Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If Laiho increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taxes paid by

If Laiho increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taxes paid by the companys shareholders?

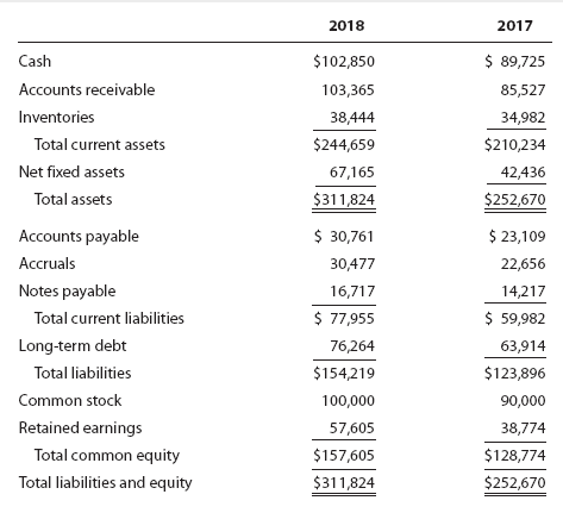

2018 2017 Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets $102,850 103,365 38,444 $244,659 67,165 $311,824 $ 89,725 85,527 34,982 $210,234 42,436 $252,670 Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity $ 30,761 30,477 16,717 $ 77,955 76,264 $154,219 100,000 57,605 $157,605 $311,824 $ 23,109 22,656 14,217 $ 59,982 63,914 $123,896 90,000 38,774 $128,774 $252,670Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started