Question

Toprise Limited is a company that develops property. The company has a June financial year-end. Mr. Spice is the accountant of Toprise Limited has approached

Toprise Limited is a company that develops property. The company has a June financial year-end. Mr. Spice is the accountant of Toprise Limited has approached you for advice on IAS 40 Investment Properties. Mr. Spice has requested your assistance relating to the following transactions that occurred during the current financial year-end, 30 June 2023:

Transaction 1:

The head office building, which is situated on the company’s Sandton property has been damaged due to mould and mildew as a result of water leakage from the outside.

The management of Toprise Limited made the decision on 30 November 2022 to relocate its head office to the Centurion property immediately as their employee health and wellness are important. The Centurion property was previously let to tenants under an operating lease. The fair value of the Centurion property was as follows:

30 June 2022: R25 450 000 30 November 2022: R25 890 000On 30 November 2022, the land element of the property amounted to R5 550 000 and the property had a remaining useful life of 21 years.

Transaction 2:

During the current financial year-end, two new investment properties were purchased in Stellenbosch and Cape Town City Centre. The costs incurred are presented below:

Stellenbosch: R19 950 000

Cape Town City Centre: R11 300 000

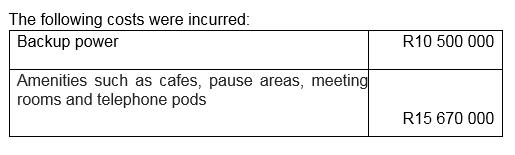

Due to the increased loadshedding, additional costs have been incurred at the Cape Town City Centre property to attract and retain tenants.

Legal and transfer fees for both properties amounted to R2 230 000.

Transaction 3:

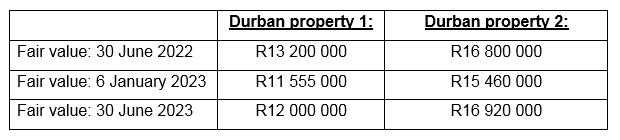

On 6 January 2023, the management of Toprise Limited decided that two of the investment properties in Durban should be sold:

Management has decided that Durban property 1 is to be sold after its redevelopment, whereas Durban property 2 is to be sold without any redevelopment.

Redevelopment of Durban property 1 commenced on 6 January 2023.

Additional information:

- Ignore all tax implications.

- Assume that the above-mentioned transactions were the only movements that occurred with regard to investment property.

- Toprise Limited uses the cost model for property, plant and equipment and the fair value model for investment properties.

- All properties measured under the cost model are depreciated on the straight-line basis over the asset’s useful life.

- Property, plant, and equipment have a nil residual value.

- The combined fair value of all the investment properties owned by Toprise Limited is as follows:

30 June 2022: R435 000 000

30 June 2023: R575 600 000

REQUIRED:

1.1) With reference to the requirements of International Financial Reporting Standards, explain how transactions 1, 2 and 3 should be accounted for in the annual financial statements of Toprise Limited for the financial year-ended 30 June 2023. Round all amounts to the nearest Rand.

1.2) Calculate the fair value adjustment to be recognized in the statement of profit or loss and other comprehensive income of Toprise Limited for the year ended 30 June 2023. Round all amounts to the nearest Rand.

The following costs were incurred: Backup power Amenities such as cafes, pause areas, meeting rooms and telephone pods R10 500 000 R15 670 000

Step by Step Solution

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

11 Accounting treatment for transactions 1 2 and 3 in the annual financial statements of Toprise Limited for the financial yearended 30 June 2023 Transaction 1 Relocation of Head Office Building Since ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started