Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If possible 5 and 6 Problem #4 (5 points) Annette purchased stock on March 1, 2013, for $20,000. At December 31, 2019, it was worth

If possible 5 and 6

If possible 5 and 6

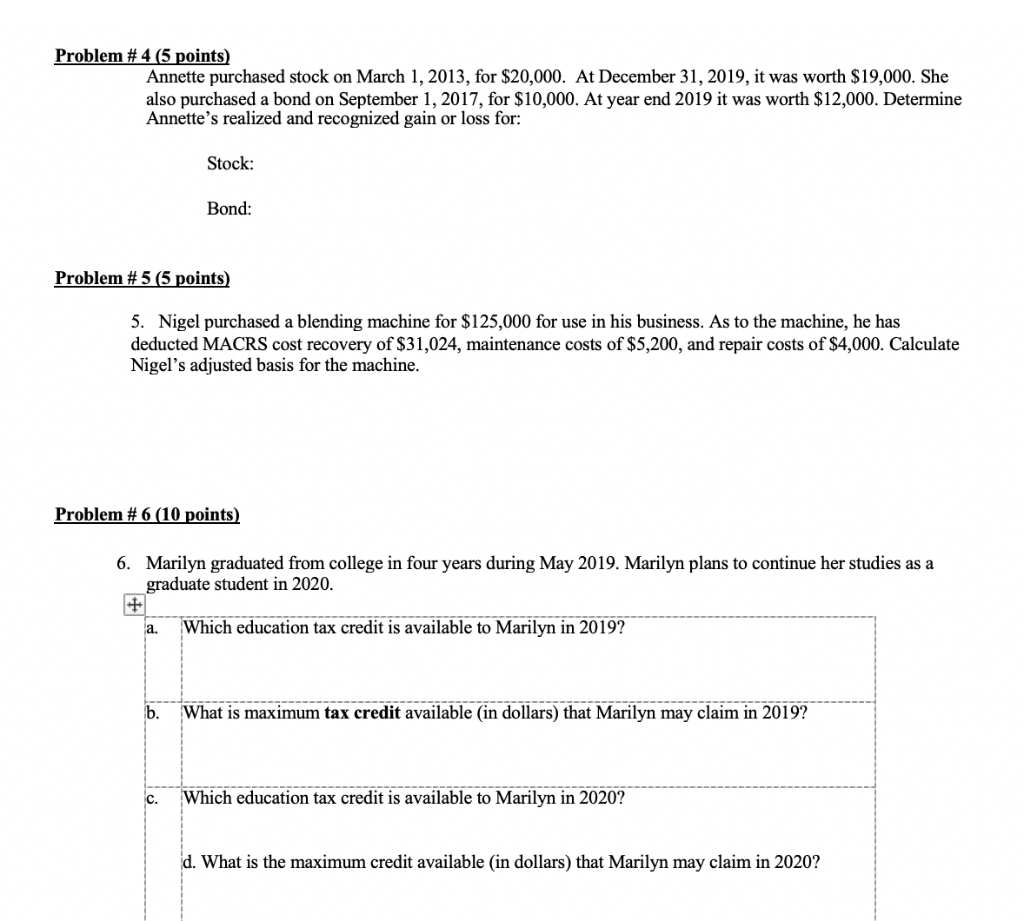

Problem #4 (5 points) Annette purchased stock on March 1, 2013, for $20,000. At December 31, 2019, it was worth $19,000. She also purchased a bond on September 1, 2017, for $10,000. At year end 2019 it was worth $12,000. Determine Annette's realized and recognized gain or loss for: Stock: Bond: Problem #55 points) 5. Nigel purchased a blending machine for $125,000 for use in his business. As to the machine, he has deducted MACRS cost recovery of $31,024, maintenance costs of $5,200, and repair costs of $4,000. Calculate Nigel's adjusted basis for the machine. Problem #6 (10 points) 6. Marilyn graduated from college in four years during May 2019. Marilyn plans to continue her studies as a graduate student in 2020. a. Which education tax credit is available to Marilyn in 2019? b. What is maximum tax credit available in dollars) that Marilyn may claim in 2019? c. Which education tax credit is available to Marilyn in 2020? d. What is the maximum credit available (in dollars) that Marilyn may claim in 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started