**If possible please explain formulas and how you arrive at these answers** Thank you! :)

**If possible please explain formulas and how you arrive at these answers** Thank you! :)

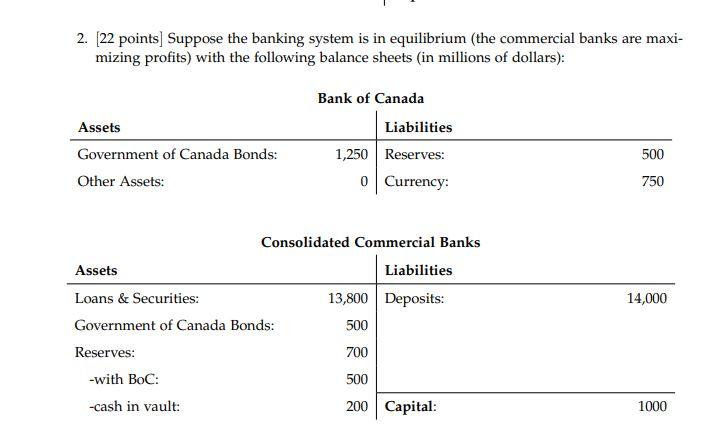

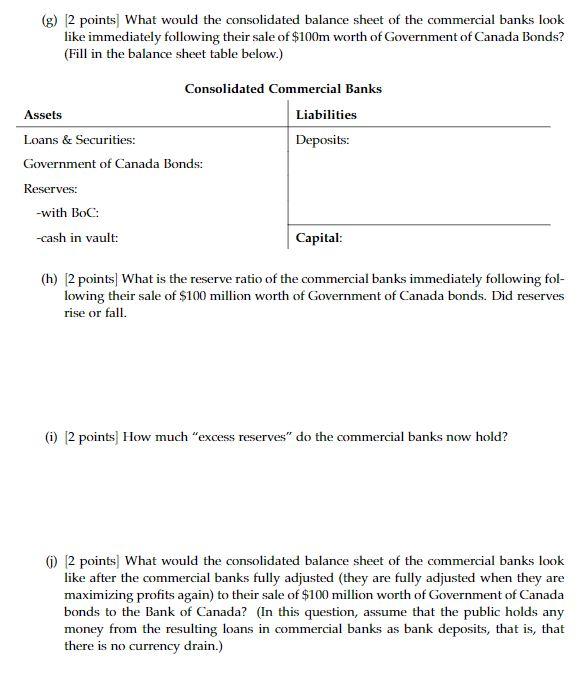

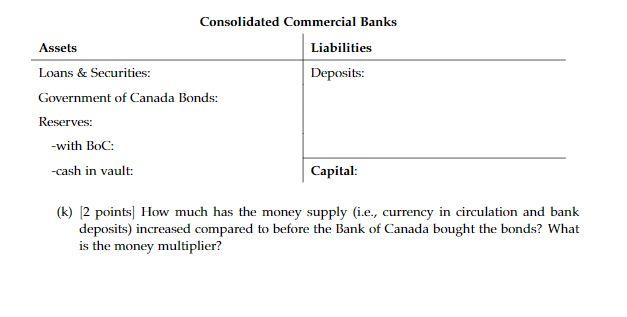

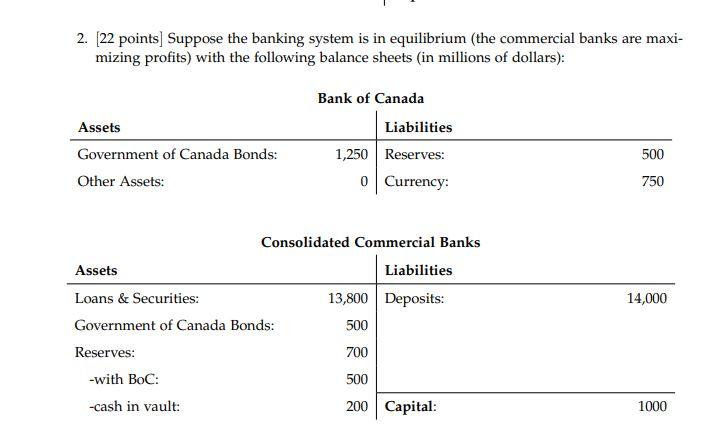

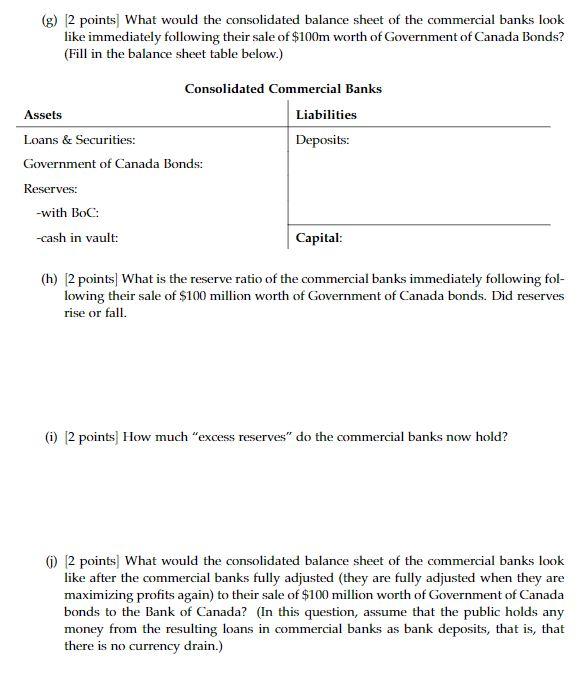

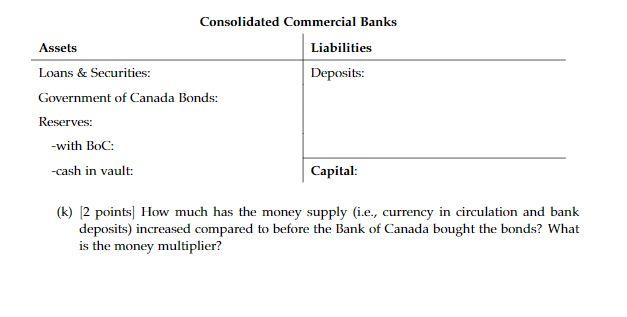

2. [22 points] Suppose the banking system is in equilibrium (the commercial banks are maximizing profits) with the following balance sheets (in millions of dollars): (g) [2 points] What would the consolidated balance sheet of the commercial banks look like immediately following their sale of $100m worth of Government of Canada Bonds? (Fill in the balance sheet table below.) (h) [2 points] What is the reserve ratio of the commercial banks immediately following following their sale of $100 million worth of Government of Canada bonds. Did reserves rise or fall. (i) [2 points] How much "excess reserves" do the commercial banks now hold? (j) [2 points] What would the consolidated balance sheet of the commercial banks look like after the commercial banks fully adjusted (they are fully adjusted when they are maximizing profits again) to their sale of $100 million worth of Government of Canada bonds to the Bank of Canada? (In this question, assume that the public holds any money from the resulting loans in commercial banks as bank deposits, that is, that there is no currency drain.) (k) [2 points] How much has the money supply (i.e., currency in circulation and bank deposits) increased compared to before the Bank of Canada bought the bonds? What is the money multiplier? 2. [22 points] Suppose the banking system is in equilibrium (the commercial banks are maximizing profits) with the following balance sheets (in millions of dollars): (g) [2 points] What would the consolidated balance sheet of the commercial banks look like immediately following their sale of $100m worth of Government of Canada Bonds? (Fill in the balance sheet table below.) (h) [2 points] What is the reserve ratio of the commercial banks immediately following following their sale of $100 million worth of Government of Canada bonds. Did reserves rise or fall. (i) [2 points] How much "excess reserves" do the commercial banks now hold? (j) [2 points] What would the consolidated balance sheet of the commercial banks look like after the commercial banks fully adjusted (they are fully adjusted when they are maximizing profits again) to their sale of $100 million worth of Government of Canada bonds to the Bank of Canada? (In this question, assume that the public holds any money from the resulting loans in commercial banks as bank deposits, that is, that there is no currency drain.) (k) [2 points] How much has the money supply (i.e., currency in circulation and bank deposits) increased compared to before the Bank of Canada bought the bonds? What is the money multiplier

**If possible please explain formulas and how you arrive at these answers** Thank you! :)

**If possible please explain formulas and how you arrive at these answers** Thank you! :)