Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If possible show all steps on Excel. Thank you :) Project Mountain Ridge Ocean Park Estates Lakeview Seabreeze Green Hills West Ranch Cost Today $3,000,000

If possible show all steps on Excel. Thank you :)

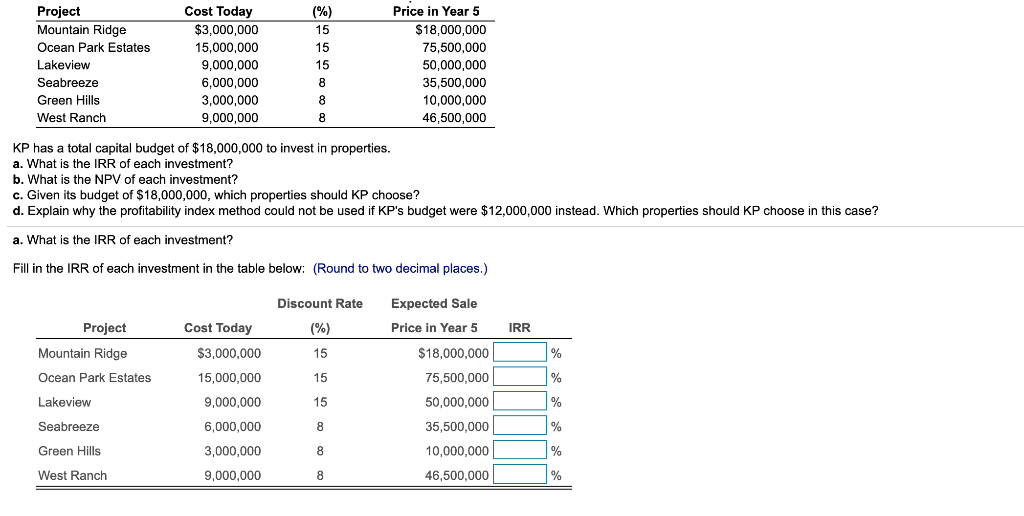

Project Mountain Ridge Ocean Park Estates Lakeview Seabreeze Green Hills West Ranch Cost Today $3,000,000 15,000,000 9,000,000 6,000,000 3,000,000 9,000,000 (%) 15 15 15 8 8 8 Price in Year 5 $18,000,000 75,500,000 50,000,000 35,500,000 10,000,000 46,500,000 KP has a total capital budget of $18,000,000 to invest in properties. a. What is the IRR of each investment? b. What is the NPV of each investment? c. Given its budget of $18,000,000, which properties should KP choose? d. Explain why the profitability index method could not be used if KP's budget were $12,000,000 instead. Which properties should KP choose in this case? a. What is the IRR of each investment? Fill in the IRR of each investment in the table below: (Round to two decimal places.) Discount Rate (%) 15 IRR Project Mountain Ridge Ocean Park Estates Lakeview % Expected Sale Price in Year 5 $18,000,000 $ 75,500,000 50,000,000 15 Cost Today $3,000,000 15,000,000 9,000,000 6,000,000 3,000,000 % 15 % Seabreeze 8 % Green Hills 8 35,500,000 10,000,000 46,500,000 % West Ranch 9,000,000 8 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started