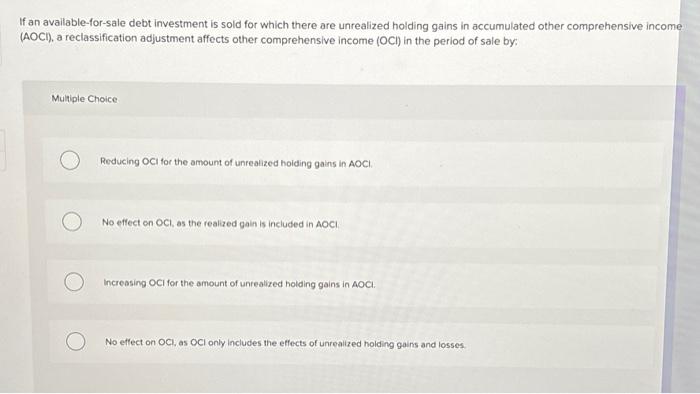

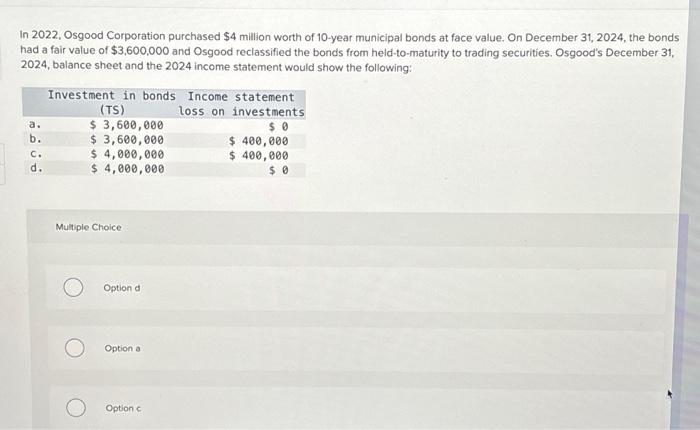

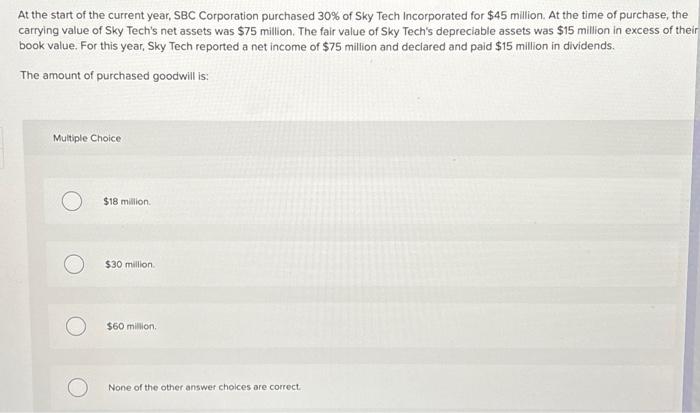

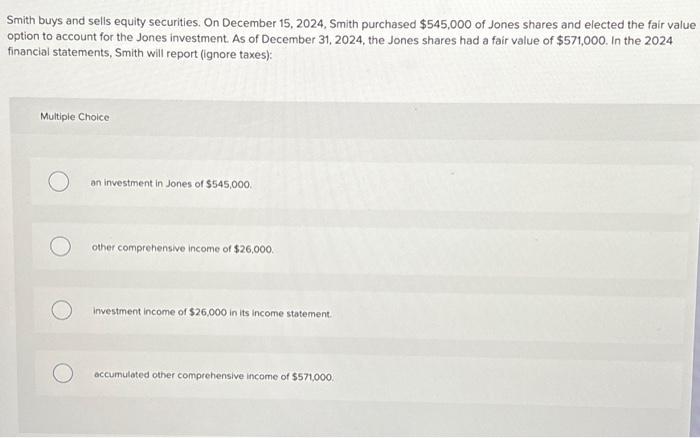

If an available-for-sale debt investment is sold for which there are unrealized holding gains in accumulated other comprehensive incom (AOC1 ), a reclassification adjustment affects other comprehensive income (OCl) in the period of sale by: Multiple Choice Reducing OCI for the amount of unrealized hoiding gains in AOCl. No effect on OCl, as the realized gain is included in AOCl Increasing OCI for the amount of unrealized holding gains in AOC. No effect on OCl, as OCl only includes the effects of unrealized holding gains and losses. In 2022, Osgood Corporation purchased $4 million worth of 10-year municipal bonds at face value. On December 31,2024 , the bonds had a fair value of $3.600,000 and Osgood reclassified the bonds from held-to-maturity to trading securities. Osgood's December 31 , 2024, balance sheet and the 2024 income statement would show the following: Multiple Choice Option d Option a Option c At the start of the current year, SBC Corporation purchased 30% of Sky Tech Incorporated for $45 million. At the time of purchase, the carrying value of Sky Tech's net assets was $75 million. The fair value of Sky Tech's depreciable assets was $15 million in excess of their book value. For this year, Sky Tech reported a net income of $75 million and declared and paid $15 million in dividends. The amount of purchased goodwill is: Multiple Choice $18 miliion. $30 million. $60 million. None of the other answer choices are correct. Smith buys and sells equity securities. On December 15,2024 . Smith purchased $545,000 of Jones shares and elected the fair value option to account for the Jones investment. As of December 31, 2024, the Jones shares had a fair value of $571,000. In the 2024 financial statements, Smith will report (ignore taxes): Multiple Choice an investment in Jones of $545,000. other comprehensive income of $26,000. investment income of $26,000 in its income statement. accumulated other comprehensive income of $571,000. If an available-for-sale debt investment is sold for which there are unrealized holding gains in accumulated other comprehensive incom (AOC1 ), a reclassification adjustment affects other comprehensive income (OCl) in the period of sale by: Multiple Choice Reducing OCI for the amount of unrealized hoiding gains in AOCl. No effect on OCl, as the realized gain is included in AOCl Increasing OCI for the amount of unrealized holding gains in AOC. No effect on OCl, as OCl only includes the effects of unrealized holding gains and losses. In 2022, Osgood Corporation purchased $4 million worth of 10-year municipal bonds at face value. On December 31,2024 , the bonds had a fair value of $3.600,000 and Osgood reclassified the bonds from held-to-maturity to trading securities. Osgood's December 31 , 2024, balance sheet and the 2024 income statement would show the following: Multiple Choice Option d Option a Option c At the start of the current year, SBC Corporation purchased 30% of Sky Tech Incorporated for $45 million. At the time of purchase, the carrying value of Sky Tech's net assets was $75 million. The fair value of Sky Tech's depreciable assets was $15 million in excess of their book value. For this year, Sky Tech reported a net income of $75 million and declared and paid $15 million in dividends. The amount of purchased goodwill is: Multiple Choice $18 miliion. $30 million. $60 million. None of the other answer choices are correct. Smith buys and sells equity securities. On December 15,2024 . Smith purchased $545,000 of Jones shares and elected the fair value option to account for the Jones investment. As of December 31, 2024, the Jones shares had a fair value of $571,000. In the 2024 financial statements, Smith will report (ignore taxes): Multiple Choice an investment in Jones of $545,000. other comprehensive income of $26,000. investment income of $26,000 in its income statement. accumulated other comprehensive income of $571,000