Answered step by step

Verified Expert Solution

Question

1 Approved Answer

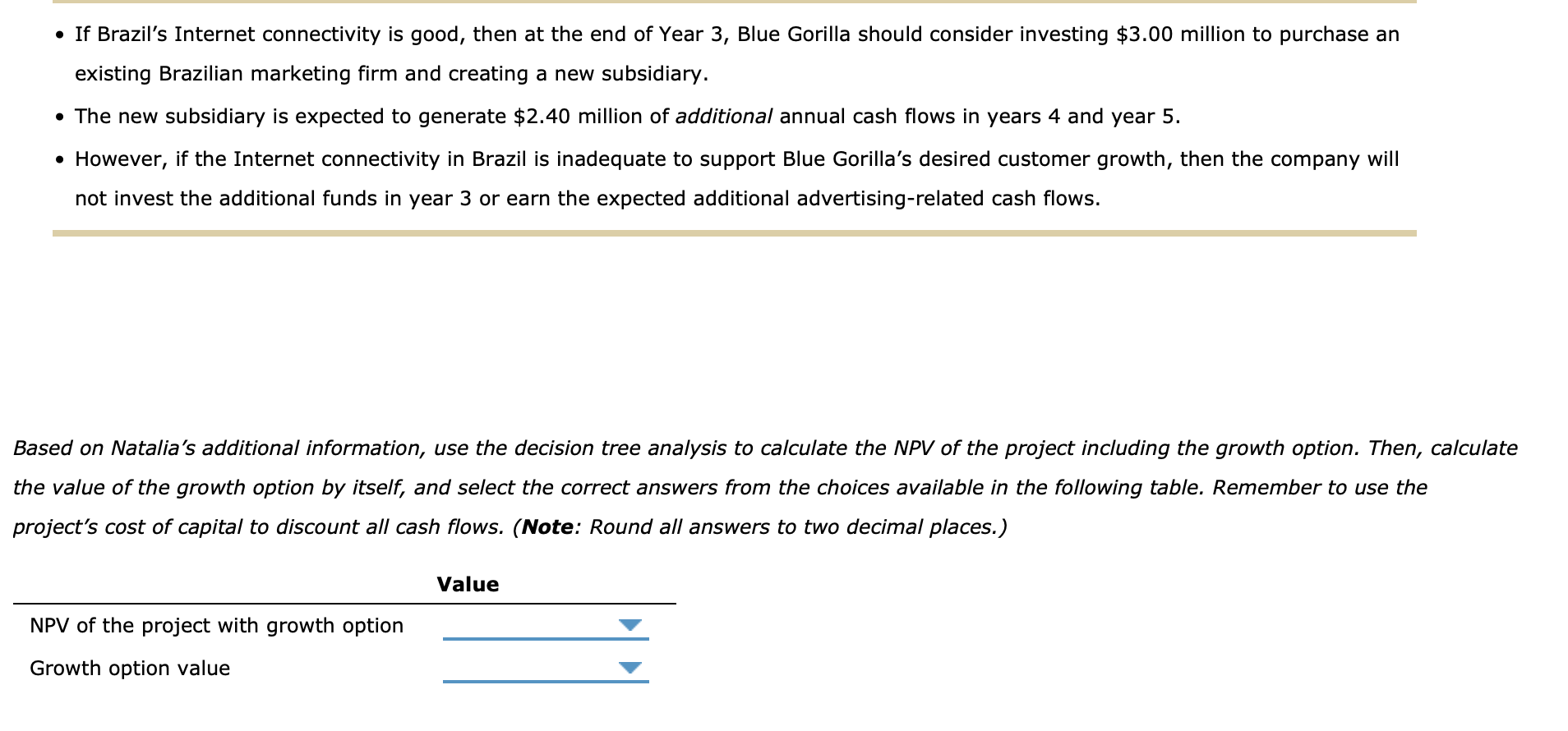

If Brazil's Internet connectivity is good, then at the end of Year 3 , Blue Gorilla should consider investing $ 3 . 0 0 million

If Brazil's Internet connectivity is good, then at the end of Year Blue Gorilla should consider investing $ million to purchase an Lastly, Natalia wants to use the the BlackScholes option pricing model OPM to determine the value of the growth option. To do this, she has

collected and computed the values for several additional variables, and has given you the BlackScholes OPM equation for the valuation of an option

:

where

the current, or a proxy, price of the value of the underlying asset which equals the present value of the delayed project's

forecasted future cash flows

and estimates of the variance of the project's expected return

the option's strike price, which is the cost of purchasing the Brazilian firm that will become the Blue Gorilla's subsidiary

the mathematical constant equal to dots, which can be truncated and rounded to

the market's riskfree rate

the time until the option expires, which, in this situation, is assumed to be the end of third year, when the potential purchase of

the subsidiary would take place According to Natalia, these variables should assume the following values:

Given these values, the estimated value of Blue Gorilla's growth option using the BlackScholes OPM V is

Note: Round all

calculations to two decimal places.

existing Brazilian marketing firm and creating a new subsidiary.

The new subsidiary is expected to generate $ million of additional annual cash flows in years and year

However, if the Internet connectivity in Brazil is inadequate to support Blue Gorilla's desired customer growth, then the company will

not invest the additional funds in year or earn the expected additional advertisingrelated cash flows.

Based on Natalia's additional information, use the decision tree analysis to calculate the NPV of the project including the growth option. Then, calculate

the value of the growth option by itself, and select the correct answers from the choices available in the following table. Remember to use the

project's cost of capital to discount all cash flows. Note: Round all answers to two decimal places.

Value

NPV of the project with growth option

Growth option value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started