Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If, in Year 9, a company reports operating profit of $55 million, earns net income of $38 million, has 19 million shares of common

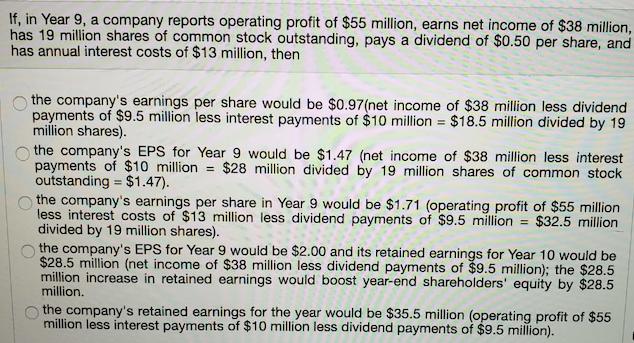

If, in Year 9, a company reports operating profit of $55 million, earns net income of $38 million, has 19 million shares of common stock outstanding, pays a dividend of $0.50 per share, and has annual interest costs of $13 million, then the company's earnings per share would be $0.97(net income of $38 million less dividend payments of $9.5 million less interest payments of $10 million = $18.5 million divided by 19 million shares). the company's EPS for Year 9 would be $1.47 (net income of $38 million less interest payments of $10 million = $28 million divided by 19 million shares of common stock outstanding = $1.47). the company's earnings per share in Year 9 would be $1.71 (operating profit of $55 million less interest costs of $13 million less dividend payments of $9.5 million = $32.5 million divided by 19 million shares). the company's EPS for Year 9 would be $2.00 and its retained earnings for Year 10 would be $28.5 million (net income of $38 million less dividend payments of $9.5 million); the $28.5 million increase in retained earnings would boost year-end shareholders' equity by $28.5 million. the company's retained earnings for the year would be $35.5 million (operating profit of $55 million less interest payments of $10 million less dividend payments of $9.5 million).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started