Answered step by step

Verified Expert Solution

Question

1 Approved Answer

if someone could help me with these, that would be amazing! I'll definitely leave a thumbs up. 3. Jordan Enterprises plans to issue $ 120,000,000

if someone could help me with these, that would be amazing! I'll definitely leave a thumbs up.

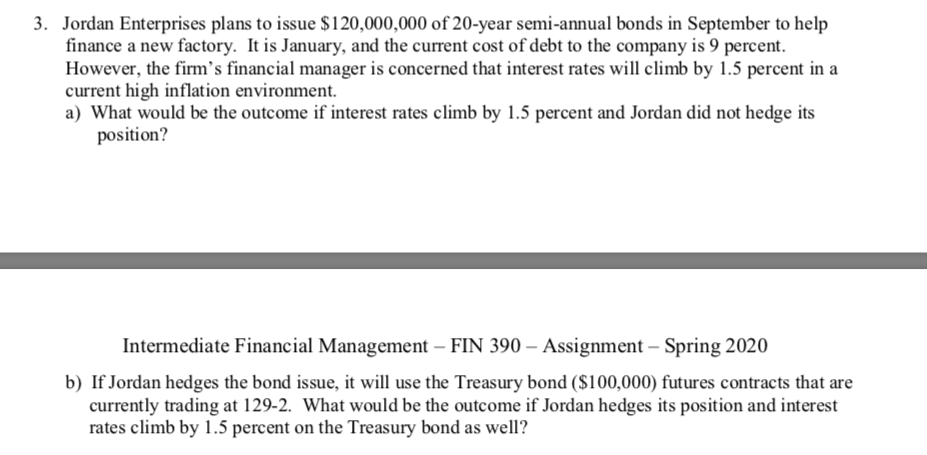

3. Jordan Enterprises plans to issue $ 120,000,000 of 20-year semi-annual bonds in September to help finance a new factory. It is January, and the current cost of debt to the company is 9 percent. However, the firm's financial manager is concerned that interest rates will climb by 1.5 percent in a current high inflation environment. a) What would be the outcome if interest rates climb by 1.5 percent and Jordan did not hedge its position? Intermediate Financial Management - FIN 390 Assignment - Spring 2020 b) If Jordan hedges the bond issue, it will use the Treasury bond ($100,000) futures contracts that are currently trading at 129-2. What would be the outcome of Jordan hedges its position and interest rates climb by 1.5 percent on the Treasury bond as well? 3. Jordan Enterprises plans to issue $ 120,000,000 of 20-year semi-annual bonds in September to help finance a new factory. It is January, and the current cost of debt to the company is 9 percent. However, the firm's financial manager is concerned that interest rates will climb by 1.5 percent in a current high inflation environment. a) What would be the outcome if interest rates climb by 1.5 percent and Jordan did not hedge its position? Intermediate Financial Management - FIN 390 Assignment - Spring 2020 b) If Jordan hedges the bond issue, it will use the Treasury bond ($100,000) futures contracts that are currently trading at 129-2. What would be the outcome of Jordan hedges its position and interest rates climb by 1.5 percent on the Treasury bond as well

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started