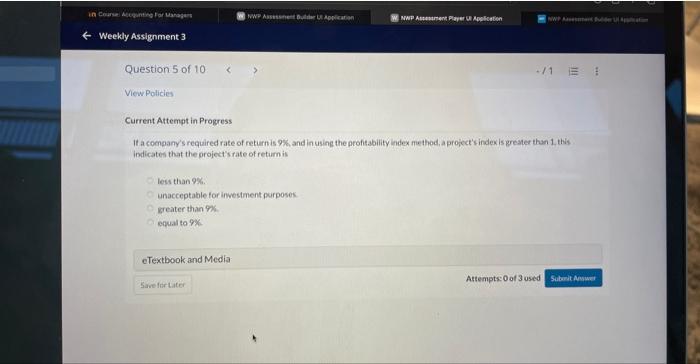

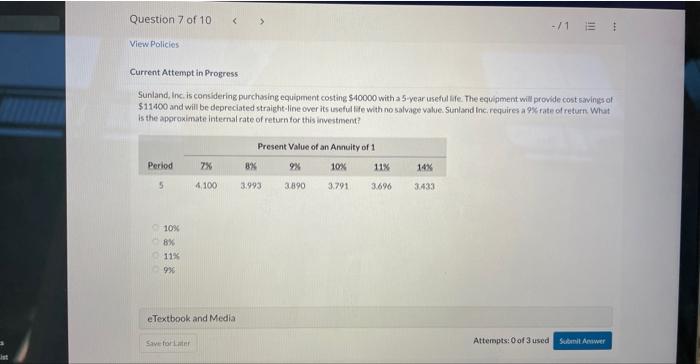

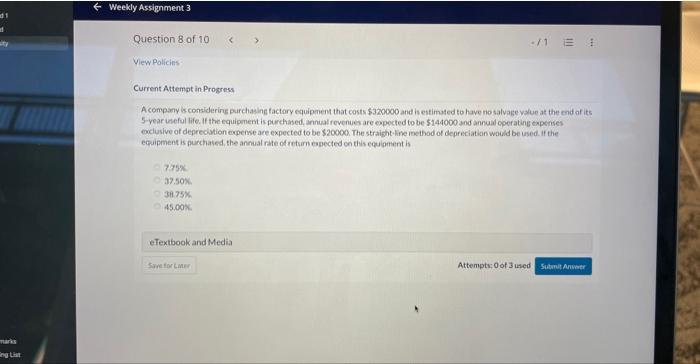

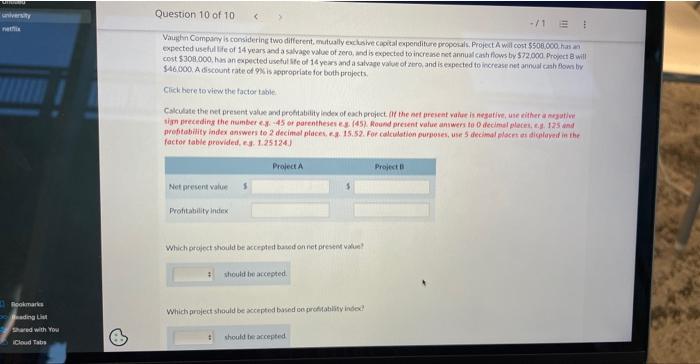

If a company uses a 11.8\% discoxint rate with the net present value method, and then does the same analysis, but with a is. 6 .6 discount rate. which of the following is likely to occur? The 15.68 rate will show the project is more protitable than the 11.8% rate. The relative arofitability of the two studies depends only on the timing of the cash flows. not an the discount rate: The 11.8 s rate wili show the project is more profitable than the 15.6% rate. Both rates will produce the same net present value. Using the profitability index method, the present value of cash inflows for Project Flower is 587300 and the present value of cash inflows of Project Plant is $47200. If Project Flower and Project Plant require initial imvestments of $90400 and $39700, respectively. and have the same uneful life, the project that should be accepted is Either project may be accepted. Project Plant. Prolect Flower Neither project should be accepted It a company's required rate of return is 9% and in using the profitability index frethod, a profect's indexis greater than 1 , this indicates that the orojects rate of return is lessthan 96. unacceptable for investment purposes. greater than 9%. equal to 9x Sunland, Inc. is considering purchasing equigment costing $40000 with a 5 -year useful ife. The equipment will provide cost siviniss of $11400 and will be depreciated straight-line over its aseful tife with no salvage value sunland inc. requires a 9% rate of return. What is the aporoximate internal rate of return for this investment? 10x 8.) 113 9x eTextbook and Media A company is considerins purchasing factary equipment that costs $320000 and is estimsted to have no salvage value at the cnd af its 5 -year ineful life. If the equipment is purchased, annual fevenues are oppected to be $144000 and annual cperating expenses coclusive of depreclution expense are expected to be $20000. The straight line inethod of depreciatian wasld be used. If the ecuipment is pucchated, the annual rate of return espected on this equiment is 7.75037.50x311.75K45.00x Vaughin Company is considering two different, matually exchahe capital eqpenditure proporals, Project A wal cogt 5500,000 has aa expected usehul life of 14 years and a salvage value of zero, and is expected to increase not annual cash fows by $72000. Prepec 8 will cost $308,000, his an expected usetul Mfe of 14 years and a salvage value of rero, and is expected to increase net annuar can fows by. S46.000. A dscount rate of 9. is appropriate for both projects. Click bere to view the factor table profitability index answers to 2 decimel places, r. A. 15.52. For calculation purposes, use 5 decinal alscrt an dicolareif in fhe factor table provided, es. 1.25124. Which projost yould be accepted bated onnet present viain? shoulf be arcepted. Which project should be accepted bused sen protrablist inda