If someone could help me fill this in that would be extremely helpful thank you!!

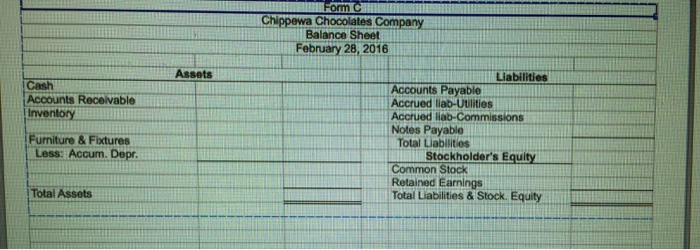

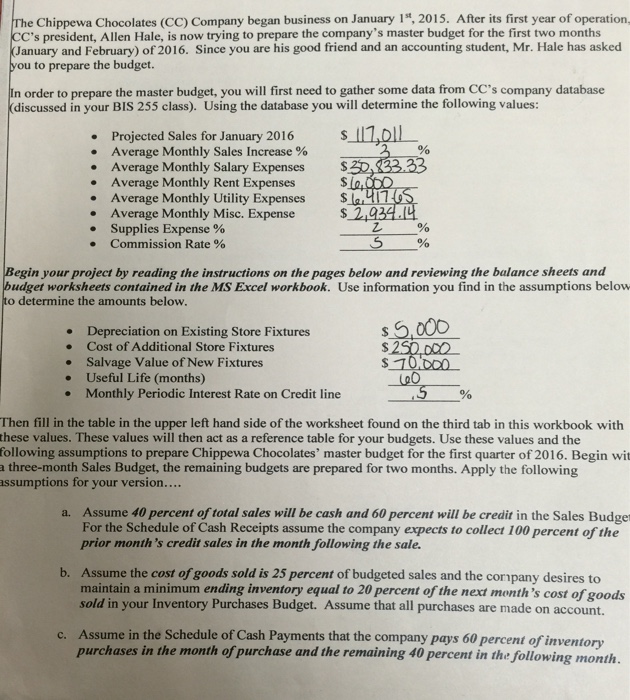

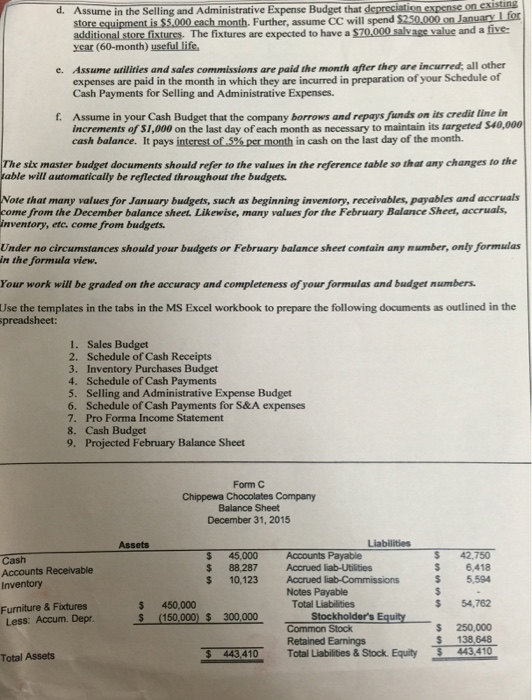

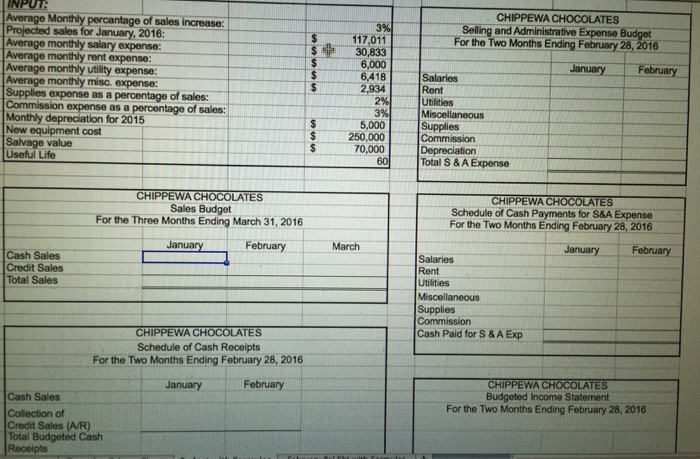

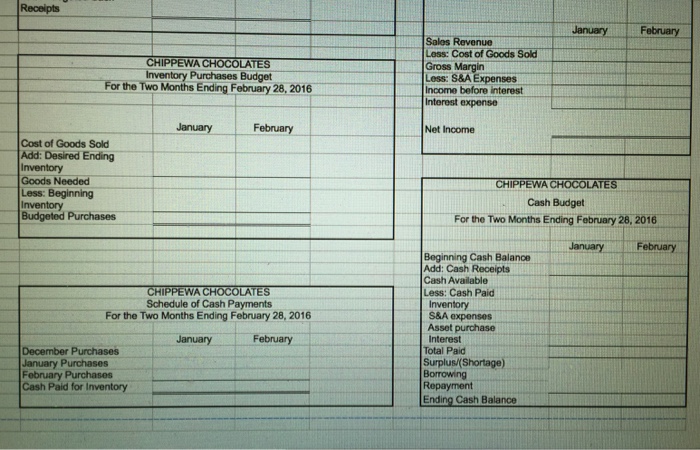

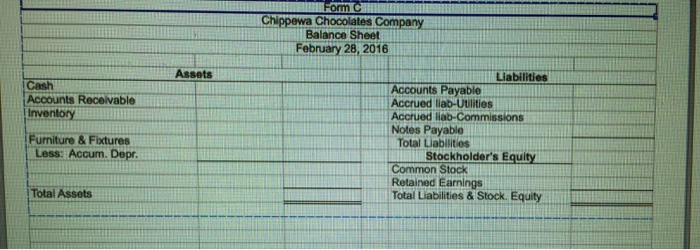

The Chippewa Chocolates (CC) Company began business on January 1st, 2015. After its first year of operati CC's president, Allen Hale, is now trying to prepare the company's master budget for the first two months January and February) of 2016. Since you are his good friend and an accounting student, Mr. Hale has asked you to prepare the budget. In order to prepare the master budget, you will first need to gather some data from CC's company database discussed in your BIS 255 class). Using the database you will determine the following values: Projected Sales for January 2016 Average Monthly Sales Increase % . Average Monthly Salary Expenses .Average Monthly Rent Expenses e Average Monthly Utility Expenses . Average Monthly Misc. Expense Supplies Expense % Commission Rate % Begin your project by reading the instructions on the pages below and reviewing the balance sheets and budget worksheets contained in the MS Excel workbook. Use information you find in the assumptions below o determine the amounts below. Depreciation on Existing Store Fixtures Cost of Additional Store Fixtures Salvage Value of New Fixtures Useful Life (months) Monthly Periodic Interest Rate on Credit line . . . S T L00 Then fill in the table in the upper left hand side of the worksheet found on the third tab in this workbook with these values. These values will then act as a reference table for your budgets. Use these values and the ollowing assumptions to prepare Chippewa Chocolates' master budget for the first quarter of 2016. Begin wit a three-month Sales Budget, the remaining budgets are prepared for two months. Apply the following ssumptions for your version Assume 40 percent of total sales will be cash and 60 percent will be credit in the Sales Budge For the Schedule of Cash Receipts assume the company expects to collect 100 percent of the prior month's credit sales in the month following the sale Assume the cost of goods sold is 25 percent of budgeted sales and the corpany desires to maintain a minimum ending inventory equal to 20 percent of the next month's cost of goods b. Assume that all purchases are made on account. Assume in the Schedule of Cash Payments that the company pays 60 percent of inventory purchases in the month of purchase and the remaining 40 percent in the following ase and the remaining 40 percent in the following month

If someone could help me fill this in that would be extremely helpful thank you!!

If someone could help me fill this in that would be extremely helpful thank you!!