Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If someone know how to work this problem please assist me with this? There is no other information to give. This is the whole problem.

If someone know how to work this problem please assist me with this? There is no other information to give. This is the whole problem. Intermediate Accounting II

If someone know how to work this problem please assist me with this? There is no other information to give. This is the whole problem. Intermediate Accounting II

Thank you,Sharon

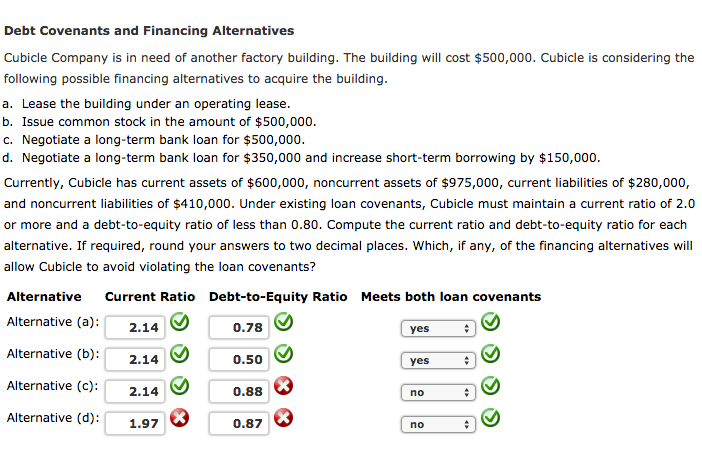

Cubicle Company is in need of another factory building. The building will cost $500,000. Cubicle is considering the following possible financing alternatives to acquire the building. Lease the building under an operating lease. Issue common stock in the amount of $500,000. Negotiate a long-term bank loan for $500,000. Negotiate a long-term bank loan for $350,000 and increase short-term borrowing by $150,000. Currently, Cubicle has current assets of $600,000, noncurrent assets of $975,000, current liabilities of $280,000, and noncurrent liabilities of $410,000. Under existing loan covenants, Cubicle must maintain a current ratio of 2.0 or more and a debt-to-equity ratio of less than 0.80. Compute the current ratio and debt-to-equity ratio for each alternative. If required, round your answers to two decimal places. Which, if any, of the financing alternatives will allow Cubicle to avoid violating the loan covenantsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started