Answered step by step

Verified Expert Solution

Question

1 Approved Answer

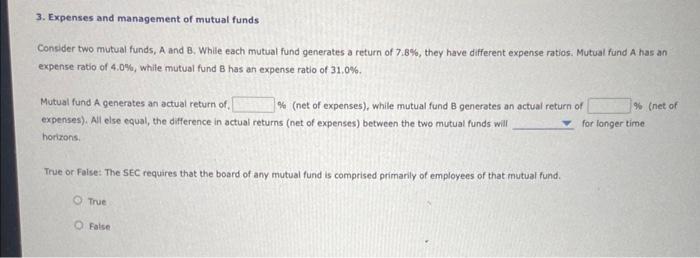

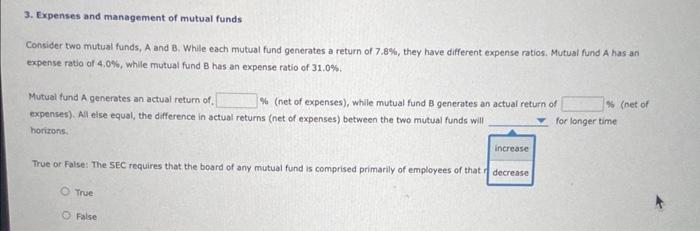

If correct will give thumbs up 3. Expenses and management of mutual funds Consider two mutual funds, A and B, While each mutual fund generates

If correct will give thumbs up

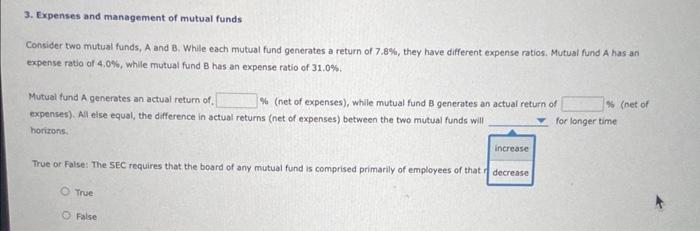

3. Expenses and management of mutual funds Consider two mutual funds, A and B, While each mutual fund generates a return of 7.8%, they have different expense ratios. Mutual fund A has an expense ratio of 4.0%, while mutual fund B has an expense ratio of 31.0%. Mutual fund A generates an actual return of. (net of expenses), while mutual fund B generates an actual return of expenses). All else equal, the difference in actual retums (net of expenses) between the two mutual funds will horirons. True or False: The SEC requires that the board of any mutual fund is comprised primanly of employees of that inutual fund. True False 3. Expenses and management of mutual funds Consider two mutual funds, A and B. While each mutual fund generates a return of 7.8%, they have different expense ratios. Mutual fund A has an expense ratio of 4,0%6, whlle mutual fund B has an expense ratio of 31.0%. Mutual fund A generates an actual return of, \%. (net of expenses), while mutual fund 3 generates an actual return of expenses). All eise equal, the difference in actual returns (net of expenses) between the two mutual funds will horizons. True or False: The SEC requires that the board of any mutual fund is comprised primarily of employees of that, Tinse False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started