Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the market portfolio has an expected return of 10% and a volatility of 20%, and Microsoft's stock has a volatility of 15%. Given that

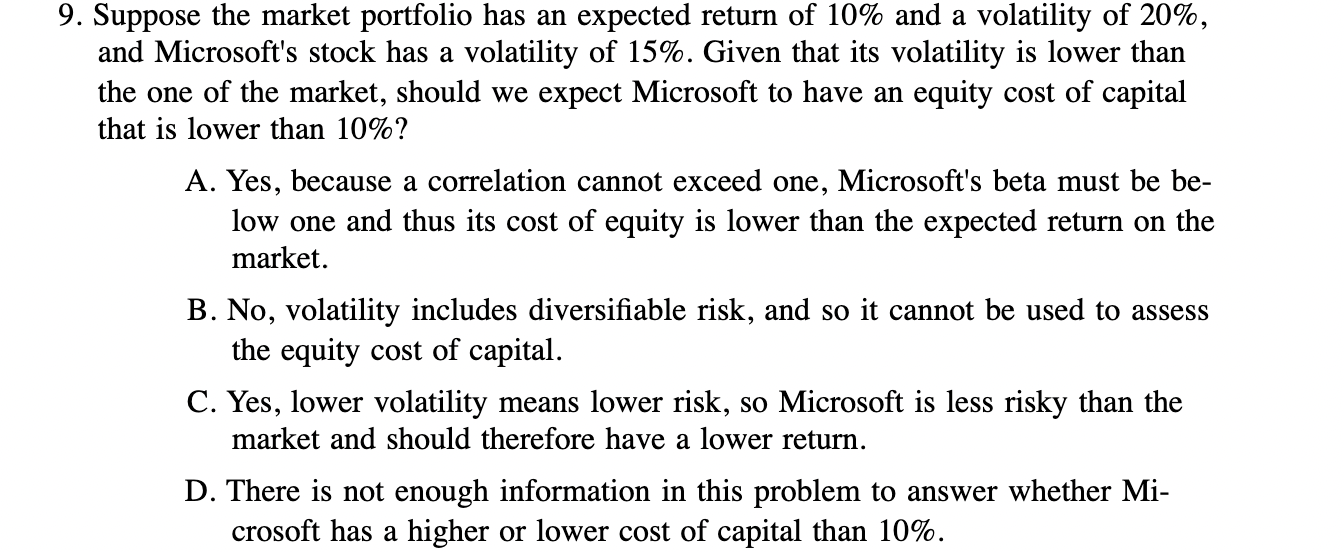

Suppose the market portfolio has an expected return of 10% and a volatility of 20%, and Microsoft's stock has a volatility of 15%. Given that its volatility is lower than the one of the market, should we expect Microsoft to have an equity cost of capital that is lower than 10% ? A. Yes, because a correlation cannot exceed one, Microsoft's beta must be below one and thus its cost of equity is lower than the expected return on the market. B. No, volatility includes diversifiable risk, and so it cannot be used to assess the equity cost of capital. C. Yes, lower volatility means lower risk, so Microsoft is less risky than the market and should therefore have a lower return. D. There is not enough information in this problem to answer whether Microsoft has a higher or lower cost of capital than 10%. Suppose the market portfolio has an expected return of 10% and a volatility of 20%, and Microsoft's stock has a volatility of 15%. Given that its volatility is lower than the one of the market, should we expect Microsoft to have an equity cost of capital that is lower than 10% ? A. Yes, because a correlation cannot exceed one, Microsoft's beta must be below one and thus its cost of equity is lower than the expected return on the market. B. No, volatility includes diversifiable risk, and so it cannot be used to assess the equity cost of capital. C. Yes, lower volatility means lower risk, so Microsoft is less risky than the market and should therefore have a lower return. D. There is not enough information in this problem to answer whether Microsoft has a higher or lower cost of capital than 10%

Suppose the market portfolio has an expected return of 10% and a volatility of 20%, and Microsoft's stock has a volatility of 15%. Given that its volatility is lower than the one of the market, should we expect Microsoft to have an equity cost of capital that is lower than 10% ? A. Yes, because a correlation cannot exceed one, Microsoft's beta must be below one and thus its cost of equity is lower than the expected return on the market. B. No, volatility includes diversifiable risk, and so it cannot be used to assess the equity cost of capital. C. Yes, lower volatility means lower risk, so Microsoft is less risky than the market and should therefore have a lower return. D. There is not enough information in this problem to answer whether Microsoft has a higher or lower cost of capital than 10%. Suppose the market portfolio has an expected return of 10% and a volatility of 20%, and Microsoft's stock has a volatility of 15%. Given that its volatility is lower than the one of the market, should we expect Microsoft to have an equity cost of capital that is lower than 10% ? A. Yes, because a correlation cannot exceed one, Microsoft's beta must be below one and thus its cost of equity is lower than the expected return on the market. B. No, volatility includes diversifiable risk, and so it cannot be used to assess the equity cost of capital. C. Yes, lower volatility means lower risk, so Microsoft is less risky than the market and should therefore have a lower return. D. There is not enough information in this problem to answer whether Microsoft has a higher or lower cost of capital than 10% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started