Question

If Irving decides to use the strategy advised by many personal finance gurusthe snowball method, or paying off the card with the smaller balance firsthow

If Irving decides to use the strategy advised by many personal finance gurus—the snowball method, or paying off the card with the smaller balance first—how much of his $300 budget would he initially devote to each credit card

If Irving decides to use the strategy advised by many personal finance gurus—the snowball method, or paying off the card with the smaller balance first—how much of his $300 budget would he initially devote to each credit card

Options

$225 to card 1; $75 to card 2

$0 to card 1; $300 to card 2

$120 to card 1; $180 to card 2

$270 to card 1; $30 to card 2

If Irving decides to follow economic theory and pay off his higher-interest rate card first, how much money would he initially devote to each credit card?

Options

$300 to card 1; $0 to card 2

$270 to card 1; $30 to card 2

$225 to card 1; $75 to card 2

$120 to card 1; $180 to card 2

If Irving decides to do what most Americans do, which is split his money proportionally between both accounts based on the size of each card’s balance, how much money would he initially devote to each credit card?

Options

$0 to card 1; $300 to card 2

$225 to card 1; $75 to card 2

$120 to card 1; $180 to card 2

$270 to card 1; $30 to card 2

Assuming Irving sticks to a repayment plan, which method would be fastest and save money (compared with the other options)?

Options

The economic theory method

The method that most borrowers follow

Any of the three methods

The snowball method

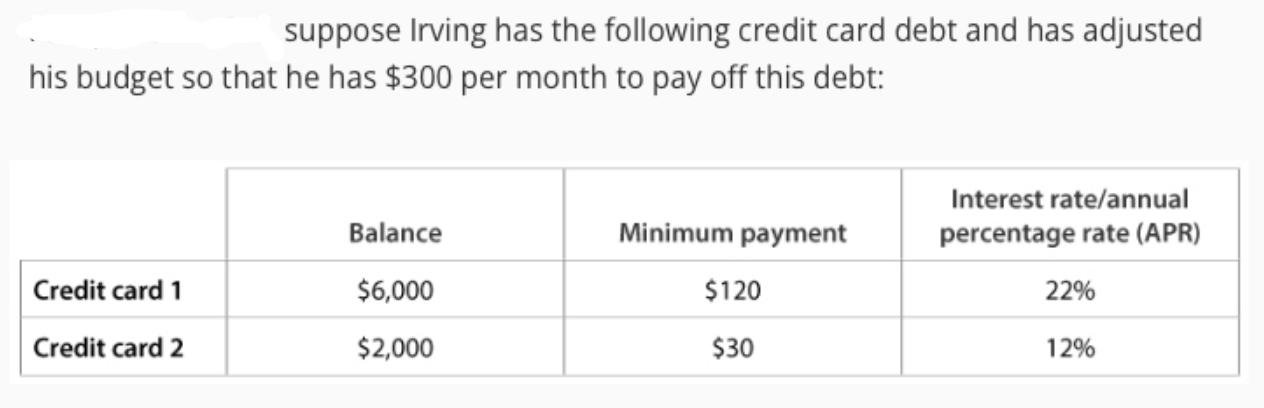

suppose Irving has the following credit card debt and has adjusted his budget so that he has $300 per month to pay off this debt: Credit card 1 Credit card 2 Balance $6,000 $2,000 Minimum payment $120 $30 Interest rate/annual percentage rate (APR) 22% 12%

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below If Irving decides to use the s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started