Answered step by step

Verified Expert Solution

Question

1 Approved Answer

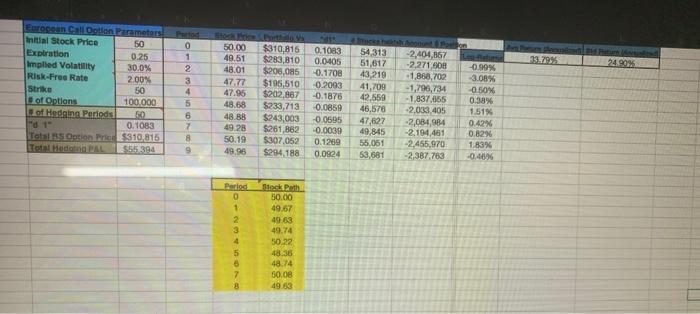

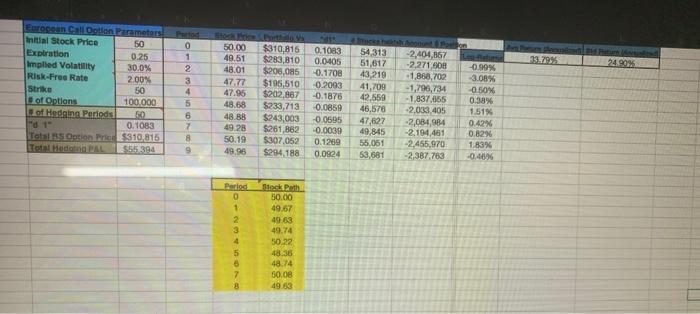

If I use data provided at the top, how do I compute the annualized realized volatility of the log-returns and the total realized P&L when

If I use data provided at the top, how do I compute the annualized realized volatility of the log-returns and the total realized P&L when hedging for the data at the bottomo(colored yellow)

Po 33.79% 24.905 European CallOption Parameters Initial Stock Price 50 Expiration 0.25 Implied Volatility 30.0% Risk-Free Rate 2.00% Strike 50 of Options 100,000 of Hedging Periods 50 0 1 0.1083 Total Option Price $310,816 Total Huda PAL $55 394 DOGO 2 3 4 5 6 7 8 9 Stockhol 50.00 $310,815 49.51 $283,810 48.01 $200,085 47.77 $195,510 47.95 $202,867 48.68 $233,713 48.88 $243,003 49.28 $261 362 50.19 $307,052 49.96 $294.188 0.1083 0.0405 -0.1708 -0.2003 -0.1878 -0.0859 -0.0695 -0.0039 0.1259 0.0924 54,313 51,617 43,219 41,709 42,559 46,578 47,627 49,845 56,061 63,681 -2,404,867 -2.271 608 -1,868,702 -1,796,734 -1.837,665 -2.003.405 -2,084,984 -2.194.461 -2.465,970 -2,387,763 -0.99% 3.08% -0.50 0.38% 151% 0.42% 0.82% 1.83% -0.46% Period 0 1 2 3 4 5 6 7 Stock Path 50.00 49.67 49.63 49.74 50.22 48.36 48.74 50.08 49.53 Po 33.79% 24.905 European CallOption Parameters Initial Stock Price 50 Expiration 0.25 Implied Volatility 30.0% Risk-Free Rate 2.00% Strike 50 of Options 100,000 of Hedging Periods 50 0 1 0.1083 Total Option Price $310,816 Total Huda PAL $55 394 DOGO 2 3 4 5 6 7 8 9 Stockhol 50.00 $310,815 49.51 $283,810 48.01 $200,085 47.77 $195,510 47.95 $202,867 48.68 $233,713 48.88 $243,003 49.28 $261 362 50.19 $307,052 49.96 $294.188 0.1083 0.0405 -0.1708 -0.2003 -0.1878 -0.0859 -0.0695 -0.0039 0.1259 0.0924 54,313 51,617 43,219 41,709 42,559 46,578 47,627 49,845 56,061 63,681 -2,404,867 -2.271 608 -1,868,702 -1,796,734 -1.837,665 -2.003.405 -2,084,984 -2.194.461 -2.465,970 -2,387,763 -0.99% 3.08% -0.50 0.38% 151% 0.42% 0.82% 1.83% -0.46% Period 0 1 2 3 4 5 6 7 Stock Path 50.00 49.67 49.63 49.74 50.22 48.36 48.74 50.08 49.53

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started