Answered step by step

Verified Expert Solution

Question

1 Approved Answer

if not clearly visable pleae email me at sherrodrobbins@gmail.com Decision on Transfer Pricing Materials used by the Instrument Division of T_Kong Industries are currently purchased

if not clearly visable pleae email me at sherrodrobbins@gmail.com

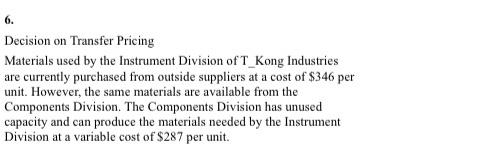

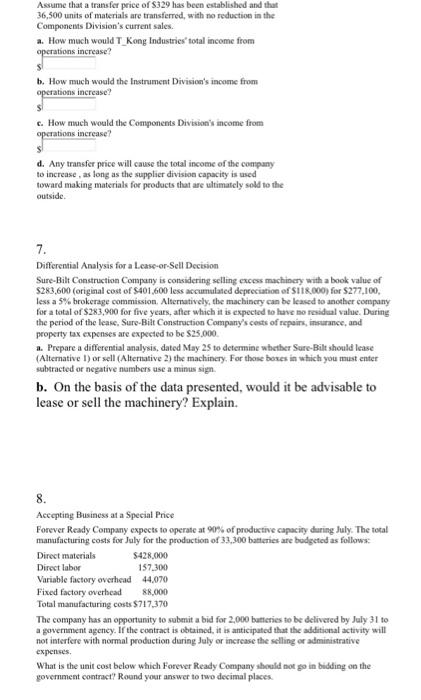

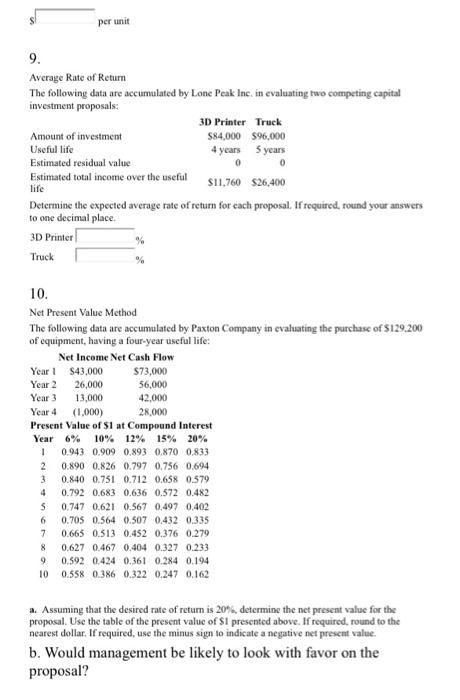

Decision on Transfer Pricing Materials used by the Instrument Division of T_Kong Industries are currently purchased from outside suppliers at a cost of $346 per unit. However, the same materials are available from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable cost of $287 per unit. Assume that a transfer price of 5329 has been established and that 36,500 units of materials are transferred, with no reduction in the Components Division's current sales .. How much would T_Kong Industries total income from operations increase? b. How much would the Instrument Division's income from operations increase? c. How much would the Components Divisions income from operations increase? d. Any transfer price will cause the total income of the company to increase, as long as the supplier division capacity is used toward making materials for products that are ultimately sold to the outside 7. Differential Analysis for a Lease-on-Sell Decision Sure-Bilt Construction Company is considering selling excess machinery with a book value of $283,600 (original cost of $401,600 less accumulated depreciation of S118.000) for S277,100, less a 5% brokerage commission. Alternatively, the machinery can be leased to another company for a total of 283,900 for five years, after which it is expected to have no residual value. During the period of the lease. Sure-Bilt Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $25.000 1. Prepare a differential analysis, dated May 25 to determine whether Sure-Bilt should lease (Alternative 1) or sell (Alternative 2) the machinery. For those boxes in which you must enter subtracted or negative numbers use a minus sign b. On the basis of the data presented, would it be advisable to lease or sell the machinery? Explain. 8. Accepting Business at a Special Price Forever Ready Company expects to operate at 90% of productive capacity during July. The total manufacturing costs for July for the production of 33,300 batteries are bodgeted as follows: Direct materials S428.000 Direct labor 157.300 Variable factory overhead 44,070 Fixed factory overhead 88,000 Total manufacturing costs $717,370 The company has an opportunity to submit a bid for 2,000 batteries to be delivered by July 31 to a government agency. If the contract is obtained, it is anticipated that the additional activity will not interfere with normal production during July or increase the selling or administrative expenses What is the unit cost below which Forever Ready Company should not go in bidding on the government contract? Round your answer to two decimal places per unit 9. Average Rate of Return The following data are accumulated by Lone Peak Inc. in evaluating two competing capital investment proposals: 3D Printer Truck Amount of investment $84,000 $96,000 Useful life 4 years 5 years Estimated residual value 0 0 Estimated total income over the useful $11.760 $26.400 Determine the expected average rate of return for each proposal. If required, round your answers to one decimal place. life 3D Printer % Truck % 10. Net Present Value Method The following data are accumulated by Paxton Company in evaluating the purchase of 129.200 of equipment, having a four-year useful life: Net Income Net Cash Flow Year S43.000 $73,000 Year 2 26,000 56,000 Year 3 13,000 42,000 Year 4 (1.000) 28.000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 S 0.747 0.621 0.567 0,497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 a. Assuming that the desired rate of retum is 20%, determine the net present value for the proposal. Use the table of the present value of Si presented above. If required, round to the nearest dollar. If required, use the minus sign to indicate a negative net present value. b. Would management be likely to look with favor on the proposal? Decision on Transfer Pricing Materials used by the Instrument Division of T_Kong Industries are currently purchased from outside suppliers at a cost of $346 per unit. However, the same materials are available from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable cost of $287 per unit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started